OpenEden is gaining significant traction, recently hitting an all-time high in platform activity ahead of its anticipated token launch.

Launched in 2022 by Jeremy Ng—a former Managing Director at Goldman Sachs and former Asia CEO of Crypto.com—OpenEden set out to bring real-world assets like U.S. Treasuries on-chain.

The project holds 8th place in the league of the largest U.S. Treasury bills tokenization projects.

Currently, the platform offers users access to two main products: TBILL yield-earning tokens backed by U.S. Treasury bills and OpenDollar (USDO), a rebasing, yield-bearing stablecoin.

TBILL On Chain

The project’s first product, the TBILL Vault, is a smart contract-based vault that gives investors direct exposure to a pool of short-dated U.S. Treasury Bills. Users can subscribe to the vault at any time by depositing stablecoins and minting the TBILL token.

Each TBILL token is backed 1:1 by short-term U.S. T-Bills and a small portion of U.S. dollars. TBILL holders receive returns that reflect the performance of the underlying T-Bills portfolio.

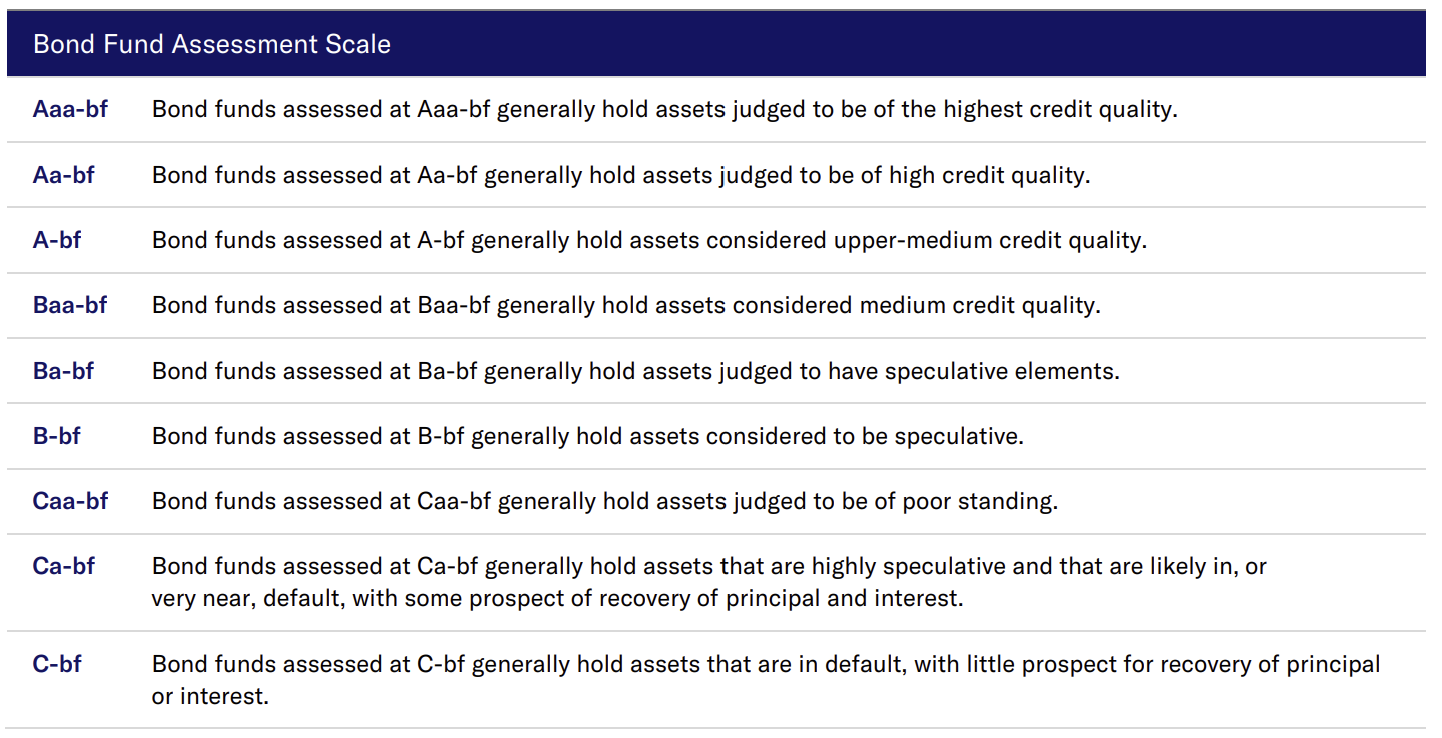

TBILL is issued by a regulated fund, Hill Lights International Limited, registered in the British Virgin Islands. It holds the distinction of being the first tokenized U.S. T-Bills product to receive an ‘Investment Grade’ rating from Moody’s. In June 2024, the agency granted the fund an “A-bf” bond fund rating.

However, the TBILL Vault isn’t open to everyone. It’s a permissioned product, meaning only accredited investors are eligible to hold TBILL tokens. Still, despite that restriction, it has already attracted $183 million in TVL. The current yield is around 3.9%, which is relatively strong given it’s backed by short-term U.S. government debt.

USDO Rebasing Stablecoin

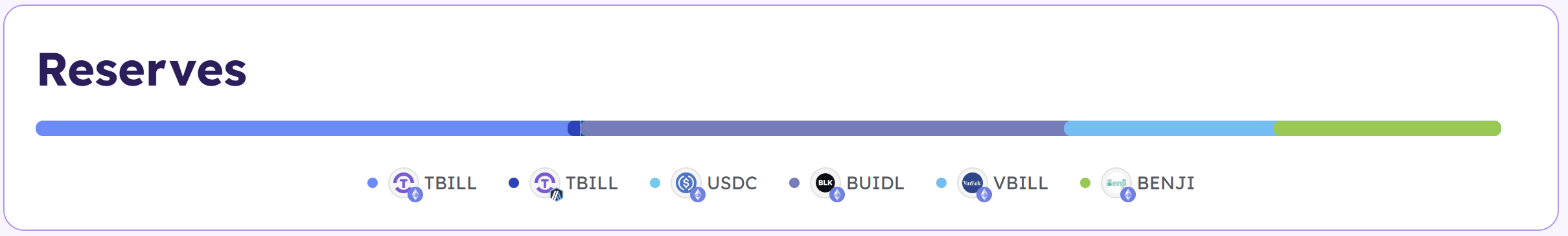

The second product is USDO, a stablecoin backed by a mix of reserve digital assets including Blackrock's BUIDL, Franklin Templeton's BENJI, Securitize's TBILL, USDC and OpenEden's own TBILL.

USDO is defined as a rebasing stablecoin. Each day, the smart contract increases the USDO balance automatically based on the yield earned from the reserves. Unlike traditional stablecoins that pay interest externally, USDO's daily “rebase” adds tokens directly into holders' wallets, proportional to their share of the total amount in circulation. This ensures that everyone earns their share of the yield in an technically efficient way and the token price remains $1.

OpenEden’s USDO is designed as a rebasing token not only for technical efficiency, but also, possibly, to align with regulatory compliance in the U.S., which prohibits stablecoins from offering interest.

Because rebasing tokens can be tricky to use across DeFi platforms, OpenEden also created a wrapped version called cUSDO. This version doesn’t rebase. Instead, its value goes up over time as it collects yield internally, so it works with DeFi protocols that don’t support rebasing mechanics.

USDO is issued by an entity licensed by the Bermuda Monetary Authority. Only KYC’d institutions and businesses in approved jurisdictions can mint USDO directly, but anyone in DeFi can pick it up on secondary markets, which keeps it accessible to everyday users.

Right now, USDO holds $272 million in TVL and offers a yield of 3.9% APY. That is solid, especially for institutions, but the real draw for DeFi users is the chance to earn more.

OpenEden Governance Tokens

OpenEden has a points system running, so users have the option to either keep earning points or give them up for higher returns upfront. These high yields are attracting more users and helping to grow the platform’s TVL.

Such an incentive system exists in other projects as well. For instance, on Pendle, if you choose to forfeit your points, you can earn about 9.9% APY with cUSDO. And if you are comfortable with leverage, Spectra lets you push yields up to 83% APY.

The project has not officially announced a project governance token, but the structure of its BILLS points system strongly implies one is in development. If eventually introduced with sound tokenomics, a governance token could provide an additional boost to the platform’s growth and community engagement.