Introducing Aevohttps://t.co/dLDO2HMB2r pic.twitter.com/9xI7ibrcQz

— Aevo (@aevoxyz) September 28, 2022

In September 2022 Ribbon Finance, an Ethereum-based DeFi derivatives platform first announced plans to launch Aevo, a new crypto options trading service. Developers promised to launch a closed beta in October 2022, and a public mainnet by the end of the year. Now the company says that the platform will be launched within the next few weeks, which is the beginning of April 2023.

Earlier in 2021 Ribbon figured out a way to package options contracts into vaults, which allows users to profit from an automated options strategy. This is now known as a DOV - DeFi Option Vault. Although DOVs are simple to understand and use, they are often too simple and inflexible for serious traders. Aevo has all the features necessary for a pro options trader, including “a robust margining system (with portfolio margin), as well as hundreds of instruments to trade, including daily/weekly/monthly/quarterly options”.

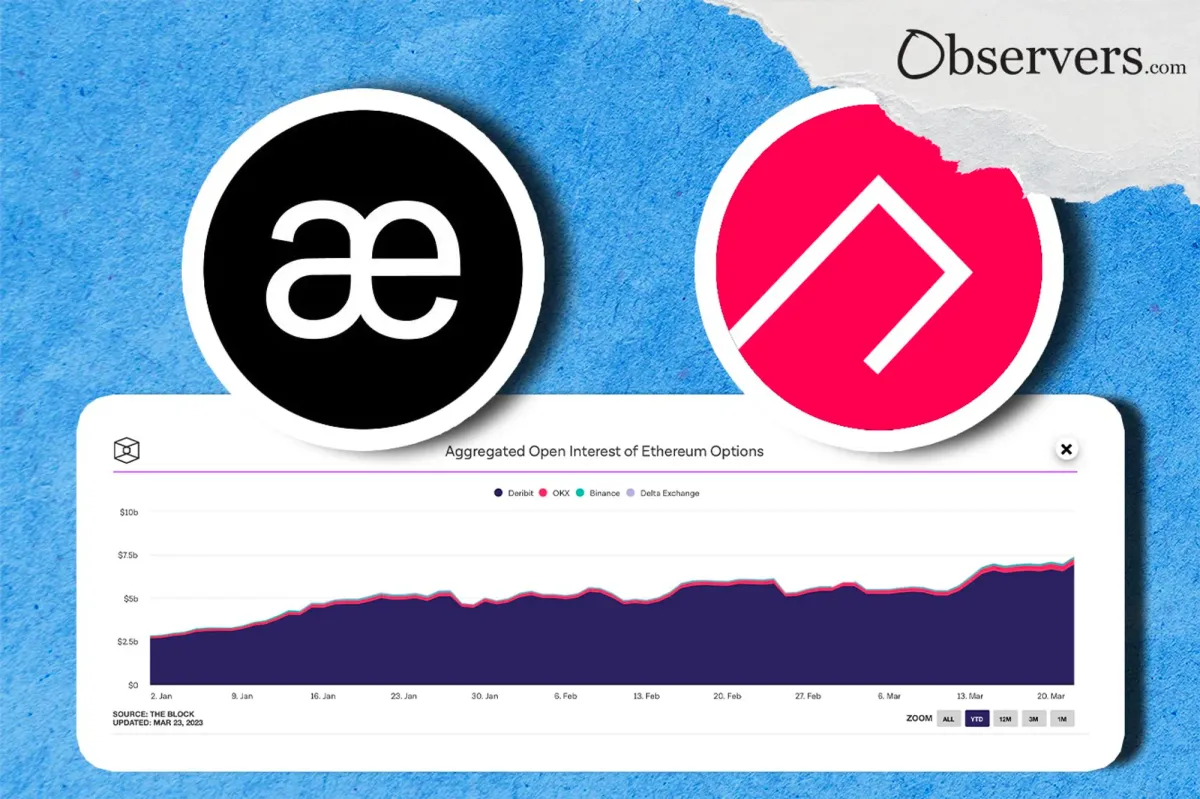

Aevo aims to become a better alternative to centralized exchanges like Deribit (the world's biggest Bitcoin and Ethereum options exchange). As the developers say, any CEX can be mismanaged, which might hinder the system's P&L. Meanwhile Aevo tries to solve that issue by allowing options’ contracts to be settled on a blockchain.

Eventually, Aevo will be united with Ribbon. Thus RBN Vaults will drive consistent flow to Aevo (currently around $80 million a week), and Aevo will allow much more sophisticated structures to be built on top.

Ouroboros Capital had an opportunity to test out the beta and shared their experience. To cut to the case: in the end they decided to buy RBN tokens.

1/N: @ribbonfinance's blockchain settled options platform Aevo is launching within the next few weeks. We are big options traders and were able to test out the product which post led us to also buy $RBN tokens. A thread on Aevo and our investment thesis.

— Ouroboros Capital (@OuroborosCap8) March 15, 2023

According to this thread, Aevo's edge includes passive flow from Ribbon’s DOV which solves the problem of getting liquidity onto the platform, settlement of options in USDC, and a smooth UI/UX.

9/N: UI/UX was also smooth in the beta. Very clean and easy to use. pic.twitter.com/FtxCo3GMY6

— Ouroboros Capital (@OuroborosCap8) March 15, 2023

Very soon we’ll also have an opportunity to check it out and will let you know how it is! Meanwhile we might suggest that buying some RBN could be a smart idea, especially taking into account that now it costs just $0.24 which is 95% below the all-time-high of $4.89…