On May 2, the U.S. Department of Justice (DOJ) announced the arrest of Maximilien de Hoop Cartier for his involvement in a scheme to launder drug trafficking proceeds using Tether's stablecoin.

According to the DOJ press release, Cartier, along with five Colombian nationals, conspired to launder proceeds from drug trafficking through over-the-counter USDT transactions. The group reportedly attempted to import 100 kilograms of cocaine into the United States while simultaneously laundering hundreds of millions of dollars.

While the full extent of their laundering activities remains under investigation, authorities confirmed that they had already successfully laundered 14.5 million USDT between May and November 2023. The investigation revealed that Cartier transferred the funds from the U.S. to Colombia through a network of shell companies and bank accounts under his control, deliberately misleading financial institutions about the true nature of his transactions. According to the DOJ, "Cartier has been a member of the [money laundering] network since at least about January 2020."

Cartier was detained in Miami, Florida, on February 22, while his co-conspirators were arrested in Colombia on April 30. The indictment details four counts of criminal conduct against him, including conspiracy to distribute cocaine, conspiracy to commit money laundering, money laundering (each count could lead to up to 20 years in prison), and operating an unlicensed money-transmitting business (up to five years).

The five Colombian nationals who allegedly worked with Cartier also face harsh sentences. Leonardo de Jesus Zuluaga Duque is charged with conspiring to commit money laundering and to import over 5 kilograms of cocaine into the U.S., and is facing 10 years to life in prison. Erica Milena Lopez Ortiz faces similar charges of money laundering and cocaine importation. Felipe Estrada Echeverry is accused of conspiracy to commit money laundering. Alexander Areiza Ceballos and Adrian Fernando Areiza Ceballos are each charged with conspiring to import over 5 kilograms of cocaine into the U.S.

U.S. Attorney Damian Williams praised the law enforcement officers and prosecutors involved in the investigation:

"The charges brought today demonstrate this Office’s commitment to prosecuting international drug traffickers and piercing complicated money laundering networks seeking to exploit the U.S financial system. [...] I commend the efforts of our law enforcements partners and the career prosecutors from this Office who work tirelessly to investigate and disrupt these money laundering and drug trafficking networks. We will continue to relentlessly protect the U.S. financial system from exploitation."

DOJ cracks down on money laundering activities

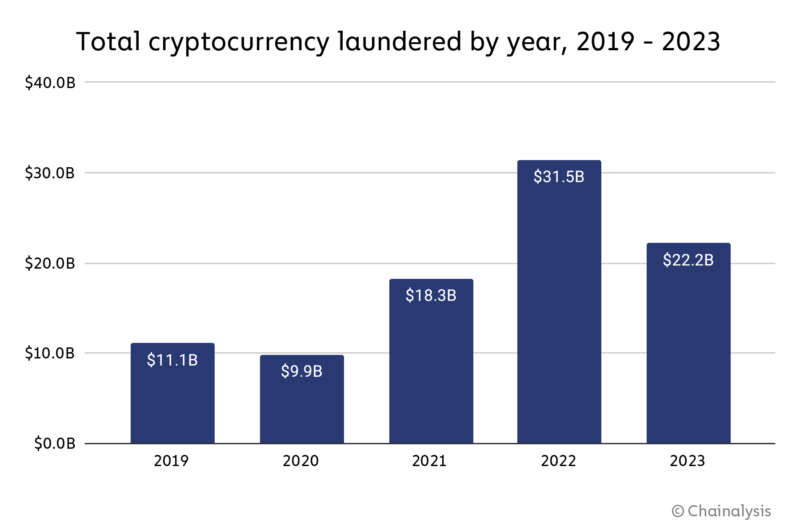

While cryptocurrency is often associated with money laundering concerns, recent research carried out by Chainalysis reveals a significant decline in illicit cryptocurrency transactions.

Illicit addresses sent $22.2 billion to various services in 2023, a massive drop from $31.5 billion in 2022. This decline is partially due to a general decrease in overall crypto transaction volume. Still, the reduction in money laundering activity outpaced the overall drop, suggesting a potential tightening of the net around illicit actors.

Further highlighting the global crackdown on cryptocurrency-based money laundering, on May 3, the DOJ announced that Alexander Vinnik, the operator of the infamous BTC-e exchange, pleaded guilty to money laundering charges.

The platform, which processed over $9 billion in transactions, served as a haven for cybercriminals, facilitating the laundering of illicit funds for ransomware operators and drug traffickers alike. Its disregard for anti-money laundering regulations made it a prime target for criminals seeking to hide their tracks. Vinnik's confession underscores the international effort required to dismantle such operations, echoing Deputy Attorney General Lisa Monaco's emphasis on global collaboration in tackling sophisticated money laundering schemes within the cryptocurrency space:

"Today’s result shows how the Justice Department, working with international partners, reaches across the globe to combat cryptocrime. This guilty plea reflects the Department’s ongoing commitment to use all tools to fight money laundering, police crypto markets, and recover restitution for victims."

This case adds to the charges brought against Cartier and Aliaksandr Klimenka, another alleged operator of BTC-e, further demonstrating the DOJ's ongoing pursuit of those responsible for enabling large-scale financial crime through cryptocurrency.