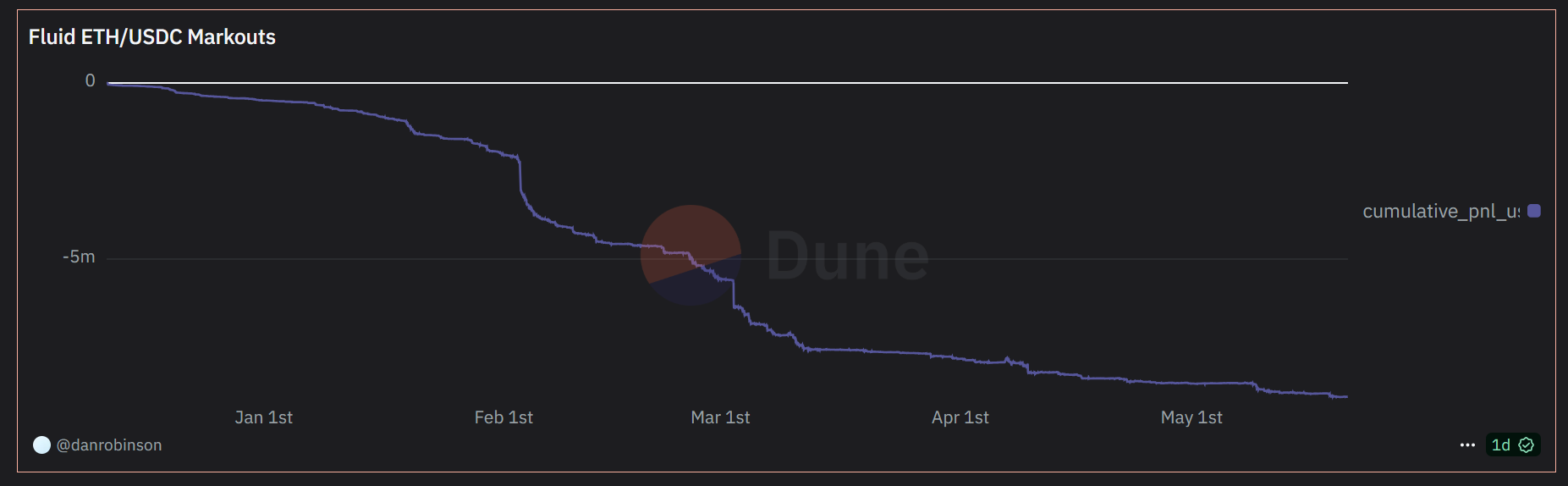

The Fluid ETH/USDC pool has been generating substantial losses for its liquidity providers (LPs). Since its launch in late December, the pool has struggled to perform, and while early losses were modest, the recent spike in Ethereum volatility has made things considerably worse.

So far, the pool has racked up almost $9 million in losses, raising questions about the viability of its design, which was intended to profit by actively managing user liquidity.

Fluid is a DeFi protocol that combines lending, borrowing, and decentralized trading within a single platform. Its architecture allows users to provide liquidity, such as in ETH/USDC pairs, and use their LP tokens as collateral to borrow funds. This setup is meant to enable users to earn trading fees while maintaining an active loan, potentially offsetting the cost of borrowing.

A distinctive feature of Fluid is its rebalancing mechanism—a system that maintains a target ratio of exposure to the pool's assets. It actively shifts the portfolio allocation—buying or selling ETH and USDC—to keep it within a predefined price range or risk profile.

Buy Low Sell High

In stable or mildly volatile conditions, rebalancing can help optimize yield and maintain target exposure. But in sharp price swings, it often compounds impermanent loss by actively locking it in—a drawback that passive DEXs may avoid if the price later returns to equilibrium.

To maintain its target ratio, Fluid’s rebalancing mechanism caused the pool to become overexposed to ETH during price drops and then underexposed during the recovery, leading to net losses even after ETH rebounded.

According to Samyak Jain, the project’s founder, the losses are solely due to unprecedented ETH volatility.

“The pool performs exceptionally well when prices stay within range, generating solid fees for LPs. But during high volatility, rebalancing kicks in—and that’s where the realized losses start to outweigh the fee income.”

When the pool launched in December, ETH was trading near $4,000. Since then, it has experienced its most extreme price swings in two years, plummeting to $1,400 before recovering to around $2,600.

The team maintains that the pool can perform well in more stable conditions—it simply hasn’t had the opportunity to prove itself due to the market’s recent turbulence.

Still, many users say they have taken heavy losses—some down as much as 70% within just a few weeks of joining the pool. It is a clear sign that the system wasn’t built to handle recent volatility.

“When ETH dropped, the pool became massively long ETH. When ETH recovered, it was suddenly very short, I don’t see how this was ever meant to work for a non-stable asset.”

Some users on X have criticized the team for overhyping the pool without properly disclosing its risks. Many claim it was clear from the beginning that the pool’s rebalancing mechanics would lead to losses during volatile periods.

“A lot of uninformed capital got sucked into Fluid, lured by flashy APR projections—only to find out the fee income was nowhere near enough to cover the rebalancing losses.”

To address the backlash, Jain has proposed a partial compensation plan. A total of 500,000 FLUID tokens (0.5% of the supply) will be vested over one year for affected users. In addition, LPs who remain in the pool will receive $400,000 in monthly FLUID rewards through June or July.

Fluid V2

The team is also preparing to launch Fluid v2. At the core of the new versions is a unified liquidity layer that consolidates assets across various protocols within the ecosystem. This architecture addresses liquidity fragmentation by providing a shared pool of assets, enhancing capital efficiency, and ensuring more stable interest rates for borrowers and lenders.

Fluid V2 is also expected to feature more efficient rebalancing mechanisms for managing liquidity in highly volatile conditions.

Whether these fixes will actually satisfy users is still up in the air. Some of the biggest losses came from those using leverage, and for them, token rewards likely won’t come close to covering the damage.

Interestingly, despite the issues with the ETH/USDC pool, Fluid’s total value locked continues to climb, recently reaching an all-time high of $1.1 billion. Many users see these early issues as just part of the learning curve, and even with some losses, most still believe in the protocol’s future.