Latest Articles

157 Articles

Learn about DeFi (Decentralized Finance) and its impact on traditional financial systems. Discover the opportunities and challenges it presents.

Learn about DeFi (Decentralized Finance) and its impact on traditional financial systems. Discover the opportunities and challenges it presents.

The increase in volume has been attributed to rising activity across the BNB ecosystem and the launch of PancakeSwap’s Version 4 ‘Infinity’ upgrade, which introduced multiple new pool types and gas-saving features.

The auto-rebalancing mechanism in Fluid’s ETH/USDC pool failed under recent ETH volatility, resulting in heavy losses for liquidity providers.

The new safety module significantly enhances the Aave Protocol’s protection against potential shortfall events, representing a major upgrade over the original safety module introduced in 2020.

Alexander Mardar

The new safety module significantly enhances the Aave Protocol’s protection against potential shortfall events, representing a major upgrade over the original safety module introduced in 2020.

Alexander Mardar

The increase in volume has been attributed to rising activity across the BNB ecosystem and the launch of PancakeSwap’s Version 4 ‘Infinity’ upgrade, which introduced multiple new pool types and gas-saving features.

Alexander Mardar

The auto-rebalancing mechanism in Fluid’s ETH/USDC pool failed under recent ETH volatility, resulting in heavy losses for liquidity providers.

Alexander Mardar

Coinshift’s csUSDL is a yield-bearing wrapper built on top of USDL, combining real-world asset income, DeFi lending, and token rewards. With over $113M TVL, it offers 11%+ APY and reflects a new class of stablecoins that function more like structured investment tools than payments.

Alexander Mardar

The new version diversifies the collateral base, introduces dynamic borrowing rates, and features a new design of USD-pegged stablecoin. Prior to the launch, the project went through a five-week audit contest involving over 800 researchers, multiple re-audits, and several weeks of testing

Alexander Mardar

TONSWAP is a new DEX and launchpad planned on the TON blockchain, aiming to fix poor UX and low liquidity in TON DeFi. With Telegram integration, $100M projected funding, and a meme-savvy brand, it positions itself as the ecosystem’s go-to trading hub with seamless access and deep liquidity.

Alex Harutunian

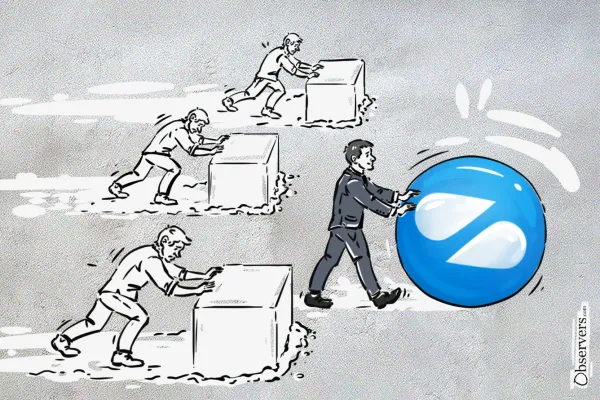

Uniswap’s Layer 2 blockchain, Unichain, has surged to $1.2B in TVL, surpassing Ethereum in daily trading volume. This rapid growth was fueled by a $21 million liquidity incentive program aimed at attracting users and boosting on-chain activity.

Alexander Mardar

The project’s fixed-income products have generated significant interest from investors. In just over six months, it has attracted over $200 million in TVL and recently raised funding at a $400 million valuation.

Alexander Mardar