The Japanese Nikkei news agency has published an article according to which, from 2023, Japan's cryptocurrency exchanges will officially be able to sell stablecoins issued outside the state.

The Financial Services Agency of Japan noted several important points about the upcoming launch of foreign stablecoins on the Japanese market:

- The new legislation will allow Japanese exchanges to make transactions with stablecoins if they manage to keep assets at the expense of deposits and the upper limit of money transfers.

- The spread of foreign stablecoins in the Japanese market requires regulators to have legislation that will ensure anti-fraud.

”When distributing, measures are also required to counteract the legalization (laundering) of proceeds from crime. However, the effectiveness of recording transaction information is questioned.” - the article says.

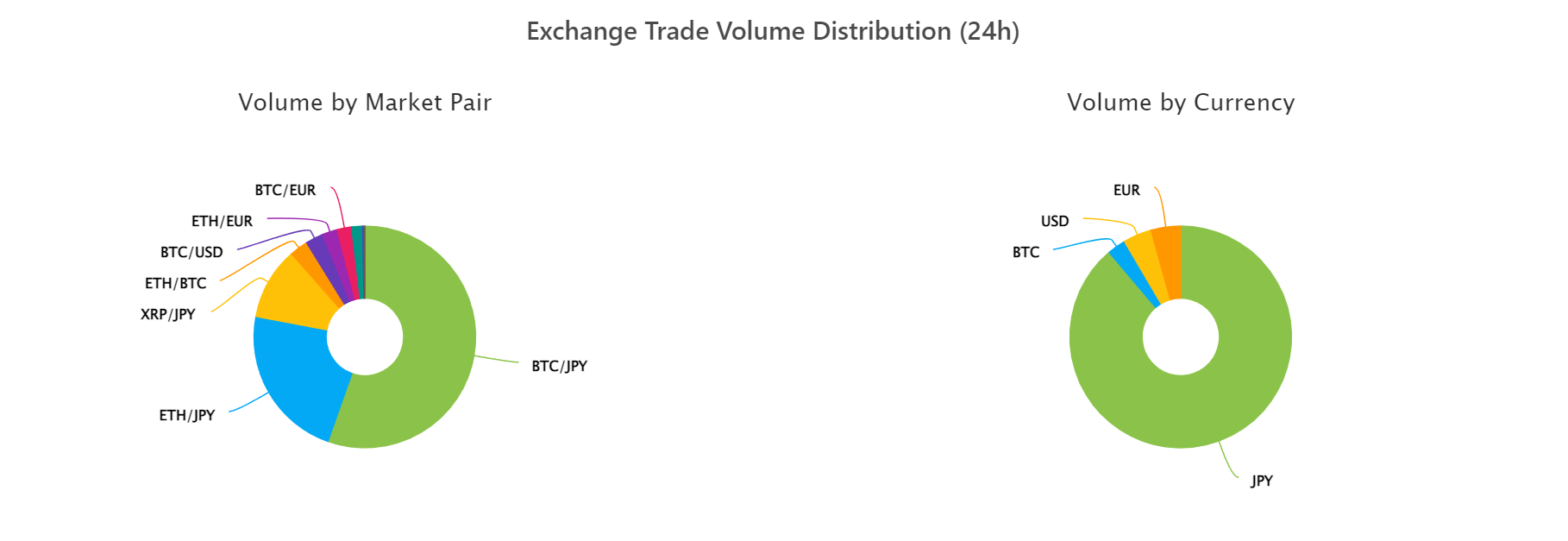

At the moment, the list of exchanges that have been registered by the Financial Services Agency includes thirty-one exchanges. One of the largest Japanese exchanges, according to CoinGecko, is BitFlyer. The exchange was registered in 2014, today the daily trading volume on the exchange is $16 million. 5 coins and 10 trading pairs are available for users on the exchange, the distribution of trades between each per day is as follows:

Thanks to the charts, you can see that most of the transactions on the exchange take place in the Japanese national currency - the yen. Since dollar-linked stablecoins, such as USDT and USDC, will enter the market, this may lead to an increase in the dollar's share in the Japanese market, which may turn into dollarization of the economy. We will monitor this process and share our observations with you.

Despite the fact that the Japanese crypto market seems to be quite isolated, major international players are clearly interested in it. For example, on November 30 of this year, Binance announced the purchase of the Sakura Exchange BitCoin (SEBC) exchange. This step will allow Binance to operate legally in the Japanese market. The terms of the deal were not disclosed. Employees actively spoke about how important this step is for the future of cryptocurrency at the global level.

“The Japanese market will play a key role in the future of cryptocurrency adoption. As one of the world’s leading economies with a highly-developed tech ecosystem, it’s already poised for strong blockchain uptake. We will actively work with regulators to develop our combined exchange in a compliant way for local users. We are eager to help Japan take a leading role in crypto.” – general manager of Binance Japan,Takeshi Chino,said .

However, there are also those companies that have decided to leave the Japanese market. Kraken crypto exchange announced its withdrawal from the Japanese market on December 28. From January 31, 2023, the license from the Financial Services Agency will be cancelled. This license was issued to a subsidiary of Payward Asia Inc, which represented Kraken in the Japanese market. It is worth noting that earlier the company had already stopped working in Japan, but after a few years it was re-registered and continued to work.

This time Kraken's departure from the Japanese market is due to the general crisis and the non-return on invested resources:

“Current market conditions in Japan in combination with a weak crypto market globally mean the resources needed to further grow our business in Japan aren’t justified at this time.”

It can be assumed that the entry of foreign stablecoins can have a positive impact on the Japanese crypto market, as well as on the stablecoins themselves. Expanding the geography can bring new customers to stablecoins. It is likely that the Japanese market will also develop and become more attractive to international companies, which may lead to a second Kraken revival in Japan. We will continue our observations and report the news!