Recently, we’ve been getting quite excited about the incoming second wave of blockchain-based games. From what we have seen so far, it looks like this will address much of what was wrong with the first wave, namely that it largely focused on the blockchain element rather than the actual gaming experience.

But it isn’t just the games that have changed, the entire Web3 ecosystem around them is vastly different from when CryptoKitties almost broke the Ethereum blockchain back in late 2017. For a start, we now have a wealth of Layer 2s (and even Layer 3s), some of which are specifically designed to support the gaming sector.

What an opportune time to step back and take an in-depth look at the current state of Web3 gaming. Fortunately, that is exactly what Game7, a collective aiming to accelerate the blockchain gaming industry, has done, with its ‘State of Web3 Gaming’ report.

Game7 is excited to share our State of Web3 Gaming Report 🚨

— Game7 DAO (@G7_DAO) November 13, 2023

Take a deep dive into -

🎮1,900 Blockchain Games

💰1,000 Funding Rounds

🧩170 Ecosystems

📅 2018 to October 2023

Insights on -

🔺Fundraising

🔺Competitive Dynamics

🔺Blockchain Networks

And much more!

Let’s… pic.twitter.com/oFLz9UcadP

Taking data from 1,900 blockchain games across 170 different ecosystems, from 2018 until the present day, the report gives the most comprehensive picture of Web3 gaming to date. Its 61 pages give insights covering topics from funding, through developer tools and ecosystems, to gameplay and genre.

Quality over quantity

The number of new Web3 games announced in 2023 has fallen by around 70% from its peak (of over 800) in the NFT-frenzy which was 2021. However, the challenging market conditions that followed in 2022 saw a significant peak in the number of games cancelled, so we can hope that this drop in new games represents a refocus on quality over quantity.

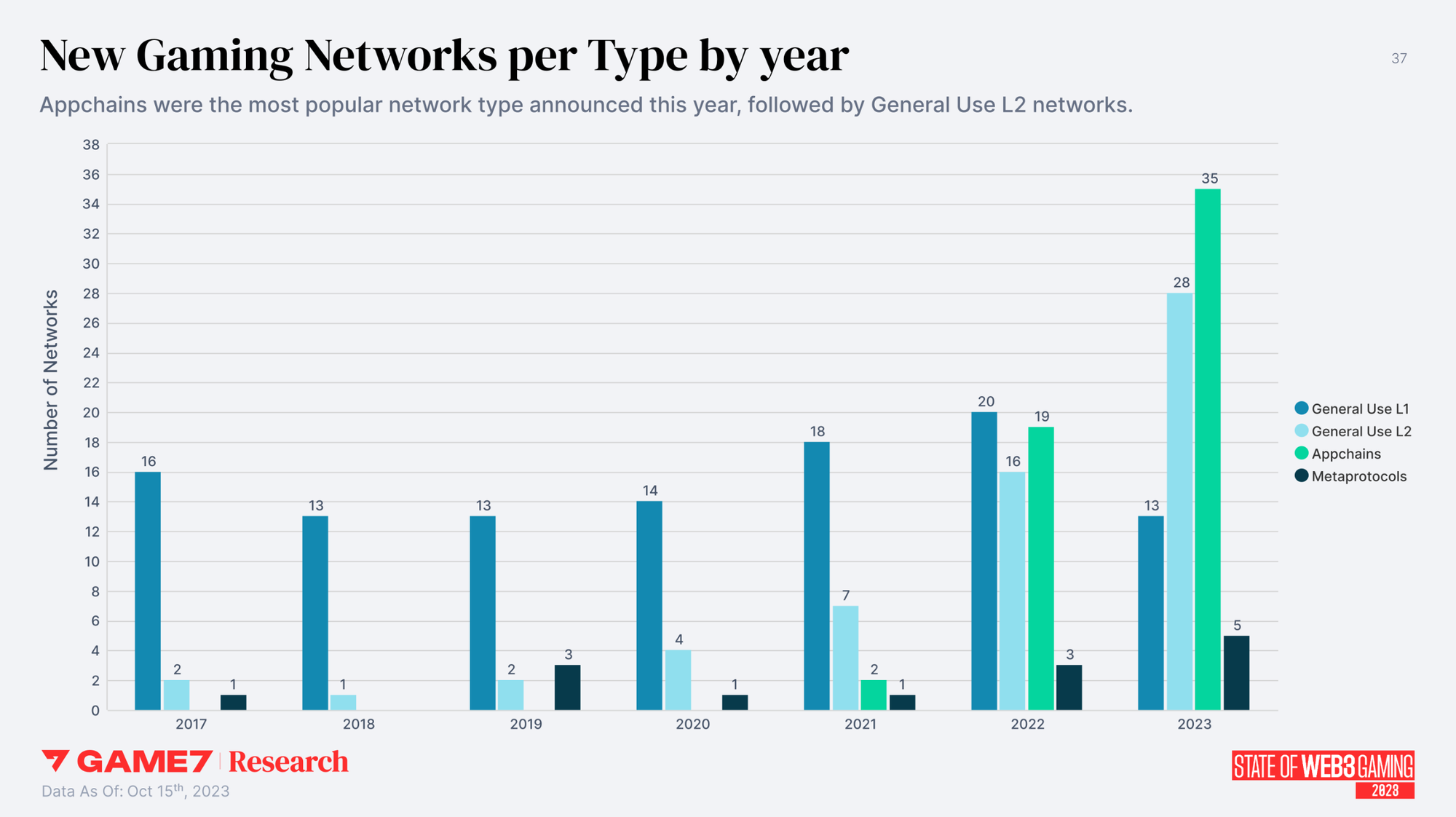

There has also been an explosion in the diversity of networks used for blockchain gaming. The bulk of the increase over the past two years has been in gaming-focused networks rather than general-purpose networks. Despite this, the majority of games are still found on Ethereum Virtual Machine-based L1 blockchains and sidechains, with Polygon at the top of the pile, ahead of BNB and the Ethereum mainnet.

There has also been an increase in the number of games migrating to alternative blockchains, particularly to Layer 2s and 3s, reportedly for cost, scaling and other reasons. Immutable and Arbitrum have emerged as front-runners in the EVM L2 ecosystem. Among non-EVM chains, Solana and ImmutableX host the most active games, and Appchains broke through as this year’s top new gaming network type.

83% of Web3 games use blockchain purely for tokenized in-game assets, with a further 12% integrating additional elements of game states (such as leaderboards, etc), and just 5% running fully on-chain. This is unsurprising, as very few games require (or would benefit from) every aspect of gameplay making a call to update an on-chain state.

Indies still dominate with big names moving in

The majority of games so far have been produced by indie developers (without investor support) or midsized development teams (under $10 million raised). 5% fall into the AA category ($10 - 25 million of financial backing) with only 1% being true top-tier AAA games. However, as we recently Observed, several big-name games and developers are now on the horizon.

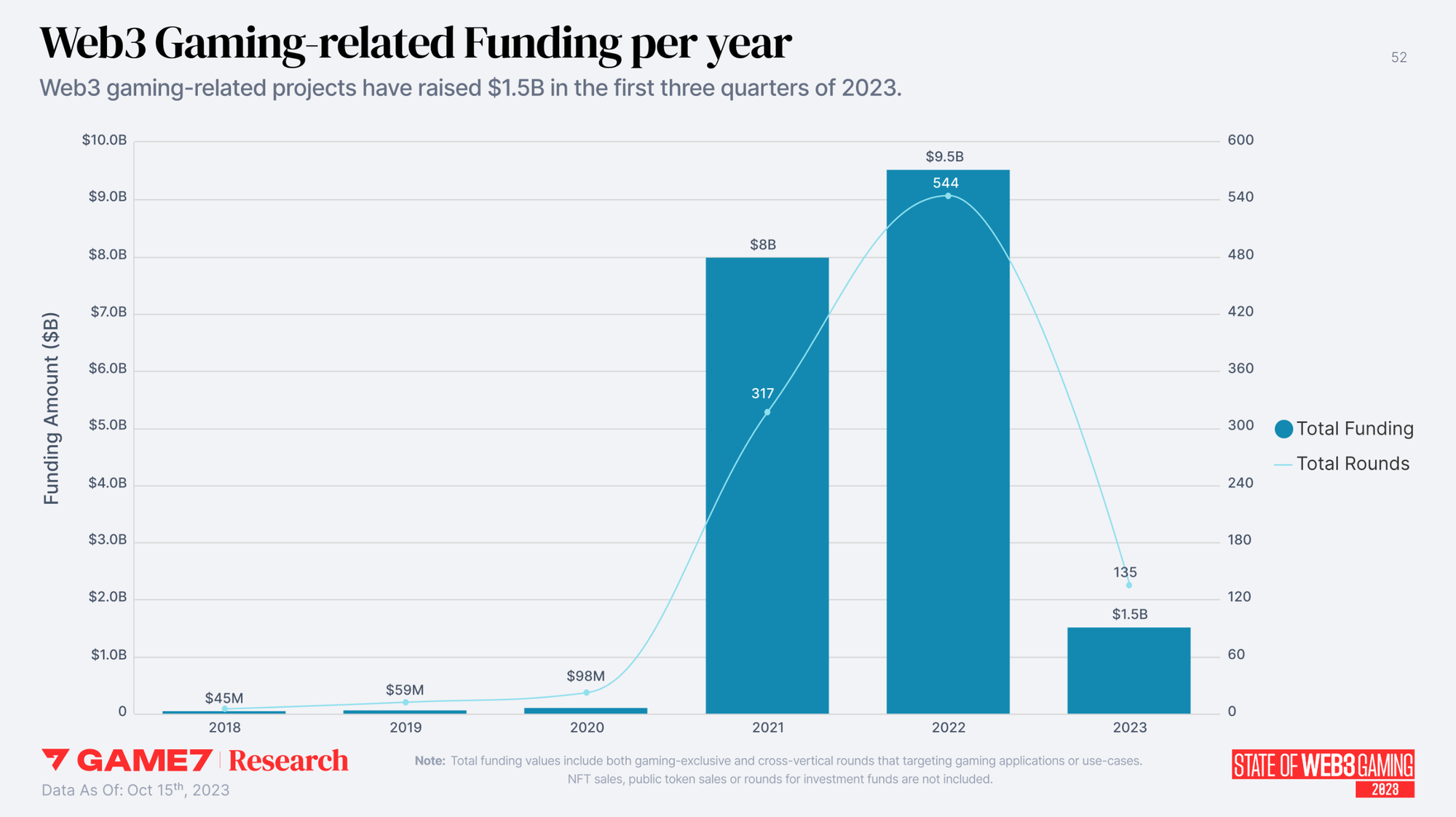

The total funding for Web3 gaming projects has understandably taken a significant hit in this year’s challenging conditions, after massive investment across 2021 and 2022. However, projects have still managed to raise $1.5 billion between them, and the reduced number of projects means that the level of investment per funding round is still reasonably high.

Sports games and Metaverse-related massively multiplayer online (MMO) titles have dominated funding, with role-playing games (RPG) coming a notable third. In terms of the games produced, RPGs make up almost a quarter of all titles released so far, with action, strategy and casual games also well represented. Sports games and MMOs each comprise 9% of the total genre split.

The report concludes that, “The Web3 gaming market is still growing post the 2022 market correction, albeit at a slower rate,” which sounds like a more manageable and stable situation than the initial frenzy that produced its first wave. We shall continue to Observe.