Ethena Labs has been garnering significant attention from DeFi enthusiasts lately, even if many believe that the project was doomed from the start, predicting a Terra/UST-like collapse with the onset of a bear market. Some even label it a CeFi stablecoin (centralized finance), operated by a hedge fund and only effective in bull markets.

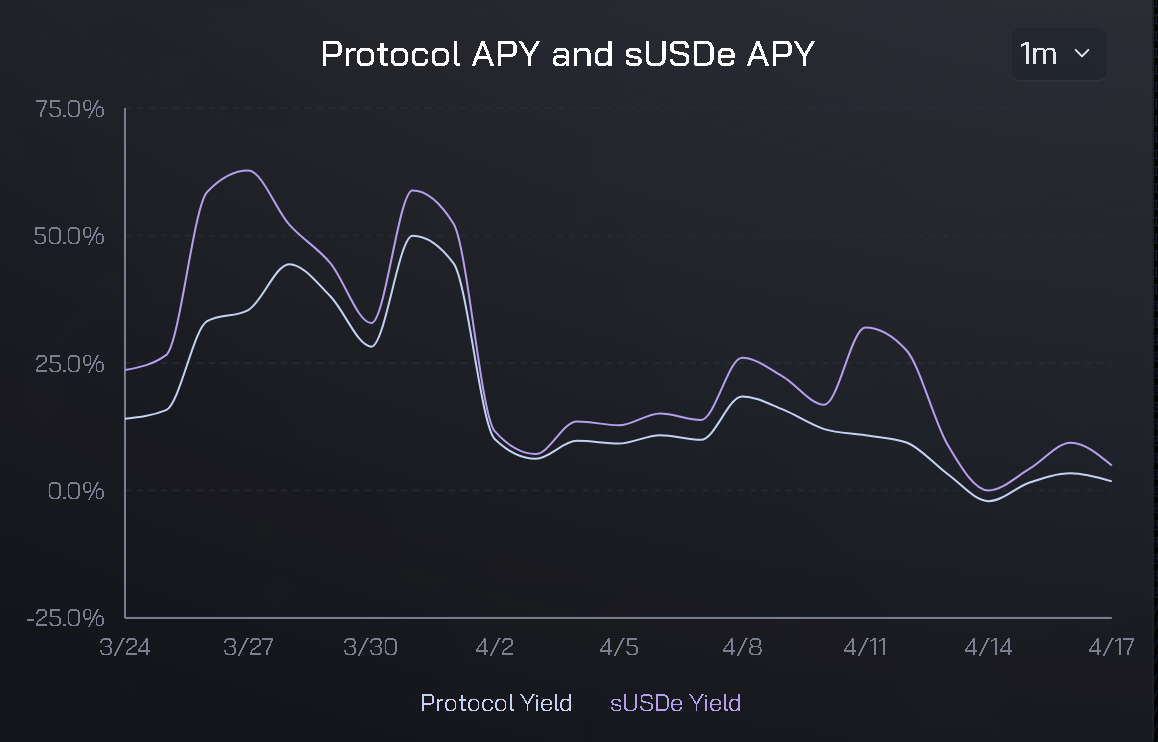

The primary selling point of Ethena’s USDe stablecoin is its yield—currently hovering at around 10% annually, though it has fluctuated since the project’s inception. In contrast, other major stablecoins like USDT or USDC do not offer any inherent yield.

Ethena’s yield primarily comes from holding short positions in centralized exchanges (funding) and staking rewards from ETH. These sources of yield are double-edged swords; they attract users but also represent significant vulnerabilities for the project.

Short Position Risk

By design, Ethena is always holding short positions (perpetual futures with low prices) on its collateral. That ensures it can compensate for the loss of the collateral price. At the same time, it provides so-called "funding" income.

Unlike traditional futures, where the hedging interest is paid by the holder, perpetual crypto swaps are 'funded' by both parties, the long and short holders, depending on the exchange rate. The swaps historically have net paid interest to shorts – this is called funding, and most swaps pay funding every eight hours.

Normally, there is a bias in the Ethereum and Bitcoin perpetual futures market toward long positions, leading traders with long positions to pay a funding rate to those with short positions (like Ethena). However, during sharp market downturns, when funding rates go negative, traders holding short positions would need to pay those with long positions.

Over the last three years, approximately 20.5% of days experienced negative funding rates. Ethena has created a reserve fund to protect against these negative rates, absorbing all funding payments during such periods so that USDe users are not affected.

Currently, this reserve fund exceeds $30 million. The size of this reserve is crucial for the project’s stability. According to Julio Moreno, head of research at CryptoQuant, significant negative funding rates at USDe market capitalizations ranging from $4 billion to $10 billion would require the reserve fund to increase substantially and be between $40 million and $100 million, respectively.

Therefore, it is important for users to continually monitor the reserve fund’s size relative to the USDe market cap. An overly large market cap coupled with a severe market downturn could potentially deplete the reserve fund, leading to a depegging of the stablecoin.

Collateral Depegging Risk

Another risk category discussed for Ethena is the Collateral Depegging Risk. Originally Arthur Hayes envisaged collateral such as Bitcoin or Ethereum for the stablecoin. Currently, however, approximately 15% of Ethena’s collateral is in Ethereum’s liquid staking tokens, particularly Lido’s stETH. While this provides an additional source of income, it also exposes USDe to an originally unrelated ETH-stETH parity risk. A depegging event of stETH collateral from ETH could result in losses, as it would impact margin requirements on stETH positions and potentially force liquidations.

The reasons for potential depegging could range from Lido’s operational issues, hacks, or broader market factors unrelated to Ethena but affecting its market positions.

Furthermore, the on-chain liquidity of stETH has been declining recently, which could affect its price if significant sell orders arise amidst low liquidity. While stETH can theoretically be unstaked to rebalance with ETH, this is not feasible on a large scale in a short period due to growing validator exit queues.

Although the above risks might seem distant during the current bull market, they warrant close attention from users of USDe and related projects, especially during a bear market.

Can USDe handle a scenario where stETH experiences a major slashing event, depegs, and the perpetual funding rate goes negative simultaneously? We will continue to observe.