During Token2049 in 2025, Stani Kulechov said the quiet part out loud: the next wave of crypto won’t demand that millions of people become on-chain power users. Instead, DeFi will slip into mainstream interfaces — embedded behind familiar apps the way cards and BNPL slipped into retail banking.

Lenders With a DeFi Engine

Lower rates and stronger infrastructure, Kulechov argued, set the stage for a “trillion-dollar” embedded-DeFi opportunity, with individual platforms eventually attracting deposit bases in the hundreds of thousands. What’s notable is that the first “fintechs” to seize this opportunity weren’t banks or wallets but centralized crypto exchanges. And the innovation didn’t start with trading — swaps were already easy to deliver — but with lending and banking-like products.

At a technical level, exchanges are wiring directly into Morpho’s vault infrastructure, outsourcing interest-rate curves, liquidation mechanics, and risk management while keeping control of the user interface and customer relationship.

For users, the experience is seamless. They click “Borrow” or “Earn” in a familiar exchange app; under the hood, assets are wrapped and posted to Morpho vaults. It’s the textbook “DeFi mullet”: a regulated app in the front, a decentralized protocol in the back.

Coinbase: The First Embedded Bank?

Coinbase was the first mover. In January 2025, it introduced BTC-backed USDC loans on Base, letting users borrow dollars against their Bitcoin without leaving the Coinbase interface. Eight months later, the company reported more than $1 billion in originations and about $1.4 billion in collateral locked — proof of how quickly an exchange can mobilize liquidity. For perspective, that already puts Coinbase’s loan book at the lower bound of an average U.S. regional bank or credit union, blurring the line between crypto exchange and digital lender.

In September 2025, Coinbase expanded into USDC deposits and lending, allowing retail users to earn yield by supplying funds to on-chain credit markets through Morpho vaults curated by Steakhouse Financial. The product launched with double-digit APYs, partly subsidized by Morpho — underscoring how early-stage DeFi economics remain fragile and incentive-driven, more promotion than organic credit demand. It showed both the power of exchanges to bootstrap liquidity and the immaturity of a market still easily steered by incentives.

Followers and First-Mover Advantage

Others are now following. Crypto.com, in partnership with Cronos and Morpho, announced it will roll out stablecoin lending in Q4 2025 with wrapped BTC and ETH collateral (CDCBTC, CDCETH). Smaller integrations are also appearing — Gelato and Morpho have launched white-label modules for wallets and fintechs — but exchanges clearly hold the first-mover advantage: captive, KYC’d user bases, regulatory experience, and enough brand trust to embed DeFi without forcing customers into the headaches of self-custody.

The strength of this model is that the frontend can evolve — redesigning apps, changing limits, or updating onboarding — without rebuilding the credit market itself. The lending engine runs independently on-chain, letting exchanges package DeFi liquidity as a plug-in service rather than rebuilding banking infrastructure from scratch.

DeFi Embedded or Just Packaged?

Much has been said about the “UI of DeFi,” but the real breakthrough seems to come from the opposite direction. Instead of DeFi tools confronting users directly, they’ve slipped quietly into the backend of familiar financial apps. The open question is whether this shift changes anything from a decentralization perspective and, consequently, a legal one.

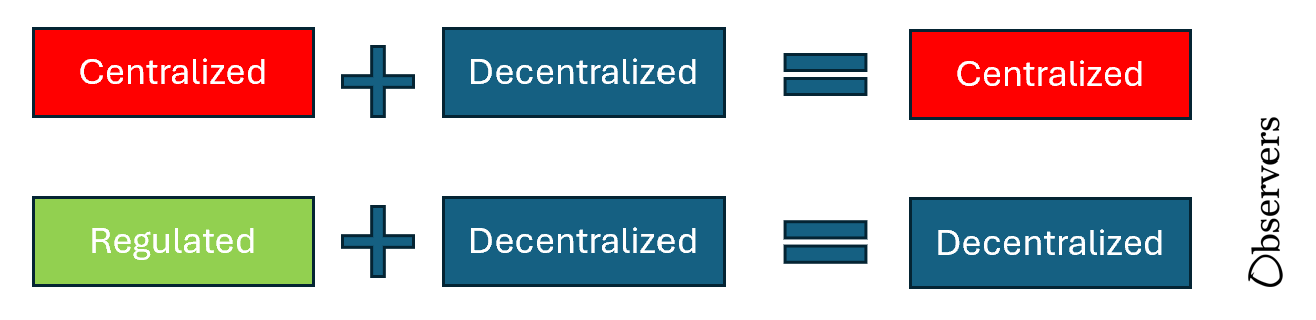

We can think of embedded DeFi through what might be called “decentralization math”:

- Centralized + Decentralized = Centralized. If the frontend controls flows, sets limits, or curates access, then even if the backend is decentralized, the product functions like a centralized lender. In that case, the operator should be regulated much like a bank or credit provider.

- Regulated + Decentralized = Decentralized. If the frontend is a thin, neutral layer — more of a user interface than a credit engine — then it should not be regulated as a lender. But that doesn’t mean it escapes oversight. The UI itself must be regulated as a UI, with standards ensuring it represents risks correctly, routes assets as intended, and doesn’t manipulate outcomes.

This framing echoes recent policy work stressing “centralization vectors” — points of control in otherwise decentralized systems. The CFTC’s 2024 DeFi Report warns that governance, oracles, and user interfaces often concentrate risks even when smart contracts are open. Academic work (Schuler et al., 2024) and the BIS argue that regulators should target these points of control rather than the underlying code.

The fact that centralized exchanges piloted this trend suggests embedded DeFi may normalize as UI infrastructure rather than a new shadow-banking layer. After all, exchanges already offer non-custodial wallets and swap interfaces alongside their custodial services, showing that a CEX can integrate DeFi rails without collapsing them into balance-sheet products. If lending follows the same path, embedded DeFi could look more like a digital distribution channel — a branch office of decentralized banking — than a full-fledged centralized bank.

Regulators remain split on this hybrid model:

- Positive cases: In the EU, MiCA explicitly allows intermediaries to provide access to decentralized services if disclosures and consumer protections are met. Some national regulators have suggested that a “UI-as-gateway” model could be treated more lightly if it doesn’t hold custody or assume credit risk.

- Negative cases: In the U.S., the SEC and state regulators have taken the opposite stance, arguing that any platform offering lending products — even if powered by DeFi protocols — is effectively acting as a lender. Coinbase’s earlier Earn program was shut down under this logic, and officials have signaled skepticism that embedding DeFi changes the analysis.

The outcome depends less on legal theory than on market demand. If appetite for non-custodial lending grows, it will push development toward thinner UIs that act as neutral gateways. If users prize convenience and brand trust, centralized actors will dominate, embedding DeFi into familiar balance-sheet services. Regulators will follow rather than lead, which means we are more likely to see new licenses for digital lenders with DeFi-style branches than bespoke rules for “regulated UIs.”