When Uniswap launched its own Layer 2 chain, Unichain, many people were unsure. Why would anyone move their assets to a separate chain just to trade tokens? To bring in users, Uniswap used a familiar strategy from the early DeFi days: offering generous rewards for providing liquidity. This quickly brought a wave of users and trading activity to the new chain.

The chain launched in February and saw a slow start. But things changed at the end of March when the Uniswap DAO passed a proposal to allocate $21 million in liquidity incentives to Unichain users. Starting in April, users began moving large amounts of money to Unichain.

Within just a few weeks, Unichain’s total value locked (TVL) surged to $1.2 billion, making it one of the top four Layer 2s by this metric. It continues to lead in net inflows, suggesting further TVL growth ahead.

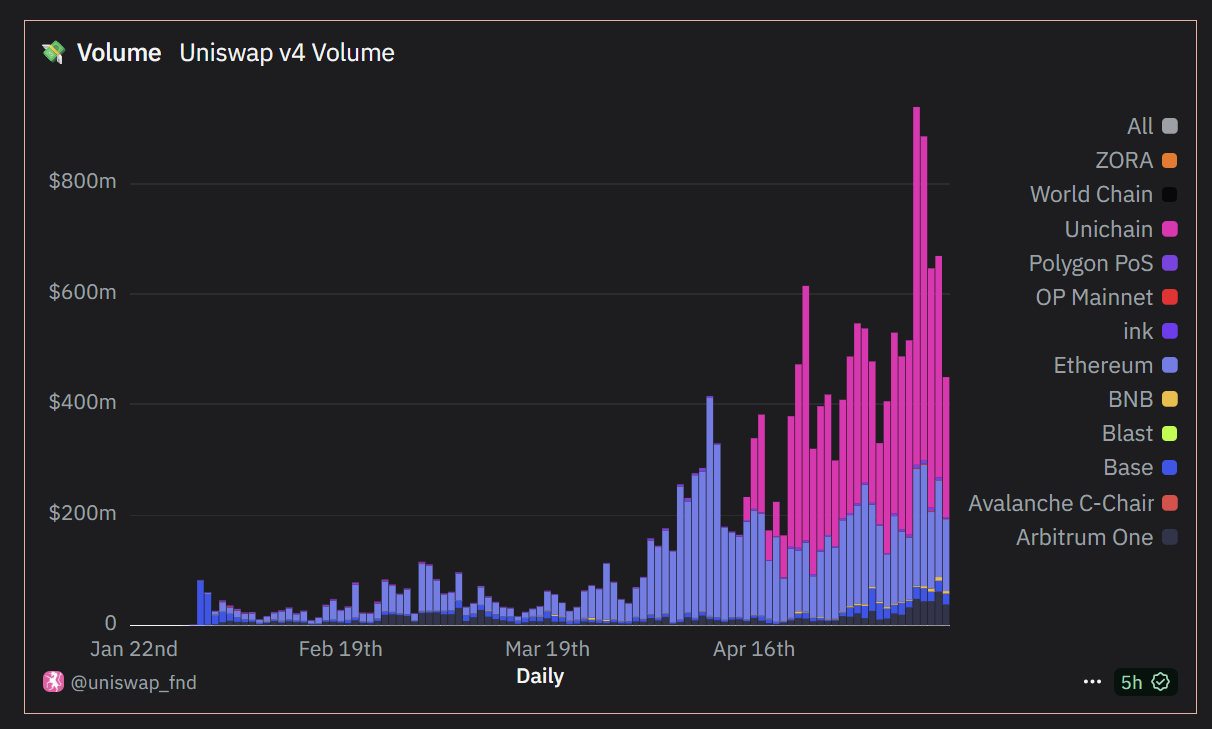

TVL alone is impressive, but the real surprise has been the trading volume. Uniswap v4 on Unichain has already flipped Ethereum in daily volume, regularly processing hundreds of millions of dollars, often 2x or more compared to Uniswap on Ethereum.

Interestingly, around 98% of DEX volume on Unichain comes from just four assets: ETH, USDC, USDT, and WBTC. This suggests that large holders who previously traded on Ethereum are now shifting to Unichain. Over $400 million has already been bridged from Ethereum, a staggering figure.

Yet, it is worth noting that while Ethereum’s trading volume has declined, it hasn’t disappeared. This implies that many new users likely came from outside Ethereum’s core ecosystem, attracted by the incentives.

Uniswap v4 is by far the most active app on Unichain (according to GrowThePie), followed by several bridges. Still, the chain already supports over 100 dApps, including major protocols like Compound, Stargate, and Venus. This momentum is likely to drive even more integrations.

Surprisingly, even the Uniswap team didn’t expect this level of growth. Their initial KPI targets were $750 million in TVL and $11 billion in cumulative swap volume within three months. But those numbers were hit in under a month. On some days, Uniswap v4 alone is doing $500 million in volume.

The incentive plan is working better than expected, and it is likely the team will consider extending the liquidity program once the current one ends.

Other DeFi Projects Launching Their Own L2s

Uniswap is not alone in the quest to establish its own Layer 2. Other DeFi heavyweights like dYdX, Aave, and MakerDAO have also ventured into dedicated Layer 2 solutions. dYdX migrated from StarkEx to its own Cosmos-based chain, prioritizing customizability and performance for derivatives trading. However, while dYdX succeeded in improving trade execution and lowering costs, its TVL and user retention faced challenges due to fragmentation from Ethereum’s ecosystem.

Aave has similarly launched Lens Protocol's Layer 2 efforts, though it remains more focused on social graph applications rather than core DeFi trading. MakerDAO’s "Endgame Plan" proposes a gradual shift toward specialized Layer 2 subDAOs, but this is still in its early stages, with no visible explosive growth like Unichain's.

What sets Unichain apart is its immediate traction in both TVL and trading volume, largely fueled by aggressive liquidity incentives and seamless integration with Uniswap's massive user base. Unlike more specialized L2 chains, Unichain leverages general-purpose DEX activity, giving it a broader appeal.

The Centralization Tradeoff: A Necessary Compromise?

The growing trend of DeFi protocols launching their own Layer 2s raises important questions about the ethos of decentralization. Layer 2s are intended to scale Ethereum while inheriting its security and immutability, but custom L2s controlled or governed heavily by a single protocol can blur these lines.

When a protocol like Uniswap launches its own chain, critics argue it becomes more akin to a "walled garden" — an advanced but ultimately siloed environment. While transaction costs decrease and performance improves, concerns arise over censorship resistance, credible neutrality, and whether such chains inherit the robust security guarantees of Ethereum's mainnet.

That said, many of these chains, including Unichain, are designed to be fully EVM-compatible and aim to decentralize their sequencers or leverage Ethereum for settlement. The tradeoff between cost efficiency and decentralization is not binary but rather a spectrum. Projects must carefully balance governance transparency, censorship resistance, and economic incentives to ensure they do not simply become centralized servers with blockchain aesthetics.

What Will Determine Unichain’s Long-Term Success?

For Unichain to succeed as a legitimate Layer 2 — and not merely a glorified Uniswap server — several criteria are critical. First, it must build an open and diverse ecosystem of applications beyond Uniswap itself. Developer incentives, tooling, and composability with other protocols are essential to prevent ecosystem stagnation.

Second, decentralizing sequencer operations and ensuring robust economic security through Ethereum settlement as well as transparent and community-driven governance are vital to maintain trust and neutrality. Without these, Unichain risks being viewed as a centralized sidechain.

Finally, the ability to sustain activity after incentive programs taper off will be the ultimate test. If Unichain can retain users and liquidity through organic growth, it will prove its value as a foundational Layer 2, not just a temporary scaling solution for Uniswap’s DEX.