Treehouse recently announced that it has raised strategic funding at a $400 million valuation. The round was led by one of the largest life insurance and financial services firms in the world, with over $500 billion in assets under management.

Treehouse Finance, a Singapore-based decentralized finance (DeFi) infrastructure company founded in 2021, was established by three individuals:

- Brandon Goh: Co-founder and CEO of Treehouse Finance. He has a background in traditional finance, having worked at institutions such as Wells Fargo Securities and Morgan Stanley. Brandon holds a Bachelor's Degree in Philosophy, Politics, & Economics from the University of Michigan.

- Bryan Goh: Co-founder and responsible for Product & Design at Treehouse Finance. He has co-founded multiple tech ventures, including Host Bully, Dibly, Travelr, and Native. Bryan earned a Bachelor of Science in Biology/Pre-Medicine from Truman State University and a Master's degree in Entrepreneurship from the University of Cambridge.

- Ben Loh: Co-founder and Chief Strategy/Operations Officer at Treehouse Finance. Further details about his background are not publicly disclosed.

Since launching Treehouse Protocol in September 2024, the project has seen fast adoption, attracting more than 30,000 unique wallets and reaching over 120,000 ETH (roughly $200 million) in Total Value Locked (TVL).

The project is building infrastructure for a decentralized fixed-income layer on Ethereum. Fixed-income infrastructure refers to the set of protocols, tools, and mechanisms that enable users to earn predictable, stable returns, like bonds in traditional finance, rather than variable yields that depend on market conditions.

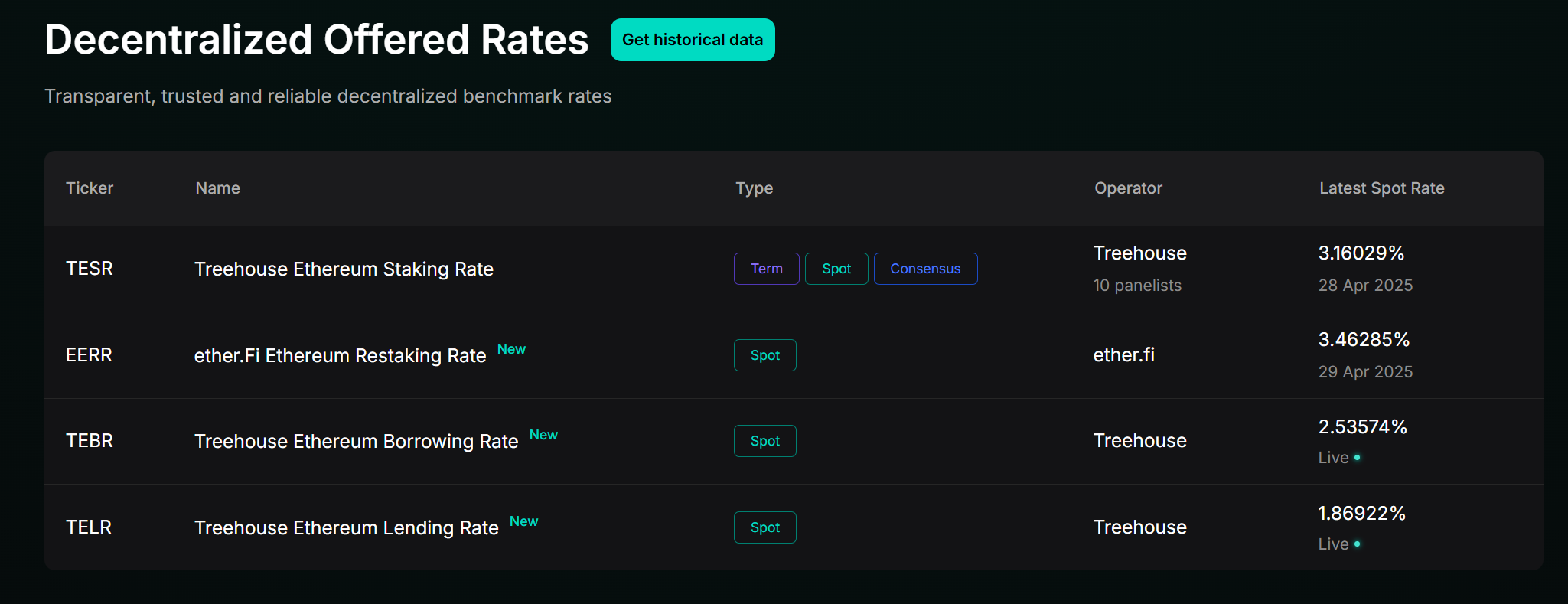

The project has already launched two core products for this layer: tAssets and Decentralized Offered Rates (DOR).

Market Efficiency Yield From Looping

The first, tAssets, are a new type of liquid staking tokens (LST) aimed at simplifying and unifying the fragmented on-chain interest rate market. The first tAsset, called tETH, uses a leveraged staking strategy that combines Lido and Aave. By holding tETH, users earn real yield that exceeds Ethereum’s standard Proof-of-Stake (PoS) rewards — all while still being able to use their assets in DeFi protocols.

Here is how the tETH strategy works: the protocol stakes ETH through a liquid staking platform, receiving an LST in return. That LST is then deposited into a lending protocol as collateral, which generates a receipt token. Using this as backing, more ETH is borrowed and staked again. The process can be repeated several times, depending on the desired risk exposure, similar to the looping described in the Pendle process.

Currently, this strategy gives a 3.31% annual yield, compared to the standard ETH staking yield of 2.83%. That 0.48% difference is referred to as the Market Efficiency Yield (MEY) — a real return gained by optimizing how capital is used across different protocols.

LIBOR For Banks, DOR For DeFi

Treehouse’s second major product is Decentralized Offered Rates (DOR), a benchmark rate designed to bring а structure to how DeFi protocols price financial products. It serves as a common reference point, similar in spirit to LIBOR, which played that role in traditional finance for decades before being phased out in favor of SOFR in 2023.

According to the project’s founder, Brandon Goh, a big reason fixed-income products haven’t taken off in DeFi is that there is no shared benchmark rate to build around. Without that baseline, scaling fixed-income products in DeFi becomes difficult. Treehouse wants its DOR rates to become an industry standard so that all lending protocols and fixed-income projects can use them.

With new funding secured, the team is now focused on scaling the infrastructure and broadening the range of fixed-income tools available across the digital asset space.