Last month the U.S. Securities and Exchange Commission (SEC) sued cryptocurrency exchange Binance and its CEO Changpeng Zhao (CZ) for multiple securities law violations, including wash trading. In particular, the SEC alleged the artificial inflation of trading volumes of crypto asset securities on the Binance.US platform by Sigma Chain, a firm owned and controlled by CZ.

Binance's representatives have denied the company or Zhao’s engagement in wash trading. However, the SEC’s investigation has shown that Binance.US officials were at least aware of the possibility of wash trading on the platform, and concerned at the seeming lack of tools in place to prevent it.

In 2019, the National Bureau of Economic Research conducted a study on crypto wash trading in which twenty-nine cryptocurrency exchanges, both centralized and decentralized, were examined. From this sample, over 77% of the trading volume on unregulated cryptocurrency exchanges was allegedly generated by wash trading. Using statistical methods, the researchers estimated that the average wash trading ratio is 53.4% on unregulated first-tier exchanges and 81.8% on smaller ones.

Interestingly, U.S.-listed Coinbase, one of the few exchanges the study authors deem as regulated, didn’t show any signs of wash trading during the review period. However, Coinbase had earlier been accused of such practices by another U.S. regulator, The Commodity Futures Trading Commission (CFTC), and eventually settled the case by paying $6.5 million in 2021.

The study did not specifically address Binance.US, but it said that Binance, the larger entity, wash-traded about 46.5% of its total trading volume.

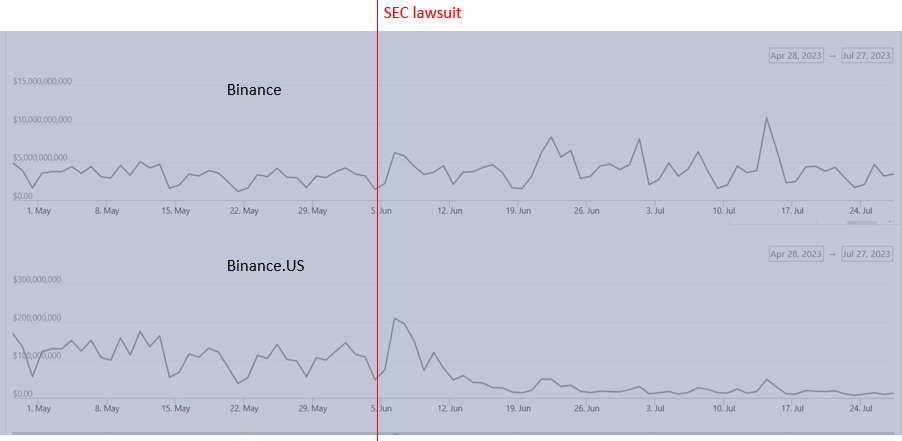

Since the lawsuit, trading volumes on Binance.US haved dropped significantly, while those on the main Binance exchange have remained at their usual levels. Whether this is due to U.S. market participants fleeing the troubled exchange or a halt to the alleged washed trading activities is unclear.

Crypto market participants have long been aware of wash trading practices, although possibly not that they are still happening at such an alleged scale. In 2019 Coingecko, a major crypto token and exchange data aggregator, introduced the 'normalized' trading volume metric, which adjusted the volume of trading reported by exchanges by relating it to other metrics such as visits to the platform and the volume of user funds on its chain addresses. Coinmarketcap, a similar resource that has been under Binance's control since 2020, has no such feature.

Standardized statistics, consistent reporting and protection of investors from manipulation are important for any mature industry. If regulators enforce wash trading controls in the crypto industry, it will be easier to Observe and report on the actual market trends.