On July 9, in its annual consultation mission statement, the International Money Fund (IMF) warned the Republic of the Marshal Islands (RMI) against advancing its FinTech initiatives, including the legalization of decentralized autonomous organizations (DAOs) and the issuing of its own decentralized digital currency.

Last year the Marshall Islands became the first sovereign nation to formalize the legal registration of DAOs for regulatory and tax purposes. MIDAO Directory Services Inc., a domestic-based organization, had been established to help DAOs register as legal entities within the country. At the time the Central Pacific island nation was hoping to become a hub for DAOs, offering quite lucrative terms.

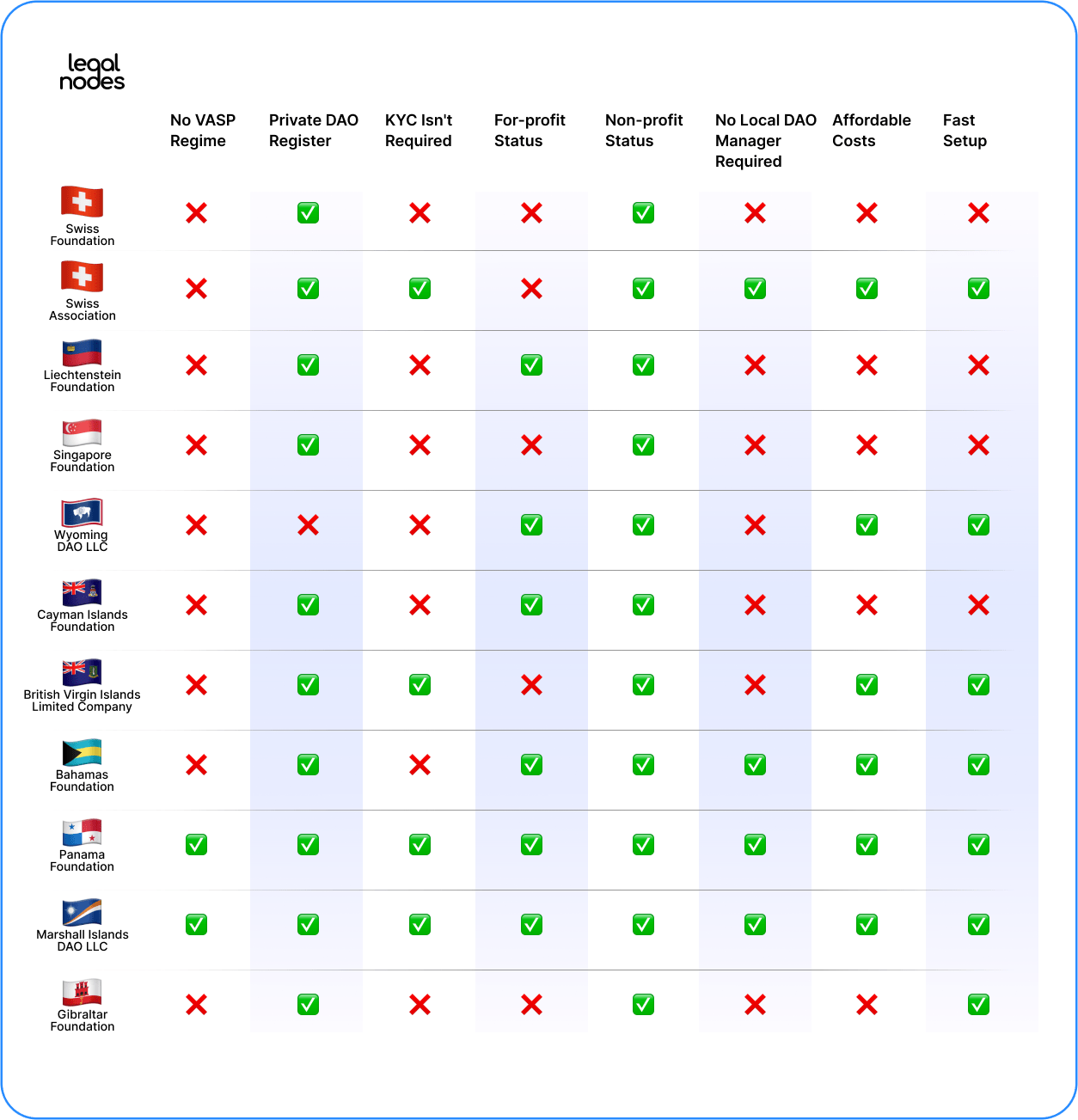

Not many countries recognise DAOs as legal entities. The lack of regulation makes matters worse. Besides, formal and legal requirements are not always suitable for decentralised entities - registration makes it difficult to keep decision-making truly decentralized. Only three U.S. states — Vermont, Wyoming and Tennessee — currently recognise DAOs as legal entities and allow them to register as a type of LLC. DAOs can also be registered as LLC, Association or Foundation in Switzerland, Liechtenstein, Singapore, Cayman Islands, Panama, the British Virgin Islands and the Bahamas. Alternatively, the DAO may be “wrapped” in or “bridged” to some other form of entity that is legally recognised.

As the chart above shows, the Marshal Islands are among the most positive countries for registering DAOs. Additionally, DAOs registered there are not subject to U.S. federal laws while still having access to some U.S. services, according to MIDAO.

Incorporating DAOs was not the only FinTech initiative in the RMI. In 2018 the Republic’s legislature passed a law making a blockchain-based currency SOV - short for “sovereign” - the new legal tender of the Marshall Islands. Despite disagreements among government officials, and IMF and U.S. Treasury Department concerns, in 2019 the team confirmed that they were continuing to develop the coin. Thus far the coin has not been issued, but it is possible to pre-register for the issuance and the pre-sale. According to the official website the TRMI (pre-sale) will begin soon, although this information has been unchanged for the past five years.

It seems that these initiatives do not go hand in hand with the IMF’s ideas on the RMI's economic development. Apart from various economic observations, the statement by IMF includes a warning that some FinTech initiatives - such as the launch of SOV and the enactment of the DAO Act - pose serious risks to the financial integrity of the RMI.

This is not the first time that the IMF has warned the RMI about its blockchain-based initiatives. From its conception in 2018, the IMF warned the RMI that its proposed SOV issuance raised serious economic, reputational, AML/CFT and governance risks, and recommended reconsidering the issuance of the digital currency as legal tender. In 2021, IMF representative Ms. Yong Sarah Zhou said that SOV was one of the downside risks (alongside climate change and related natural disasters) for an RMI economy already severely affected by COVID-19 :

“The issuance of the digital currency SOV as a second legal tender would raise risks to macroeconomic and financial stability as well as financial integrity. The issuance of the SOV could jeopardize the RMI’s last USD corresponding banking relationship. This combined with AML/CFT risks (including those related to the SOV) could disrupt external aid and other important financial flows.”

This year the IMF said that adopting stablecoins and DAOs is complicated even for high-capacity jurisdictions, and advised adopting a cautious approach toward these and other FinTech initiatives. The IMF suggested imposing a moratorium on the registration of DAOs while adequate safeguards are identified and implemented. As for SOV, IMF believes that “expeditiously enacting the SOV Repeal Bill” is the best option possible.

In the meantime, the report highlights that the RMI remains at high risk of debt distress and notes that the Republic depends on IMF money and support.

On one hand, poorly thought-out initiatives might indeed bring a lot of harm to an already unstable economy, but alternatively, blockchain-based solutions might have the potential to help countries that have failed in traditional financial efforts. What do you think? Add your thoughts in the comments.