Crypto Exchages' Changing Landscape

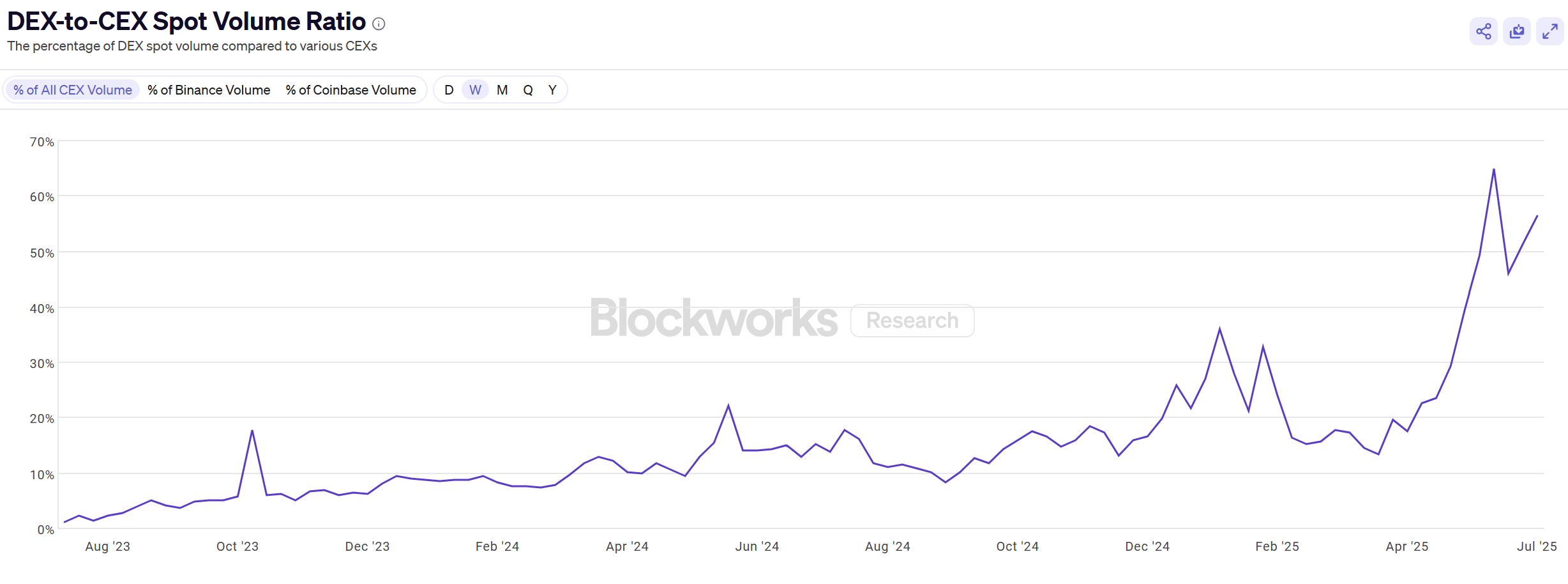

Decentralized exchanges just hit a record high, with DEX-to-CEX spot volumes reaching parity for the first time. The middle-tier altcoin sector, once central to CEX activity, is losing ground. Meanwhile, a new generation of CLOB-based DEXs is preparing to reshape the landscape of crypto trading.