When Global Dollar (USDG) launched in late 2024, it didn’t try to win the market through hype or yield gimmicks. Instead, it followed a new kind of stablecoin playbook—one focused on regulation, institutional partners, and global interoperability. Less of a crypto-native sprint, more of a strategic rollout with the patience and polish of traditional finance.

Step One: Bring the Right People to the Table

The foundation of Global Dollar is the Global Dollar Network (GDN), a consortium of heavyweight players across crypto, fintech, and institutional custody. Founding members include Robinhood, Kraken, Galaxy Digital, Anchorage Digital, Nuvei, and Worldpay.

Each member brings a piece of the puzzle:

- Robinhood offers retail access to millions of U.S. users.

- Kraken and Anchorage contribute institutional infrastructure and secure custody.

- Nuvei and Worldpay bring payment processing at the merchant level.

- Galaxy connects DeFi and trading capital.

Together, they form a stablecoin distribution machine that spans exchanges, wallets, payment gateways, and custody providers.

Step Two: Start With a Proven Issuer

USDG is issued by Paxos Digital Singapore, a subsidiary of Paxos—arguably the most experienced regulated stablecoin issuer to date.

Beyond Pax Dollar (USDP) and Pax Gold (PAXG), Paxos has also whitelabled several major regulated stablecoins—including PayPal USD (PYUSD) in collaboration with PayPal, the now discontinued Binance USD (BUSD) for Binance, and the yield-bearing Lift Dollar (USDL) in partnership with Standard Chartered under ADGM regulation—demonstrating deep experience and institutional trust. It holds licenses from regulators across the U.S., Europe, Singapore, and the UAE.

Rather than launching under a Cayman-based shell company, Global Dollar made regulatory clarity a starting condition. This approach gives institutions a reason to pay attention—and gives regulators less to worry about.

Step Three: Pick the Right Jurisdictions

Global Dollar’s regulatory perimeter starts in Singapore, where Paxos Digital Singapore is licensed by the Monetary Authority of Singapore (MAS). The country is one of the most stable, finance-forward jurisdictions in Asia and a magnet for digital asset firms looking for long-term credibility.

On the European side, USDG became one of the first stablecoin issuers to launch under the MiCA framework—the EU’s new landmark crypto legislation. That means USDG is already cleared to operate across all 27 EU member states, reaching a population of over 450 million people.

Step Four: Align Incentives

The Global Dollar Network has introduced a revenue-sharing model that sets it apart from traditional stablecoin systems. What makes the model notable is that the yield generated from the reserves of USDG isn’t kept by the issuer—instead, it is distributed across the network, rewarding partners who help grow and maintain its utility and accessibility.

Participants in the network—including exchanges like Kraken, wallets and custodians like Anchorage Digital, and payment platforms like Nuvei and Mastercard—earn a share of this yield based on their level of engagement. Whether through listing USDG, securing it, enabling transactions, or helping users mint new tokens, every action that supports the stablecoin’s adoption is tied to financial incentives. The yield distribution is calculated using a proprietary attribution system and paid out monthly.

The exact mechanics and distribution ratios haven’t been officially disclosed, but reports suggest that up to 100% of the reserve yield is shared with network partners.

"Global Dollar Network will return virtually all rewards to participants and is open for anyone to join. It is designed to incentivize global stablecoin usage and accelerate societal wide adoption of this technology," Paxos CEO Charles Cascarilla said on the launch.

The scale of the opportunity is already visible: Kraken offers users up to 4% APR on USDG holdings via its Kraken+ program—funded by its share of the network’s yield. Mastercard, meanwhile, is projected to earn over 3% annually on USDG balances integrated into its services. With over 25 institutional partners and a combined reach of more than 42 million users, Global Dollar is making a coordinated and well-capitalized push toward stablecoin adoption.

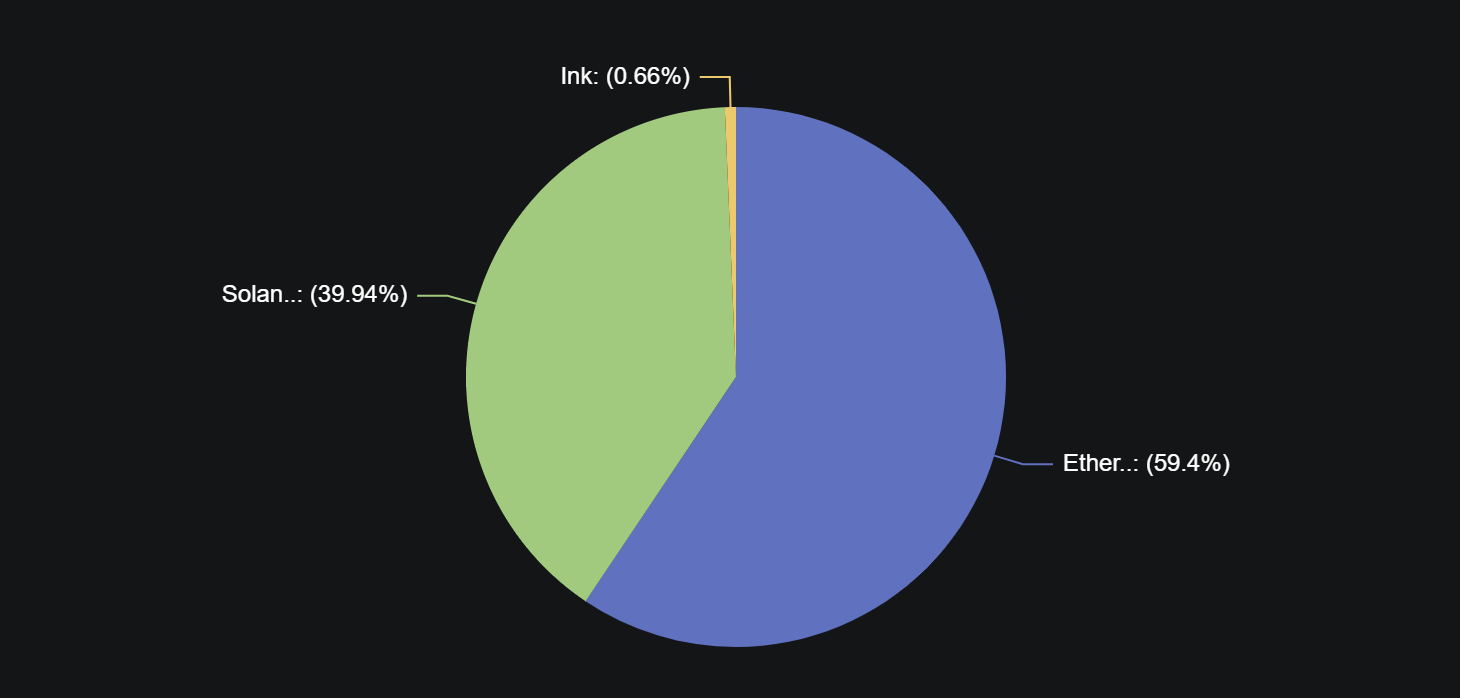

Step Five: Ethereum, Solana, ... Ink

Global Dollar went straight to the two dominant platforms for stablecoins: Ethereum and Solana. Each brings its own advantages, audience, and tradeoffs—making USDG accessible across both mainstream and high-performance ecosystems.

Ethereum is the original home of stablecoins. Its robust developer community, deep DeFi integrations, and high institutional trust make it the go-to platform for compliant financial applications. Most regulated stablecoins—USDC, PYUSD, USDP—launched first on Ethereum.

Solana, on the other hand, offers fast finality and low-cost transactions, making it attractive for consumer-facing use cases like payments, gaming, and mobile wallets. By deploying USDG on Solana, Global Dollar can target more retail and emerging market applications, especially where transaction fees matter.

In a rather unexpected next step, in July 2025, Global Dollar expanded to INK, a newer smart contract platform optimized for modular design and high-throughput execution. INK is part of the growing wave of next-gen chains focused on programmability, speed, and flexible architecture. While not yet mainstream, launching on INK positions USDG ahead of the curve in areas like custom execution environments, composability with emerging ecosystems, and alternative rollup designs.

INK also aligns with the strategy of being "regulation-ready" and performance-tuned, which could appeal to fintech and enterprise applications that need programmable money at scale without Ethereum’s overhead or Solana’s network limits.

Step Six: Put It In Every Pocket

Since day one, USDG has pursued a clear strategy: grow adoption by building a broad, incentivized partnership network. From its initial launch in late 2024, the Global Dollar Network (GDN) quickly attracted a roster of major players across crypto, fintech, and payment sectors.

Founding members like Robinhood, Kraken, Anchorage Digital, Galaxy Digital, Nuvei, and Bullish brought a powerful mix of retail access, institutional custody, and market infrastructure. As the network expanded, new partners joined to support payments, compliance, custody, and global trading—names like Worldpay, Zodia Custody, BitMart, FOMO Pay, Huma, CoinsPaid, and SwissBorg.

Each partner plays a role: wallets and custodians secure USDG, fintech platforms integrate it into payment rails, and exchanges distribute it to users globally. Thanks to the GDN's yield-sharing incentive model, every participant has economic reasons to help grow adoption.

The most recent milestone came in July 2025, when OKX, one of the world’s largest exchanges, joined the network. The integration enables seamless 1:1 USD conversions with zero withdrawal fees, significantly boosting USDG’s liquidity and accessibility.

As a result, USDG’s market cap has grown from under $50 million in early February to over $329 million in July:

With over 25 partners and counting, Global Dollar’s rollout strategy continues to hinge on shared incentives and trusted infrastructure. The next wave of announcements could further strengthen its global presence—and we'll be watching closely to see who joins next.