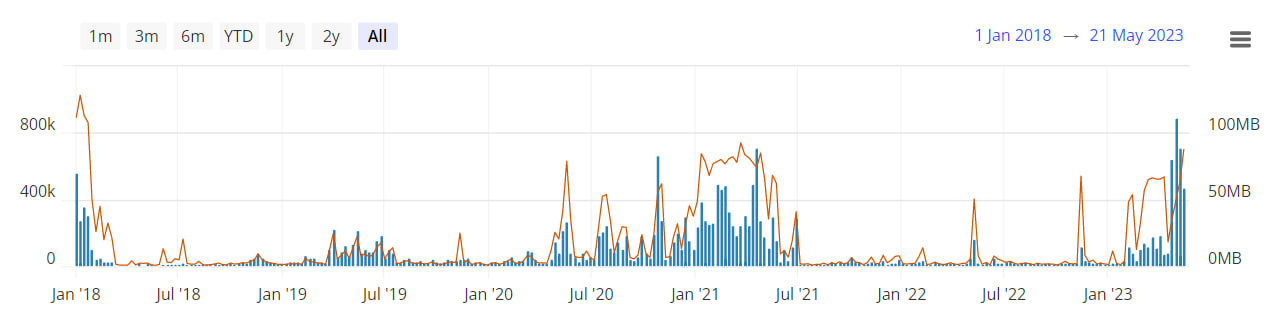

At the end of the first week in May, the Bitcoin network was buckling under the weight of a reported 400,000 unconfirmed transactions in the mempool, and users were forking out fees of over $30 to ensure that theirs didn’t get lost somewhere underneath the pile.

The network congestion this time became so bad that Binance briefly disabled bitcoin withdrawals, some commentators jumped to the conclusion that a DDOS attack was in progress, and Chicken Licken thought the sky was falling in.

The actual cause of the problem however, was far cooler/stupider depending on your point of view.

Four months earlier, a developer had devised a way to identify each and every Satoshi ever mined, and improve/deface it with the addition of a data file. This specification for Ordinals and inscriptions had enabled a new form of non-fungible token (NFT) on the Bitcoin blockchain. And arguably these NFTs were (even) better than versions on other blockchains, because the inscribed data was also held directly on it, rather than just as a linked file.

This caused a minor increase in network traffic, as projects drew pixellated punks onto their satoshis and proceeded to sell them to punk-hungry punters. But it didn’t directly cause the kind of panic that we saw earlier this month.

It did indirectly enable it though, as in March another developer used the Ordinals/inscriptions protocol to create and distribute a new type of token, the BRC-20. These pseudo-tokens only exist as ledger entries written in JSON code inscribed onto Ordinal satoshis. Aggregate all of these ledger entries together, however, and you determine the balance state of the token.

And lo, the people did mint these BRC-20 tokens in their thousands. 24,677 of them to be exact (at time of writing), mainly consisting of ‘hilarious’ meme-coins honoring everything from Pepe to pizza to Elon Musk.

As crypto bros wet their virtual pants at the idea of making real money out of little more than a ticker name, the mempool filled up and overflowed with meme-coin ledger entries being inscribed and sold. And for a while it worked.

As Observers reported, the market cap of BRC-20 tokens broke through the $1 billion mark shortly after the unconfirmed transactions and network fees peaked.

Just two weeks later though, despite the number of BRC-20 tokens having nearly doubled, the market cap has dropped to under half a billion dollars. This is still a significant amount, but it would appear that the joke isn’t quite so funny any more.

To reflect this, unconfirmed transactions have also fallen, and although there is still a way to go to clear the mempool completely, things certainly seem to be heading in the right direction. Similarly transaction fees, which didn’t actually stay at those eye-watering $30+ rates for very long, have dropped back to around $4 at time of writing.

With a bit of luck, the interest in BRC-20 tokens will continue to cool, and it won’t take long to clear the mempool and get back to the longer term average fees of around $2. We will be Observing closely.