Due to the exploit in Acala’s liquidity pool about $3 billion was lost. The aUSD stablecoin lost its peg. Later, almost all the funds were returned.

Acala is a decentralized finance network powering the aUSD ecosystem. Acala Network works in the Polkadot ecosystem. The main product of Acala Network is the aUSD stablecoin, which is pegged to the dollar. aUSD is backed only by decentralized assets in Collateralized Debt Positions (CDP).

On August 14, hackers exploited a vulnerability in the recently launched the iBTC/aUSD liquidity pool, as reported on the Twitter of the Acala project.

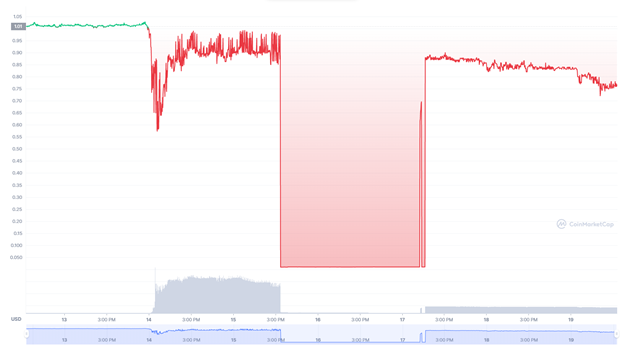

Thanks to the vulnerability, hackers minted more than a billion aUSD, which led to the aUSD stablecoin losing its peg to the dollar. aUSD dropped in price to one cent, but now the price of aUSD ranges from 70 to 80 cents.

The Acala project team managed to quickly detect the problem and figure out the addresses of the hackers’ wallets in which the dubiously minted aUSD tokens were stored.

Acala disabled the transfer option for invalid minted aUSDs and held a vote during which 95% of the community voted to burn all erroneously minted tokens.

The Acala team managed to recover and burn 1.288B aUSD during the referendum. 1.68B aUSD has been returned, but it hasn’t been burned yet. Thus, the Acala team managed to return about 3 billion aUSD.

The only thing that is alarming is how quickly the voting was conducted and results returned. 95% voted for temporarily disabling the transfer functions and for money to return from hacker’s wallets. You do not need to be professionally acquainted with the crypto industry to understand that in a real decentralized system such a majority decision is hard to achieve. Acala chose shame instead of bankruptcy. They have shown everyone that they are not decentralized. Well, that’s their choice.