We’ve been hearing about crypto debit cards for a while now. They enable one to use crypto for online and offline purchases. But which card should you get? Let’s learn more about the theory and look at some options.

If you are a cryptocurrency owner, you are probably familiar with this dilemma: you want to spend some crypto, but it takes a lot of effort to get it to your credit/debit card. Usually, you have to go through quite a few steps to make a purchase — send crypto from your hot/cold wallet to a centralised exchange (like Binance), wait for the exchange to wire your money, transfer the money to your card, and then spend. Apparently, there is a way to spend directly from your crypto balance: crypto debit cards.

Yes, crypto cards save you the hassle of moving money around, but they also have their advantages and disadvantages. The main advantages are:

- Everyday purchases with crypto made real. Online, offline, while traveling — spend money from the same account you use for trading. A crypto card can replace your regular bank account, and you won’t have to worry about overdrawing your balance.

- Easy conversion from fiat currencies to crypto. If your job is paid in crypto, you can receive it to the account linked to the debit card, and then spend it however you like.

- Cashbacks and rewards. The provider can return up to 8% of what you spend in crypto. Some also have reward programs, for example, for streaming services, while others waive card ATM fees. The market is quite young, and providers are really fighting for their clients.

Now let’s look a the drawbacks:

- Regional restrictions. For now, the geography for most crypto cards is limited to Europe and the US, rarely — Asia and Latin America. For example, the Binance debit card has been only available in Europe, and may be soon launching in Argentina.

- Not a credit card. As providers only allow you to spend the money you have, crypto debit cards are not convenient for bigger purchases, such as a car or a house.

- Taxes. Crypto taxes are a sensitive topic for US citizens. Since the IRS considers crypto a capital asset instead of currency, you have to pay ****capital gains tax on purchases with your debit card.

As we’ve dug into the perks and drawbacks of crypto debit cards, let’s have a closer look at particular cards and see which one is worth applying for.

Binance Visa debit card

A smart choice for European crypto holders, Binance card will soon be coming to Argentina. No processing or administrative fees, up to 8% BNB cashback and a quite high spending limit. Clients can pre-select the digital wallet they want to debit when they fund the card balance. The latter can currently hold only two digital currencies, namely Bitcoin and Binance’s native token BNB. Whenever a cardholder makes a payment, Binance сard instantly converts the cryptocurrencies into other fiat currencies and automatically deducts all expenses and commissions, which are yet to be disclosed. Lastly, when deciding whether or not to get this card, remember that Binance is a centralised crypto exchange, so your wallet will be a custodial one, in which the private keys are held by a third party.

Coinbase Visa debit card

Coinbase is another centralised exchange platform for buying and selling cryptocurrency that has been around for a long time. Coinbase debit card works across the US and has no sign-up or ATM withdrawal fees, offering up to 4% cashback in XLM and 1% in BTC. It is also said to be one of the most secure cards on the market. One of the main drawbacks of the Coinbase card is the high cryptocurrency liquidation fee. You’ll incur a 2.49% transaction fee for all purchases.

Crypto.com Visa debit card

Namely, one of the most popular cards on the market. It supports over a hundred cryptocurrencies, and covers not only Europe and the US, but also Asia and Latin America. It offers 5 different tiers with their own reward structure: the highest being the Obsidian card which has 5% cashback and some other perks. The card can also be topped up with fiat besides crypto. The company accepts over 20 fiat currencies. However, its staking requirements are enormous: for the Ruby Steel option, it offers 1% cashback for $400 worth of staked CRO.

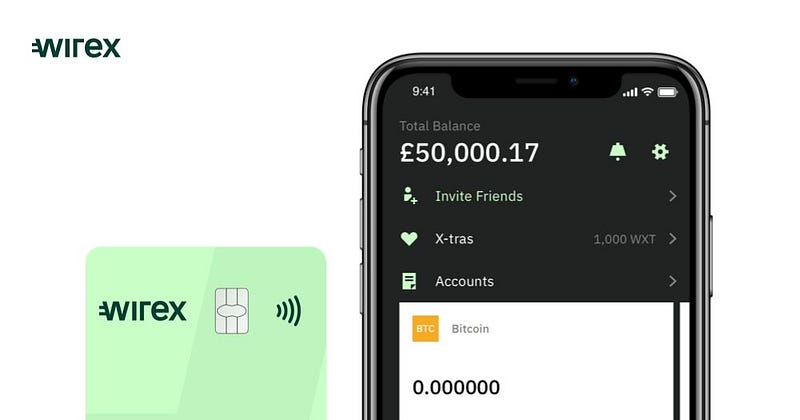

Wirex debit card

Wirex is the first card on our list that is connected to a non-custodial crypto wallet. Non-custodial means that no third party will hold the private keys to your assets or link your personal information to your spending. The card supports numerous fiat and cryptocurrencies, and works with both Visa and Mastercard. It is a great option for travellers as there are no conversion fees in other currencies. The cashback is 2% in the native WXT token, but topping it up with crypto costs 1% of the transaction amount. The card is only available in the UK and the European Economic Area.

SORA debit card

Another brand new crypto debit card with a self-custodial wallet is the SORA card. The creators at SORA community emphasise that SORA card will give users maximum ownership and access to their assets with the highest standards of privacy, resulting in an easy fiat gateway to the Polkadot ecosystem. Unlike other centralised decisions: full freedom managing your assets and keeping your personal data private. SORA card will initially be available for EUR currency use on the Mastercard network, allowing access to 90 million merchants globally, expanding to other fiat currencies later on.

The crypto card market has grown significantly in the recent years, and the products are becoming more and more sophisticated. We haven’t covered the crypto credit card offerings, like Gemini or Nexo, focusing on debit cards alone. Ultimately, the decision for which crypto debit card to get comes down to your spending habits and financial portfolio. When choosing the right card, it’s important to consider the rewards rates, spending limits, regional restrictions and other requirements like staking, in addition to which platform the card is linked to and which cryptocurrencies you interact with the most.