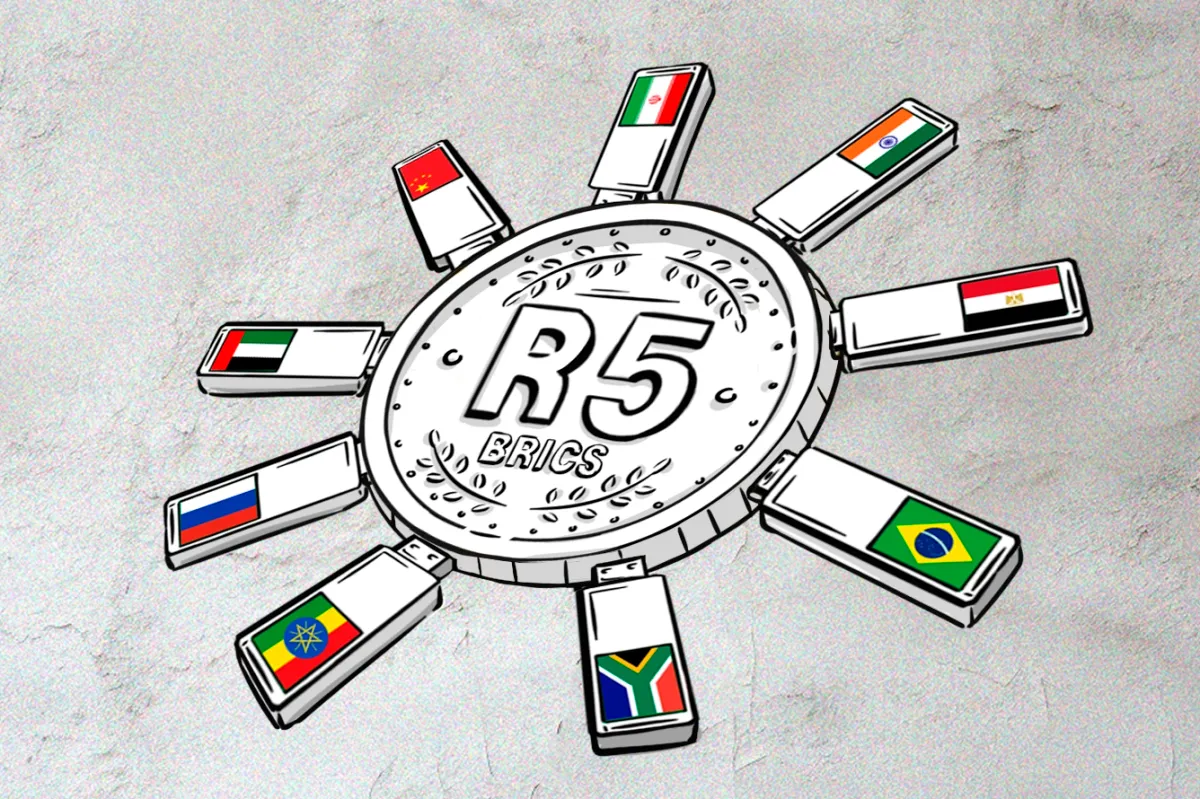

BRICS has established itself as a force to be reckoned with over the past 20 years. While initially comprised of Brazil, Russia, India, China and South Africa, the alliance's ranks have grown — and now include the likes of Iran, Egypt, Ethiopia and the United Arab Emirates.

These countries do share some common themes, including being punished by U.S. sanctions, or boasting significant oil reserves. Many have regimes that are critical of the West and crave an alternative world order.

But BRICS faces a big problem: the dollar commands staggering level of dominance — so much so that the Bank for International Settlements suggests 88% of global transactions are settled in USD. Perhaps it's little wonder that the bloc have started to consider alternatives.

Russian President Vladimir Putin, and his Brazilian counterpart Luiz Inacio Lula da Silva, have both spoken of their ambition for BRICS to launch its own global currency — potentially cutting the dollar out of the picture.

But years after "R5" was mooted, so named because all five BRICS nations have fiat currencies beginning with the letter R, there's little tangible sign that one will launch soon.

This could be a reflection of the fact that a digital currency uniting each nation would be very difficult to achieve. Beyond geography, competing cultures, political regimes and economic philosophies often mean they are oceans apart in more ways than one.

Back in March, Russia's TASS news agency reported that the Kremlin had unveiled plans to create what it called "an independent payment system" across BRICS territories that would be "convenient for governments, common people and businesses, as well as cost-effective and free of politics."

Further light on the plans could be shed in October, which is when the next BRICS Summit is being held.

While Washington is probably losing very little sleep over the prospect of an asset uniting these nations, it's undeniable that the U.S. is lagging well behind in the race to launch a central bank digital currency — with China in particular a world leader in this domain.

The China-Russia dimension of the BRICS cooperation may become the catalyst for the block's digital currency development. The trade and economic ties between the two members intensified following the sanctions imposed on Russia by the Western block countries. The Russian-Chinese trade turnover has reached a new milestone, hitting $240 billion, Russian President Vladimir Putin said today during an official visit to China. Most of the trade is reportedly majorly settled in Chinese currency. Given also the advanced development of China's digital currency and its positioning towards cross-border functionality, e-CNY has all the chances to lay the path to the BRICS digital currency.

Rich Dad Poor Dad author Robert Kiyosaki, a renowned crypto advocate, recently spoke of his believe that a BRICS currency could prove calamitious for the dollar — and spark hyperinflation in America. He posted on X:

Currently in South Africa a country I love. Watching and listening to rumors of what will happen when BRICS nations, Brazil, Russia, India, China, South Africa produce BRICS crypto, possibly backed by gold. If BRICS gold crypto happens trillions in fake money, fiat US dollars…

— Robert Kiyosaki (@theRealKiyosaki) May 12, 2024

The future remains difficult to predict — and even if a BRICS digital currency is announced, it could take years before one launches - around 10-20 years by some estimates. But with the Federal Reserve dragging its heels on a CBDC of its own, the nascent bloc may have enough of a headstart to gain some ground on the greenback.