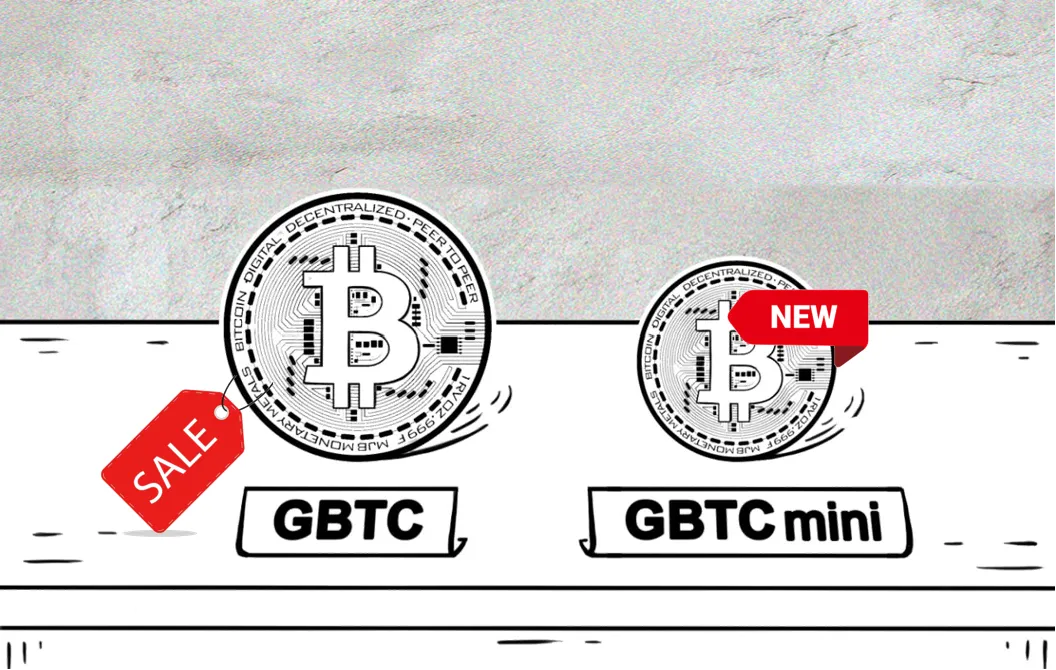

In its latest S-1 filing, Grayscale has unveiled plans to introduce a new product, the Grayscale Bitcoin Mini Trust, a spin-off from its primary Bitcoin ETF product. This strategic move aims to stem the significant outflow of investors from GBTC by offering an alternative that enables them to circumvent high fees without incurring tax liabilities.

The backdrop to this development is the U.S. SEC’s approval of several spot Bitcoin ETF products back in January, and the subsequent conversion of the Grayscale Bitcoin Trust into an ETF. Since this conversion, GBTC has experienced substantial outflows of over 230,000 Bitcoin, largely due to two main factors.

Prior to conversion, many investors capitalized on significant discounts on GBTC shares relative to Bitcoin’s market price, with these discounts sometimes reaching as high as 48%, and subsequently took profits.

Additionally, the competitive landscape has shifted, with investors migrating to alternative ETF providers that offer significantly lower fees. Currently, GBTC imposes the highest fees in the sector at around 1.5%, in stark contrast to the 0.19%-0.3% fees charged by other ETFs. Some providers, like VanEck, have even introduced zero-fee options to attract more assets and compete effectively in the market.

Source: crypto-etfs.com

This raises a pertinent question: why haven’t all investors simply transitioned to other Bitcoin ETF trusts? The answer lies in the tax implications of selling their shares, which could potentially exceed the 1.5% fee, effectively locking many investors within the GBTC fund.

The introduction of the Grayscale Bitcoin Mini Trust seeks to address this dilemma. By allocating new shares to existing investors, Grayscale not only aims to retain its client base but also to attract new investors deterred by the high fees.

This strategy, however, prompts another question: why doesn’t Grayscale simply reduce its fees? Lowering fees would mean a significant reduction in profits and revenue, a move that, at present, does not align with the company’s interests. However, should the current trend of investor outflows persist, Grayscale may eventually be compelled to reconsider its fee structure.

Interestingly, Grayscale’s portfolio extends well beyond Bitcoin, with several of its funds attracting significant investor interest of late. For instance, the Grayscale LINK fund is currently trading at a 700% premium, underscoring the lack of ETF alternatives for institutional investors to access the native token of the Chainlink oracle ecosystem. This situation highlights the potential for similar developments if ever a LINK or any other crypto ETF becomes available.

Meanwhile, the broader Bitcoin ETF market continues to attract record inflows, with the total Bitcoin holdings in ETFs recently surpassing 4.11%. Notably, the iShares Bitcoin Trust from BlackRock has seen remarkable inflows, accumulating over 200,000 Bitcoins in just two months, highlighting substantial interest from institutional investors.