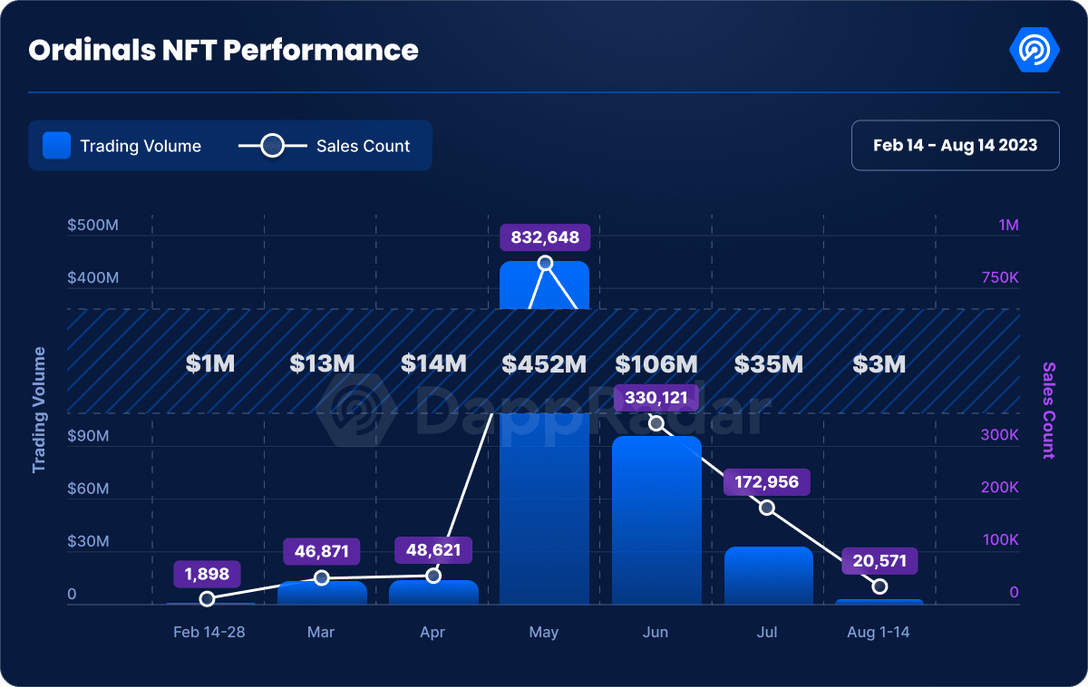

On August 17, DappRadar released a report highlighting a 97% decline in trading volume and sales count of Bitcoin Ordinals from May to mid-August, pointing to the “waning enthusiasm or perhaps confidence in Bitcoin NFTs” as the reason for such an intense freefall.

According to DappRadar, the sales volume of Bitcoin Ordinals went from $452 million at the peak of the hype cycle in May to $106 million in June, and in July, the figure dropped to a mere $35 million. By mid-August, Non-Fungible Tokens (NFTs) on Bitcoin had resulted in only $3 million in sales volume.

Ordinals were initially called a potential game-changer for the original blockchain. With the release of the Ordinals Protocol in December 2022, some satoshis lost their fungibility (being mutually interchangeable) but gained the capability of storing information within them.

The innovation generated opposing opinions within the Bitcoin community, with some relinquishing the newfound use case while others were against the development due to the increase in transaction fees it generated and the extra block space it occupied. Nonetheless, their popularity soon skyrocketed. Major studios producing profile picture (PFP) NFTs, such as Yuga Labs and DeGods, were quick to launch their collections as Ordinals.

However, the lack of a clear use case has made this trend short-lived. The shifting NFT market dynamics that have been causing a drop in sales across the entire ecosystem, even on specialized chains, could be affecting Ordinals too.

The news released by DappRadar didn’t please the Ordinals community, which has been acting on all fronts to keep the Ordinals dream alive.

Three days after the report came out, self-proclaimed ‘Ordfluencer’ Leonidas NFT argued on X (former Twitter) that the interest in the Ordinals was far from dead, pointing at the number of transactions of the NFTs (600,000 in a single day), making up 84.9% of the total Bitcoin network activity. On X, DappRadar insisted that “The data published is accurate”, explaining that the causes for different results are likely to be the exclusion of “transactions not visible on the block explorer and which remain unconfirmed” and their focus on inscriptions rather than BRC-20 swaps.

While the count methodology could be called into question, the overall downward trend has been confirmed. The Crypto Slam and Dune Analytics platforms pointed to a 67% and 69% sales volume decrease respectively, over the same period.

Bitcoin was developed with one use case in mind: peer-to-peer electronic cash. Its trajectory has changed since then, and its main use case now is as a speculative asset. This use case of Bitcoin is currently so strong that adding things like Ordinals and Inscriptions to it is hardly noticeable on its overall adoption path. It was fun while it lasted, but hopefully we can now turn the page on Ordinals and continue to Observe Bitcoin, the asset.