After the Terra LUNA and UST fallout, digital currency markets have significantly dropped in value, but now we can see some signs of recovery. Meanwhile, dominance in the markets gradually switches to Bitcoin.

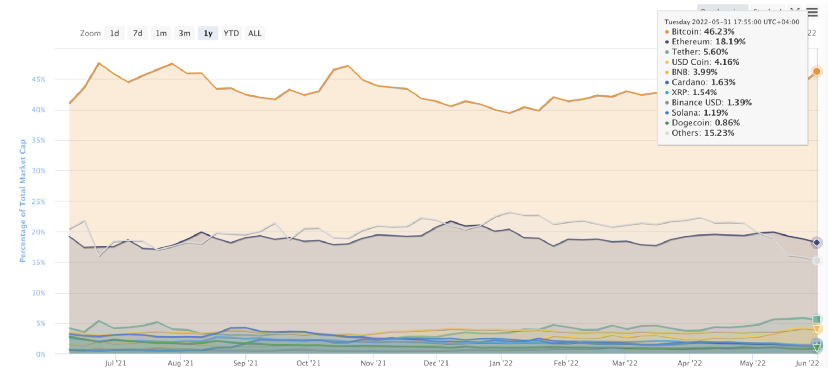

Recently digital currency markets have significantly dropped in value. Amid all this mess, Bitcoin’s market dominance has increased to 46.2%, reaching the highest value since October 2021. Meanwhile, Ethereum’s market dominance has dropped to 18%. As ETH dominance lowers and BTC dominance widens, a number of other alternative assets have faltered in value and have lost significant market cap dominance. Surprisingly USD Coin has gained almost 2% despite the current common distrust of stablecoins.

Bitcoin, the world’s oldest cryptocurrency is now showing some signs of recovery after falling below $29,000 in the middle of last month. Darshan Bathija, CEO and Co-Founder of Vauld said that bitcoin holding above the $30,000 level for the last few days is a positive sign. After 9 consecutive weeks of losses, and oversold conditions, investors seem to be returning, he said. Bitcoin is expected to reach its fair market value of $40,000 if the current trend continues but could face resistance at $42,000.

Barring Tron, a decentralized blockchain, all crypto tokens were trading sharply higher on Tuesday. Cardano zoomed more than 14 per cent, whereas Ethereum rose 6 per cent. Bitcoin, Avalanche and XRP gained 5 per cent each.

After nine weeks of decline, the crypto market recovered on Monday (30 June) and extended its gains on Tuesday as well. Altcoins, too, posted some healthy gains, with some tokens rising to double digits.

However, it is too early to conclude if the downtrend in the digital token market is over.