Ethereum-focused startup, Etherealize, recently published “The Bull Case for ETH,” a report aimed at convincing institutional investors that ETH is significantly undervalued, positioning it as digital oil that will power the economy of the future.

Etherealize, founded in 2024 by former Ethereum core contributor Danny Ryan and ex-Wall Street bond trader Vivek Raman, is a startup focused on bridging traditional finance and Ethereum. With a small, technically capable team based in New York, the company aims to make Ethereum more accessible and usable for institutions through tailored tooling, tokenization frameworks, and educational outreach. While it has received early support from the Ethereum Foundation and Vitalik Buterin, Etherealize operates independently, concentrating on practical infrastructure and narratives that align Ethereum’s evolving capabilities with real-world financial use cases.

Ethereum is Not a Speculative Asset

The report adopts a protective tone, arguing that Ethereum remains fundamentally strong despite recent market skepticism. The authors attribute ETH's lagging performance primarily to what they describe as a “mispricing” of the native token. Notably, the ETH/BTC ratio has declined more than 70% since late 2022, and ETH has shown limited responsiveness to broader market hype cycles.

However, Ethereum co-founder Vitalik Buterin has consistently emphasized that short-term price movements should not dictate the network’s direction. He prioritizes technological progress, usability, and the long-term resilience of the ecosystem over speculative appeal.

A Serious Chain in an Industry That Often Isn’t

The Etherealize report goes to great lengths to argue that institutional recognition of Ethereum will follow the path already paved by Bitcoin. While Bitcoin has been embraced as digital gold, Ethereum’s more complex architecture makes it harder for institutions to fully understand and adopt.

“Ethereum’s value proposition, by contrast, has been harder to define — not because it’s weaker, but because it’s broader. While Bitcoin is a single-purpose, store-of-value asset, Ethereum is the programmable foundation underpinning the entire tokenized economy.”

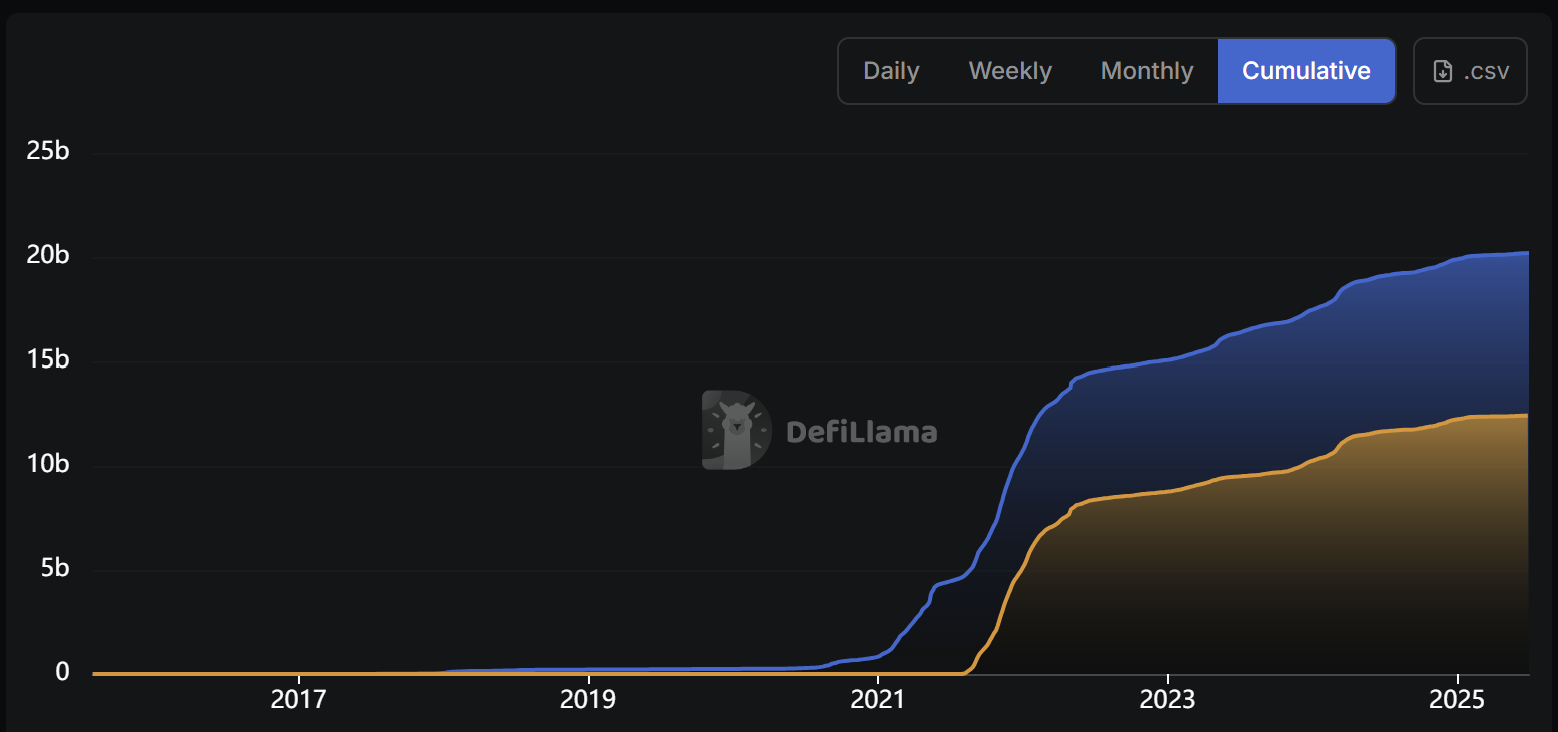

The report emphasizes Ethereum’s institutional strengths: it is the leading platform for stablecoins, tokenized assets, and other programmable financial instruments. More than 80% of tokenized assets are on Ethereum. Indeed, Ethereum is the platform of choice for institutions and governments that want to experiment with permissionless blockchains.

However, the report largely glosses over a key area of weakness: Ethereum Layer 1 has lost much of its small-scale developer activity and retail liquidity. It either moved to Ethereum L2s or migrated to Solana and similar networks.

Ethereum also missed out on the recent memecoin frenzy, a cycle that instead played out on Solana, BNB chain, and other contenders, providing them with retail activity and liquidity.

New projects are now launching these networks because that is where the action is — fast transactions, a lot of liquidity, low fees, and an active user base.

How to Appraise Ethereum’s ETH

There are various approaches to valuing crypto assets—ranging from traditional corporate finance models to newer tokenomics frameworks. In the case of ETH, valuation is especially complex: it functions as a transaction fee token, a staking instrument, an appreciating asset, and more. The report outlines a range of perspectives on how ETH should be assessed.

The authors argue that ETH represents a new asset class entirely. To fully capture its valuation potential, they suggest benchmarking ETH against global reserve assets such as oil, gold, or even the M2 money supply. Based on a combination of these methodologies, the report estimates that ETH could one day reach a theoretical value of $706,000 per token

ETH Scarcity

On tokenomics, the report emphasizes ETH’s built-in scarcity, driven by three core mechanisms:

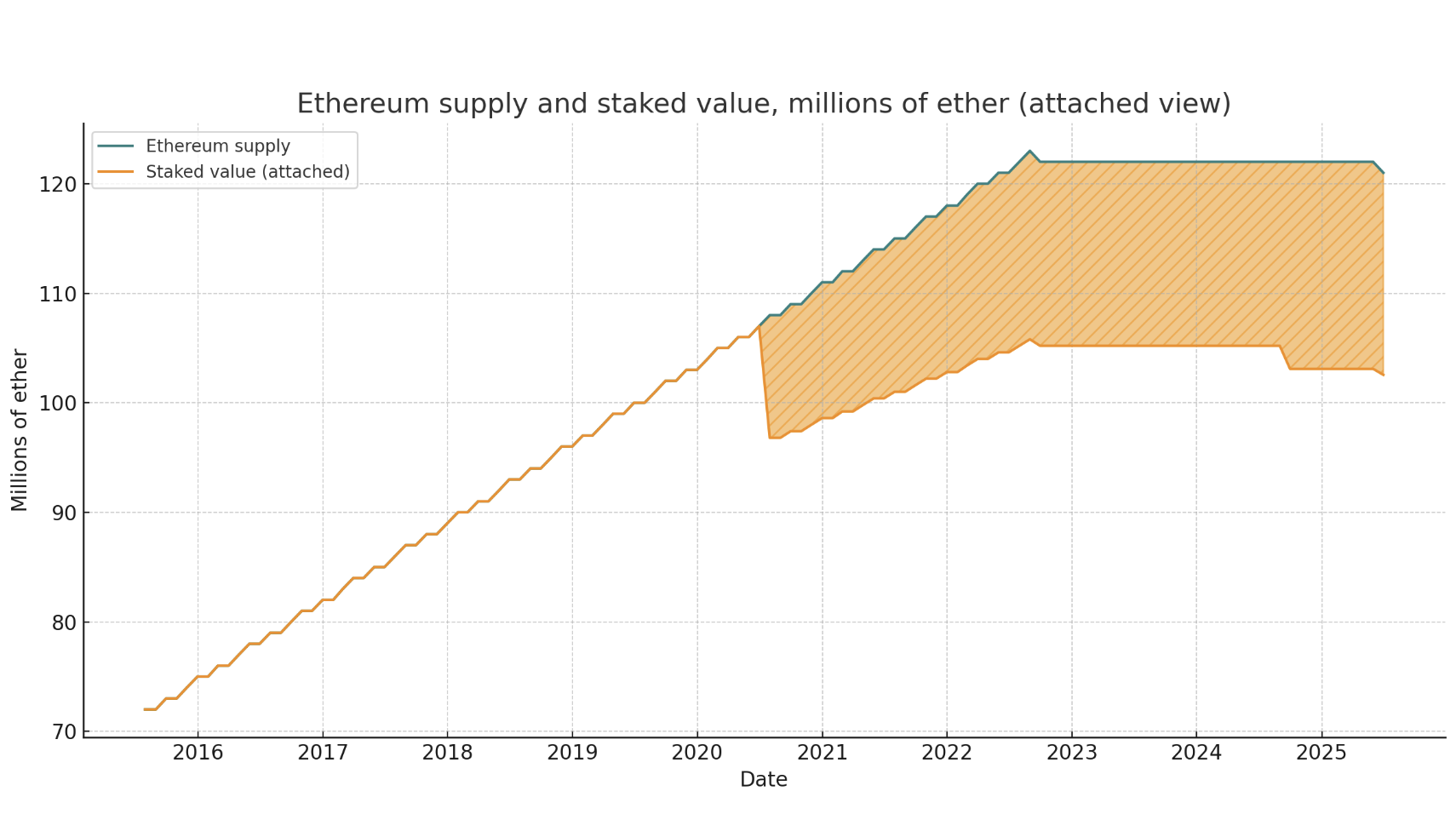

- Low issuance (currently around 1% annually),

- Fee burning under EIP-1559, and

- Staking lockups that remove a portion of the supply from circulation.

The major part (according to the report, 80%) of issued ETH is burned, leaving the total supply nearly flat.

Since the Merge in September 2022, ETH supply inflation has hovered around 0.09% annually—lower than both fiat currencies and Bitcoin.

Combined with the growing share of staked ETH (now above 29%), the result is increasing scarcity, which the authors present as a positive signal for long-term price appreciation.

ETH as a Yield-Bearing Asset

Another lens proposed in the report views ETH as a productive, yield-bearing digital commodity, thanks to validator staking rewards. The current staking yield is approximately 2.9%, which the authors describe as a kind of "non-sovereign monetary premium."

They draw parallels between ETH and gold—emphasizing that gold itself is not inherently productive, but generates yield when lent, collateralized, or otherwise put to use. Similarly, ETH’s value is not just in the asset itself, but in the economic activity it enables, particularly through staking.

More Than Just a Server Collecting Fees

The authors argue that ETH should not be valued like a tech company—based on present or projected fee revenue. Instead, they compare it to physical oil: a commodity asset with inelastic supply due to programmatic issuance limits, and utility tied to broader ecosystem demand.

However, this bullish projection rests on the assumption that Ethereum will continue to dominate the smart contract space—an assumption that is increasingly under pressure. With new specialized chains launching across use cases, Ethereum’s market share is fragmenting. The idea that one chain will serve as universal infrastructure is becoming less certain.

The authors also claim Ethereum is entering a “renaissance,” with activity returning to L1 and global acceptance of cryptocurrency growing. While sentiment may be shifting, the on-chain data doesn’t yet show a meaningful resurgence for Ethereum.

Ethereum is stagnating and needs to adapt. Some positive changes are underway, but whether they will be enough remains uncertain.

Years ago, there was no real competition, and some believed ETH could even surpass Bitcoin. Today, the landscape has changed. Many investors are disillusioned and see credible contenders threatening Ethereum’s dominance.

So while the bull case for ETH is compelling on paper, it faces real challenges, and whether it holds up in the long term is still an open question.