Uniswap has spent the past year carefully setting the stage for its own Layer 2 ambitions. With the launch of Unichain in mid-2025, the protocol reframed what it means to be an L2. Rather than just another rollup competing for blockspace, Unichain was positioned as a form of infrastructure migration — more akin to shifting from cloud servers to a proprietary stack than to launching a standalone blockchain.

Strategically, the launch was marketed as a foundation for unified cross-chain swaps — a way to move liquidity across different rollups without leaving the Uniswap ecosystem. Yet such ambitions are not easy to implement.

To make it work, Uniswap has put its full weight behind the chain, rolling out multimillion-dollar incentive programs for users. In this sense, its L2 strategy has been less about leveraging external rollups and more about pulling its own Layer 2 into the spotlight.

Unichain’s Fragile Growth

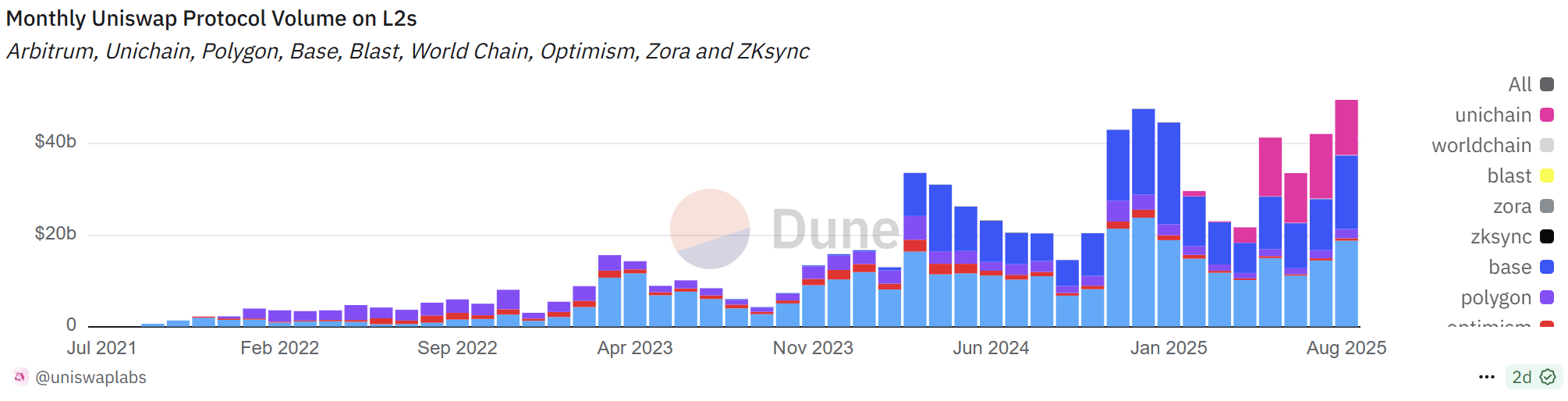

On the surface, Unichain’s launch looks like a runaway success. By August 2025, monthly Uniswap volumes on L2s surpassed $40 billion, a record high, with Unichain contributing the bulk of that growth.

Transaction activity has been consistently strong, helping Uniswap overtake rivals and cement its dominance in the rollup space.

Still, this figure remains well below the volumes processed on Uniswap’s main Ethereum deployment, with almost double the transaction volume on all L2s .

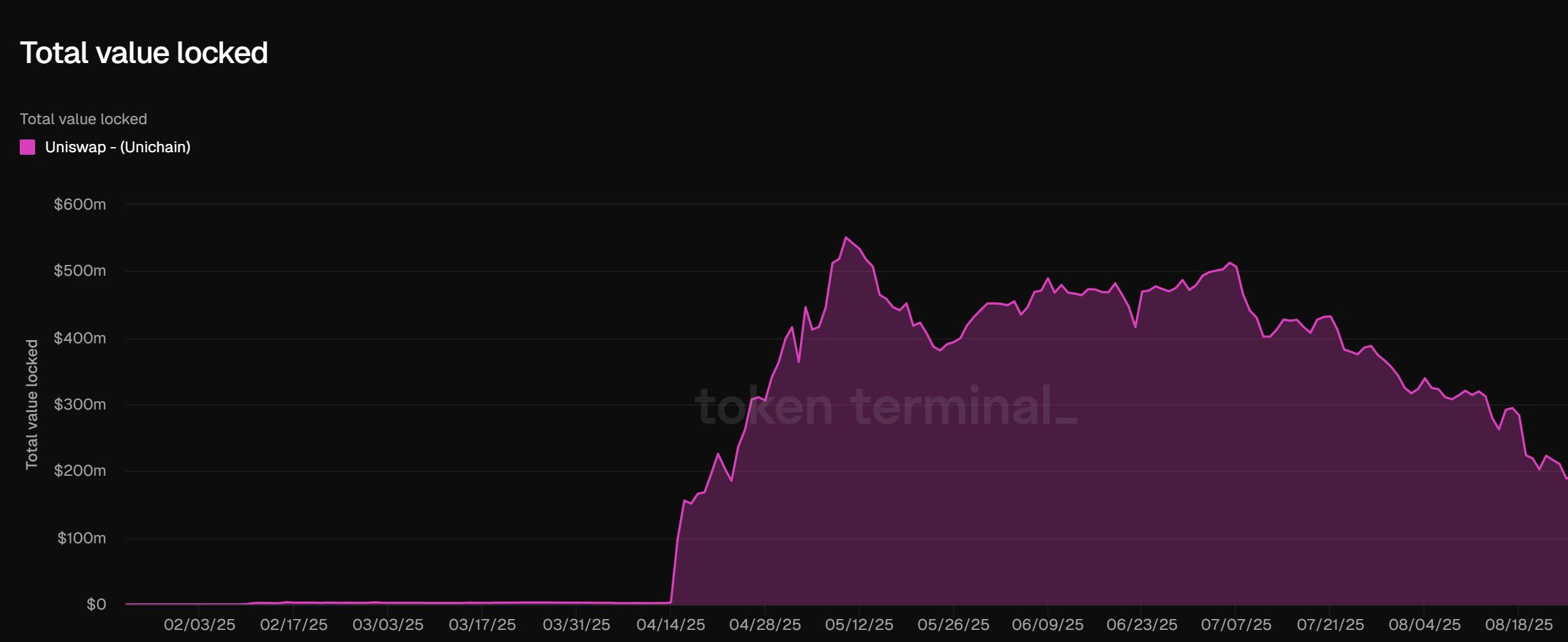

Also, Unichain liquidity dynamics tells a different story. After peaking at nearly $600 million in July 2025, Unichain’s total value locked (TVL) has steadily declined, falling below $300 million by the end of August.

Presumably, much of the early inflows were incentive-driven, and as those programs tapered, liquidity providers rotated capital elsewhere.

Why Ethereum Still Anchors the DEX Business

Uniswap’s experiment with Unichain shows both the promise and limits of running a DEX on a lighter, cheaper chain. Incentives can drive activity, but without a broad base of liquidity and traffic from surrounding applications, volumes risk becoming shallow and unsustainable. And while Unichain offers sharply lower fees, up to 95% lower by some estimates, users have not shifted away from Ethereum at scale.

That is good news for Ethereum itself: Uniswap remains one of the network’s largest revenue engines, consuming a major share of blockspace, driving validator rewards, and fueling the ETH burn mechanism that makes the asset deflationary.

In other words, for all the ambition of Layer 2s, the business of exchanges still depends on the deep liquidity, composability, and economic gravity of Ethereum.