Silicon Valley Bank (SVB) was the backbone of many start-ups and venture capital funds around the world. While the crypto market has largely been spared from an adverse effect, the same cannot be said for the NFT space. According to the latest edition of the DappRadar report, NFT traders went “numb” in response to the banking turmoil in the US.

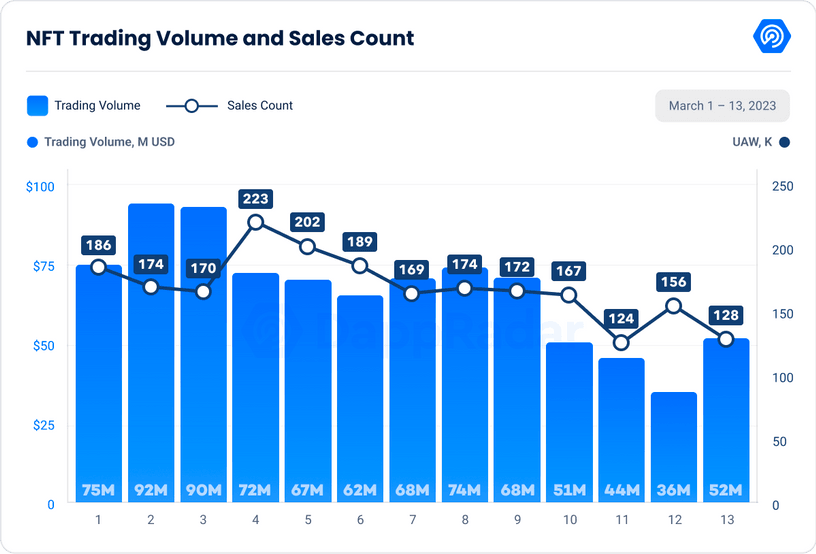

The report, published on March 16, mentioned that NFT trading volumes were drifting between $68 million and $74 million on March 10 in the event of SVB’s collapse, after which they declined to $36 million on March 12. The fall took place along with a 27.9% fall in the count of daily NFT sales that happened between March 9 and March 11. On March 11, 11,440 NFT traders were active and it was the day with the lowest figure since November 2021.

The report also discussed the de-pegging of USDC, which was as low as $0.88 and diverted the attention of traders away from the NFT market. As was obvious, it led to less activity by traders.

Albeit top-tier NFTs remained resilient throughout the event. The floor prices of blue-chip NFTs, including Bored Ape Yacht Club and CryptoPunks, were hardly affected, maybe because Yuga Labs only had a “super limited exposure” to SVB, according to co-founder Greg Solano. After a minor dip below $100,000 on March 11, the figures recovered quickly. On the other hand, Moonbirds and the Proof ecosystem were hit hard due to their exposure to the Silicon Valley Bank. Proof had earlier said that the potential loss arising wouldn’t affect the security of the customer’s assets or the project’s roadmap.

3/5: We are actively working through this situation along with the long list of others affected by the closure.

— PROOF (🥃,🦉) (@proof_xyz) March 10, 2023

Here’s what we want to reassure you of:

While this news sucks, it doesn’t affect your wallet or our roadmap.

Despite the chaos, the crypto industry has made it through this event, and stability is returning. The turmoil has highlighted the need for the crypto industry to become more self-sufficient and less reliant on traditional banking infrastructure. We continue to observe.