On June 18, 2025, the U.S. Senate passed the GENIUS Act—short for Guiding and Establishing National Innovation for U.S. Stablecoins. The bill lays out a legal framework for dollar-backed stablecoins issued by private entities and marks the first comprehensive attempt to define how digital dollars should circulate in the U.S. economy. The legislation clearly favors the private sector over direct federal control and signals bipartisan support for regulated, asset-backed digital tokens.

What Is “Genius” in the GENIUS Act?

The GENIUS Act lays down a structured legal framework for stablecoin issuance in the United States.

To issue a stablecoin in the U.S., an entity must be licensed at the federal or state level. Foreign issuers are not explicitly banned, but they must register with U.S. regulators and meet the same standards as domestic players. This clause has major implications for global stablecoins like Tether, which currently operate outside the U.S. licensing perimeter.

All tokens must be fully backed by U.S. dollars or short-term Treasury bills, and the reserves must be held in segregated, audited accounts. The law requires monthly disclosures and quarterly audits, ensuring transparency over what actually backs the digital dollars users hold.

Small issuers (under $10 billion) can operate under state oversight, while large issuers (above $10 billion) must come under federal control.

The GENIUS Act goes beyond traditional reserve and licensing rules by requiring stablecoin issuers to operate under robust anti-money-laundering (AML) and sanctions compliance programs. In addition, the Act mandates the U.S. Treasury to conduct research into cutting-edge AML methods, including the use of APIs, blockchain transaction tracing, AI tools, and digital identity verification.

Importantly, the Act defines legitimate stablecoins as payment instruments, not investment products. As such, they cannot offer interest by default or be used for fractional lending. This means compliant stablecoins are not classified as securities or money market funds, shielding them from SEC jurisdiction.

Everyone Likes Stablecoins

Stablecoins have become the most successful use case in the digital assets industry—and increasingly, in government strategies as well.

In the U.S., the political momentum behind the GENIUS Act came from an unusual coalition. Republicans widely opposed a digital dollar on ideological grounds, warning it could lead to state surveillance of Americans' financial lives. On the other hand, Democrats—especially centrists—backed stablecoins as a market-friendly alternative that wouldn't threaten existing banks.

Another layer to the political calculus was pressure from the financial industry. Commercial banks have long feared that a government-issued CBDC could drain deposits and put the Fed in direct competition with retail banks. Fintech companies, on the other hand, pushed hard for clarity on stablecoins. Adding to the intrigue, observers noted the influence of U.S. Commerce Secretary Howard Lutnick—whose firm, Cantor Fitzgerald, is custodian for Tether’s U.S. Treasury reserves.

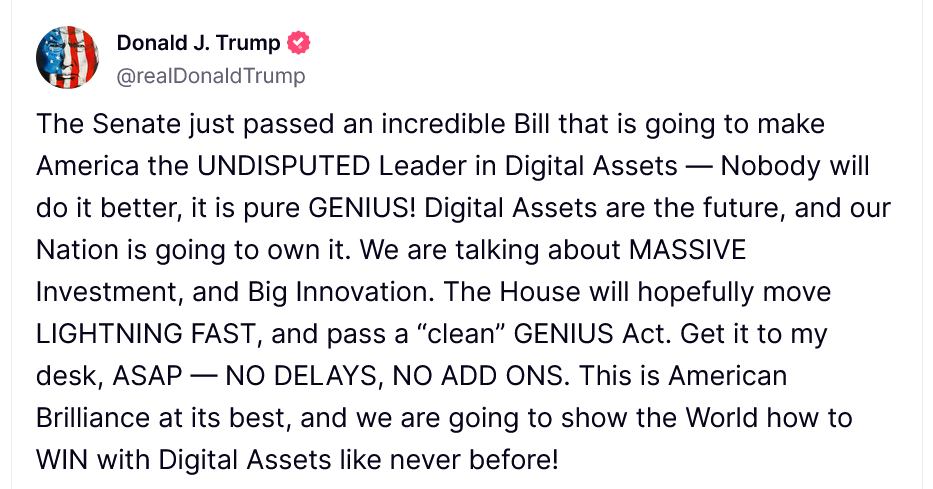

President Donald Trump had campaigned vigorously on a promise to modernize American finance and promote private-sector innovation. Just days after returning to office, he signed an executive order titled “Strengthening American Leadership in Digital Financial Technology”, which explicitly endorsed the use of regulated, dollar-backed stablecoins and directed agencies to prioritize their integration into digital infrastructure.

This bill is, in essence, a legislative extension of that directive.

Why Invent a Digital Dollar if There Are Already Many?

Besides enforcing USD-backed stablecoins, Donald Trump's order explicitly prohibited federal agencies from developing, promoting, or issuing a central bank digital currency (CBDC), and mandated the immediate termination of any ongoing CBDC initiatives.

While the GENIUS Act carries forward that vision, it stops short of directly banning a CBDC. Nowhere in the bill is the term “CBDC” explicitly used. Instead, it includes a legal clause stating that nothing in the act shall expand the Federal Reserve’s authority to offer services directly to the public.

With this bill, the U.S. is effectively outsourcing digital dollar innovation to the private sector. That may have far-reaching consequences abroad. In many emerging markets, where local currencies are unstable, dollar-backed stablecoins have already become a de facto store of value. The GENIUS Act gives those tokens a legal anchor, strengthening the global reach of the dollar without requiring a state-run CBDC.

This move also sets the U.S. apart from China and the EU. While those regions are pursuing tightly controlled digital currencies issued by central banks, the U.S. is betting on open, modular infrastructure where competition and market demand determine the outcome.

What Happens Next?

Although the GENIUS Act has passed the Senate, it must still clear the House of Representatives before becoming law.

The House Financial Services Committee is expected to review the bill and may propose amendments or schedule hearings in the coming weeks. If the bill passes the House in its current form, it will head to the President’s desk for final approval.

In parallel, regulators are preparing to define the licensing process, redemption rights, audit enforcement, and cross-border guidance.

The GENIUS Act is not the end of the stablecoin debate. But it’s the clearest signal yet that the U.S. intends to lead the digital currency race—not with a central bank token, but with a regulated, scalable network of private stablecoins anchored to the dollar.