Latest Articles

157 Articles

Learn about DeFi (Decentralized Finance) and its impact on traditional financial systems. Discover the opportunities and challenges it presents.

Learn about DeFi (Decentralized Finance) and its impact on traditional financial systems. Discover the opportunities and challenges it presents.

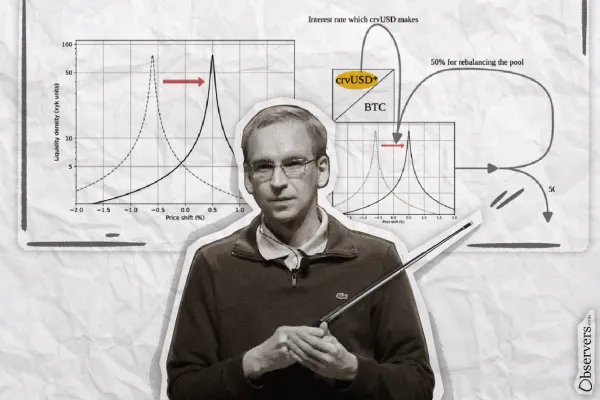

Curve Finance is launching Yield Basis with a $60M crvUSD credit line. The product aims to eliminate impermanent loss for liquidity providers, and at the same time transform CRV from a governance token into an income-generating asset with revenues shared back to holders

Hyperliquid is preparing to launch its own stablecoin, USDH, through a validator-led governance vote. With USDC currently dominating its ecosystem, USDH would reduce reliance on external issuers and capture reserve yield. Paxos, Frax, Ethena, and an Agora–MoonPay coalition are competing to deploy it

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

Alex Harutunian

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

Alex Harutunian

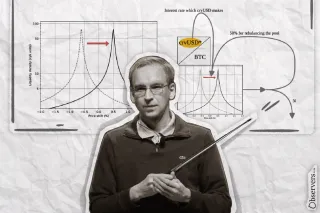

Curve Finance is launching Yield Basis with a $60M crvUSD credit line. The product aims to eliminate impermanent loss for liquidity providers, and at the same time transform CRV from a governance token into an income-generating asset with revenues shared back to holders

Alex Harutunian

Hyperliquid is preparing to launch its own stablecoin, USDH, through a validator-led governance vote. With USDC currently dominating its ecosystem, USDH would reduce reliance on external issuers and capture reserve yield. Paxos, Frax, Ethena, and an Agora–MoonPay coalition are competing to deploy it

Alex HarutunianUniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.

Alex Harutunian

Decentralized exchanges just hit a record high, with DEX-to-CEX spot volumes reaching parity for the first time. The middle-tier altcoin sector, once central to CEX activity, is losing ground. Meanwhile, a new generation of CLOB-based DEXs is preparing to reshape the landscape of crypto trading.

Alexander Mardar

EigenLayer has launched EigenCloud, a decentralized platform combining off-chain compute, verification, and data availability. Built on its restaking model, EigenCloud enables developers to build trust-minimized apps using services like EigenCompute, EigenVerify, and EigenDA.

Alexander Mardar

The platform brings real-world assets (RWAs) on-chain by offering tokenized U.S. Treasury Bills and a stablecoin with a novel yield distribution design. This gives crypto investors access to low-risk returns from T-Bills without leaving the DeFi ecosystem.

Alexander Mardar

A new stablecoin staking protocol boosts yields by rewarding users based on how long they’re willing to lock up their funds. The system, dubbed a blockchain-based fractional reserve model, balances liquidity with yield optimization and introduces layered risk management to protect liquid depositors.

Alexander Mardar