At the end of December 2021, the owner of New York’s Ross+Kramer Art Gallery, Todd Kramer, had 15 BAYC and MAYC NFTs worth more than $2.2 million stolen from him. In response to his cry for help, OpenSea NFT marketplace allegedly froze the collectibles.

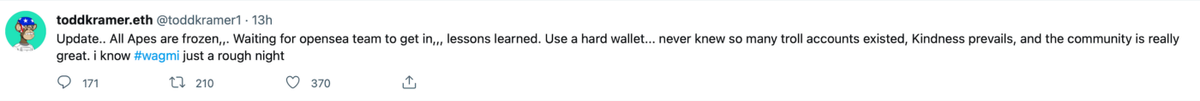

This was one of the first few NFT theft cases since Bored Ape and Mutant Ape Yacht Club NFTs have seen outstanding demand. After the incident Todd Kramer posted a tweet, he later deleted, that Opensea stepped in and froze the stolen NFTs. However, there hasn’t been any official confirmation from the marketplace itself.

With Kramer’s tweets people began complaining about the lack of decentralisation on OpenSea, and the complaints were not unreasonable as something that is made to be decentralised shouldn’t become centralised.

OpenSea and other blockchain-based platforms are not supposed to have centralised control in the same way as e-commerce marketplaces like Ebay does. OpenSea has always had a pretty loose governance policy, for which they have been criticised for: they have resolved copyright issues and restrained problematic sellers, but they rarely intervened. However, since late last year OpenSea started showing clear signs of centralisation, and it may be a part of their market dominance strategy.

Simply put, OpenSea, like any other existing NFT marketplaces including Rarible, Nifty Gateway or SuperRare, is a centralised marketplace working on blockchain that is inherently decentralised. Web3 offers portability and control over digital property, which is not available in Web2, but Web2 provides smooth service convenient for users. OpenSea aims to become a synergy of the two, however it has been failing to maintain the necessary level of customer support.

OpenSea’s rocketing growth has led to a string of platform problems: the surge in NFT trading has led to a surge in stolen tokens and other legal issues that require intervention. For instance, in December 2021 there was a messy NFT drop by “ItsBlockchain” group called CipherPunks, where some names of community members were misspelled, and the group wanted them removed, so OpenSea had to interfere and remove the collection. OpenSea has been forced to serve as a moderator for those disputes with few pre-existing policies on when and how a token should be blacklisted. Then there were security issues, unintended sales and even an insider trading case. These kinds of headaches could have given an opening to a competitor, but so far, no competitor has emerged.

Casting doubts about their platform, it’s hard to deny how powerful it is to have all buyers and tokens in the same place, making offers and doing deals. So even with the alarming signs of centralisation, this might not scare users and creators away from OpenSea. We will continue to observe.