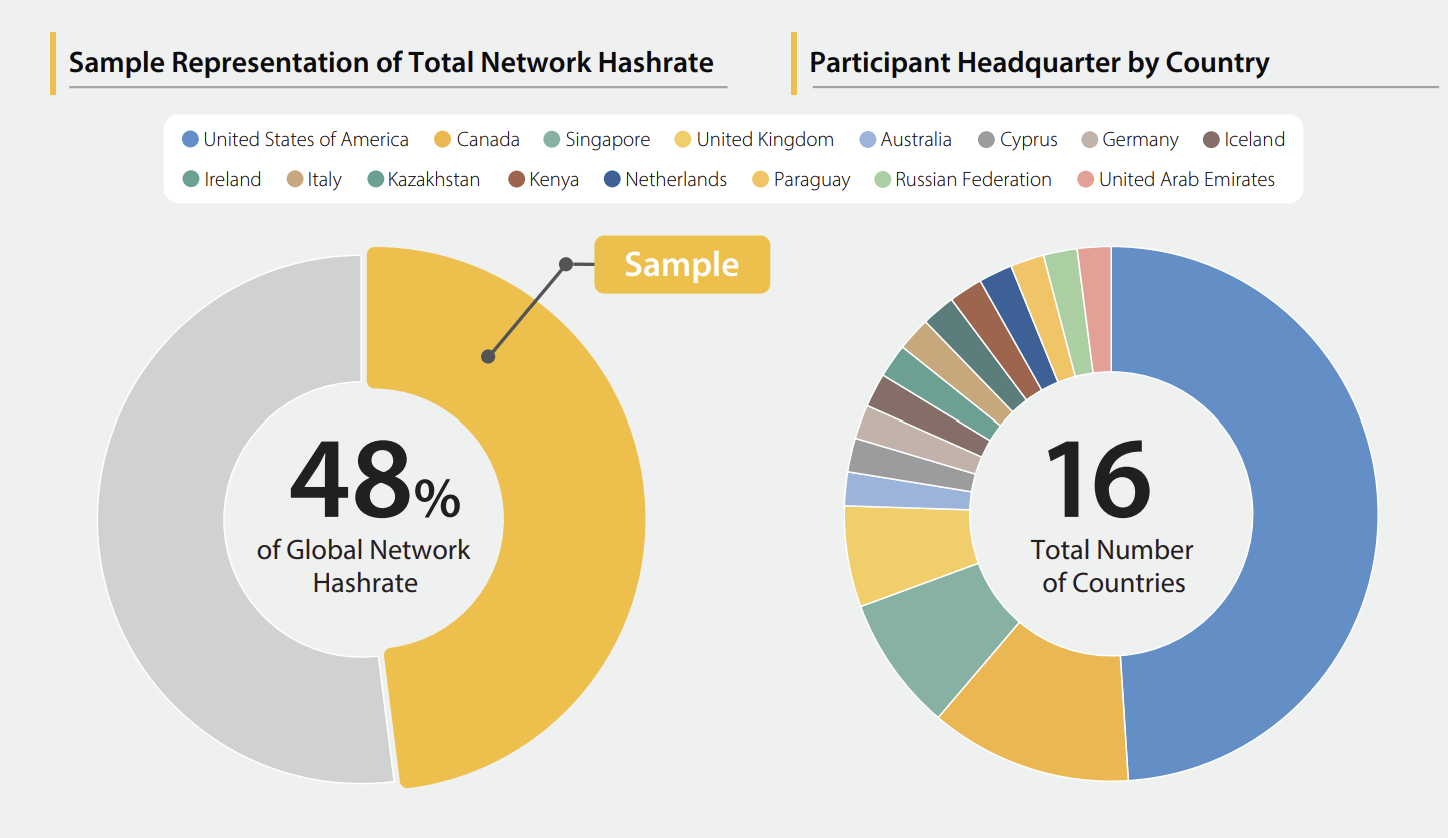

The latest report from the Cambridge Centre for Alternative Finance (CCAF), under the Cambridge Digital Assets Programme (CDAP), offers a rare window into the realities of the global Bitcoin mining industry.

The report's insights stem from a comprehensive survey accounting for 48% of the Bitcoin network's total hash rate. While the level of participation is significant, the researchers acknowledge a geographical bias in the dataset skewed towards Western participants. This may affect the representativeness of the findings for countries like China and Russia.

Key Findings: United States Leads the Way

Among the clearest outcomes of the survey is the dominant position of the United States in Bitcoin mining, at least within the observed sample. U.S.-based operations represent a sizable chunk of the hash rate, reinforcing America’s status as a global hub for digital mining.

A staggering 98.5% of the surveyed power consumption is dedicated solely to Bitcoin, revealing a near-exclusive focus by miners on the world’s premier cryptocurrency.

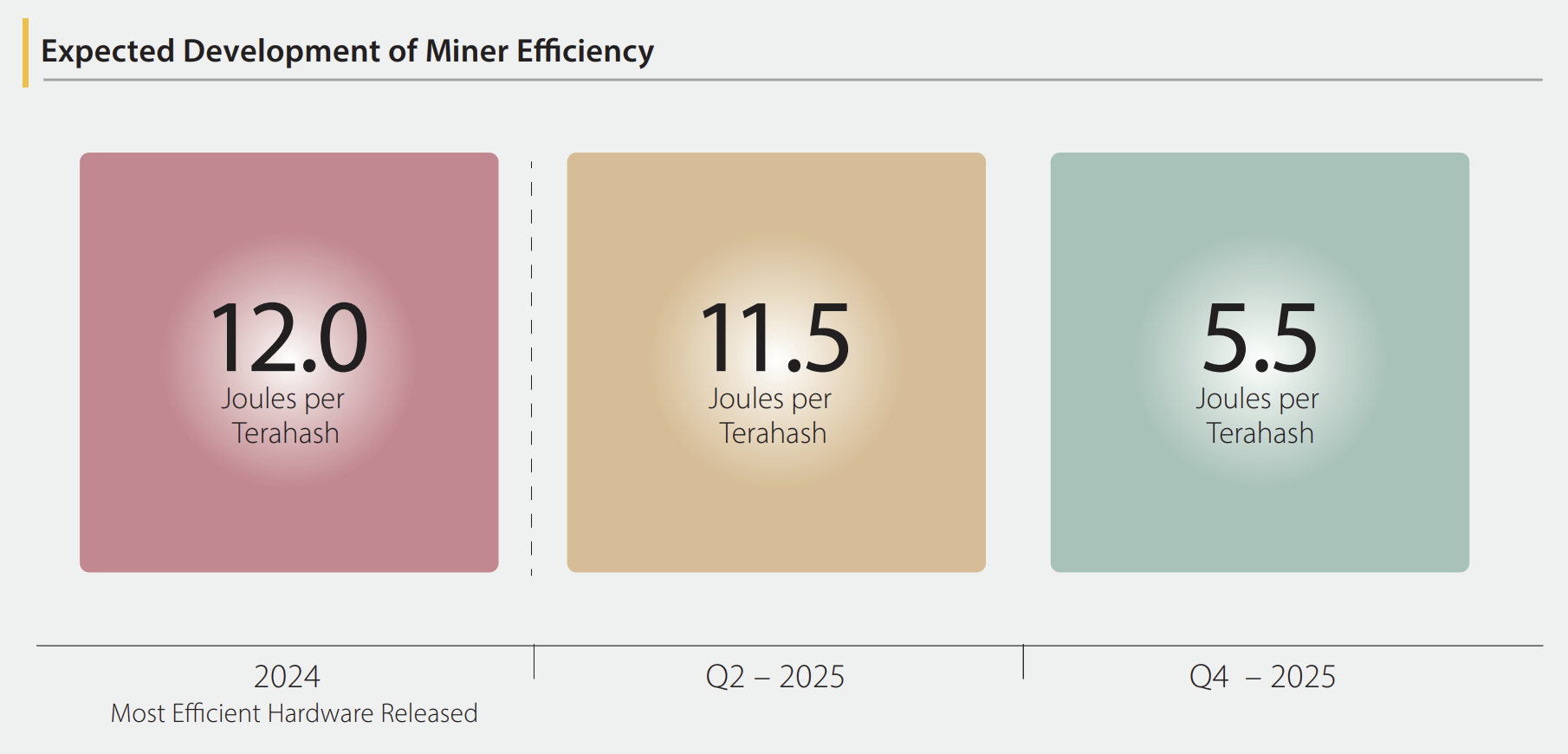

Mining Hardware Evolution: Efficiency and Market Control

Energy efficiency in Bitcoin mining has markedly improved, as shown in the decline of Joules per terahash over time.

This development parallels the consolidation of mining hardware dominance. Bitmain continues to lead the pack, controlling the lion's share of the hardware market (82% of the sample).

Yet, the rapid pace of hardware evolution contributes to another issue: e-waste. The regular retirement of older ASIC machines, which are difficult to repurpose, leads to growing environmental concerns.

Off-Grid Mining and Energy Mix

Off-grid mining represents 8.1% of operations. This small but significant portion reflects a strategy of miners seeking isolated, often cheaper or renewable, energy sources.

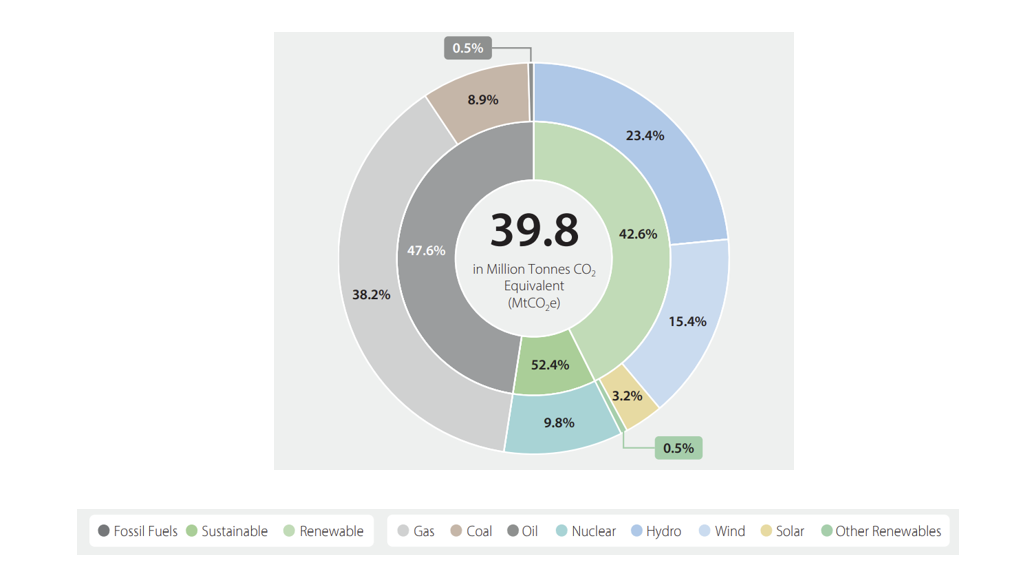

When it comes to electricity, the global mining mix is surprisingly balanced: 52.4% from sustainable energy sources and 47.6% from fossil fuels. Breaking it down further, renewables account for 42.6% of total consumption:

- Hydropower: 23.4%

- Wind: 15.4%

- Solar: 3.2%

- Other renewables: 0.5%

In addition, nuclear energy adds another 9.8%. On the fossil side, natural gas leads with 38.2%, which is also the single largest energy source, followed by coal (8.9%) and oil.

Operational Costs and Margin Pressure

Other non-electricity costs account for 18.9% of operational expenses. These include labor, equipment, and facilities. As competition grows and rewards dwindle, hash margins continue to shrink, highlighting the increasing difficulty of maintaining profitability.

Outlook: Price Predictions and AI Integration

Despite these pressures, the industry remains optimistic. Some projections in the report see Bitcoin reaching a price of $150,000, driven by growing institutional interest and supply constraints.

There's also an emerging trend: the convergence of digital mining with artificial intelligence workloads. Miners are starting to repurpose infrastructure to support AI computations, especially during times of lower Bitcoin profitability.

Beyond Mining: Bitcoin Fundamentals and Broader Insights

In addition to its mining-focused findings, the Cambridge report includes compelling educational sections on Bitcoin’s foundational design and economic mechanics.

Bitcoin Origins

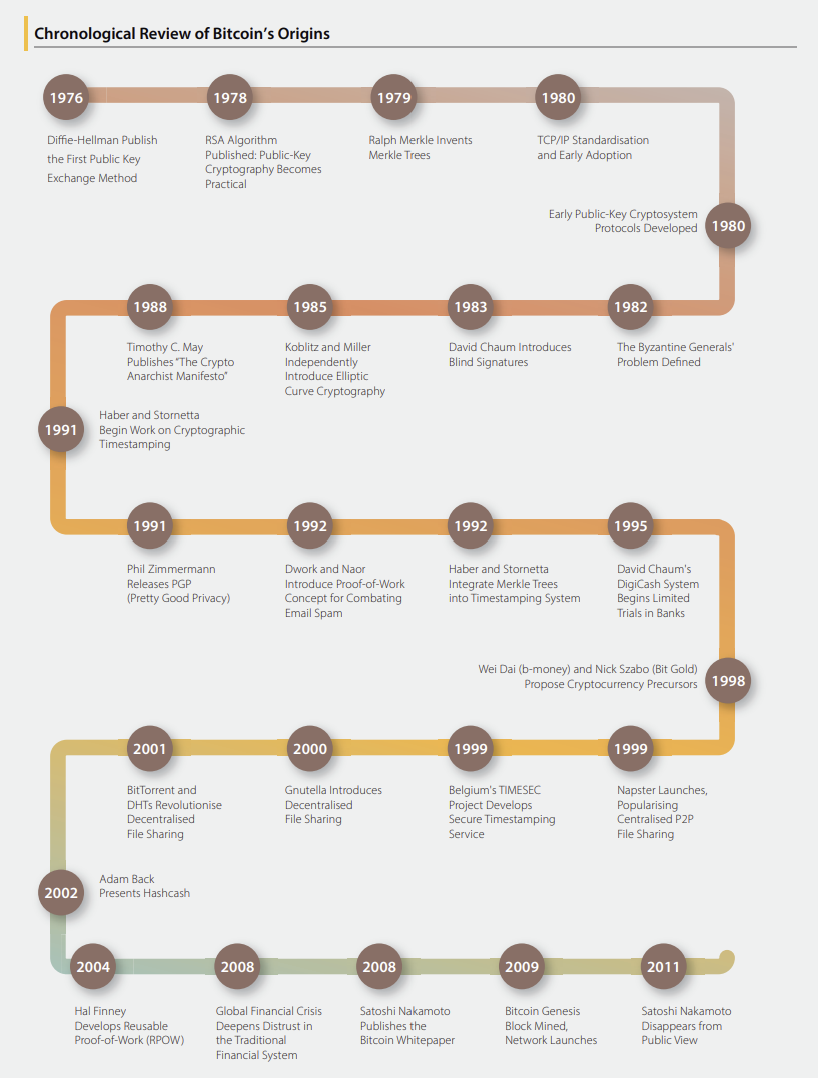

The report includes a comprehensive timeline of Bitcoin's development, from the first public key cryptography trials in the 1970s to Satoshi Nakamoto's disappearance in 2011.

Security Through Scarcity

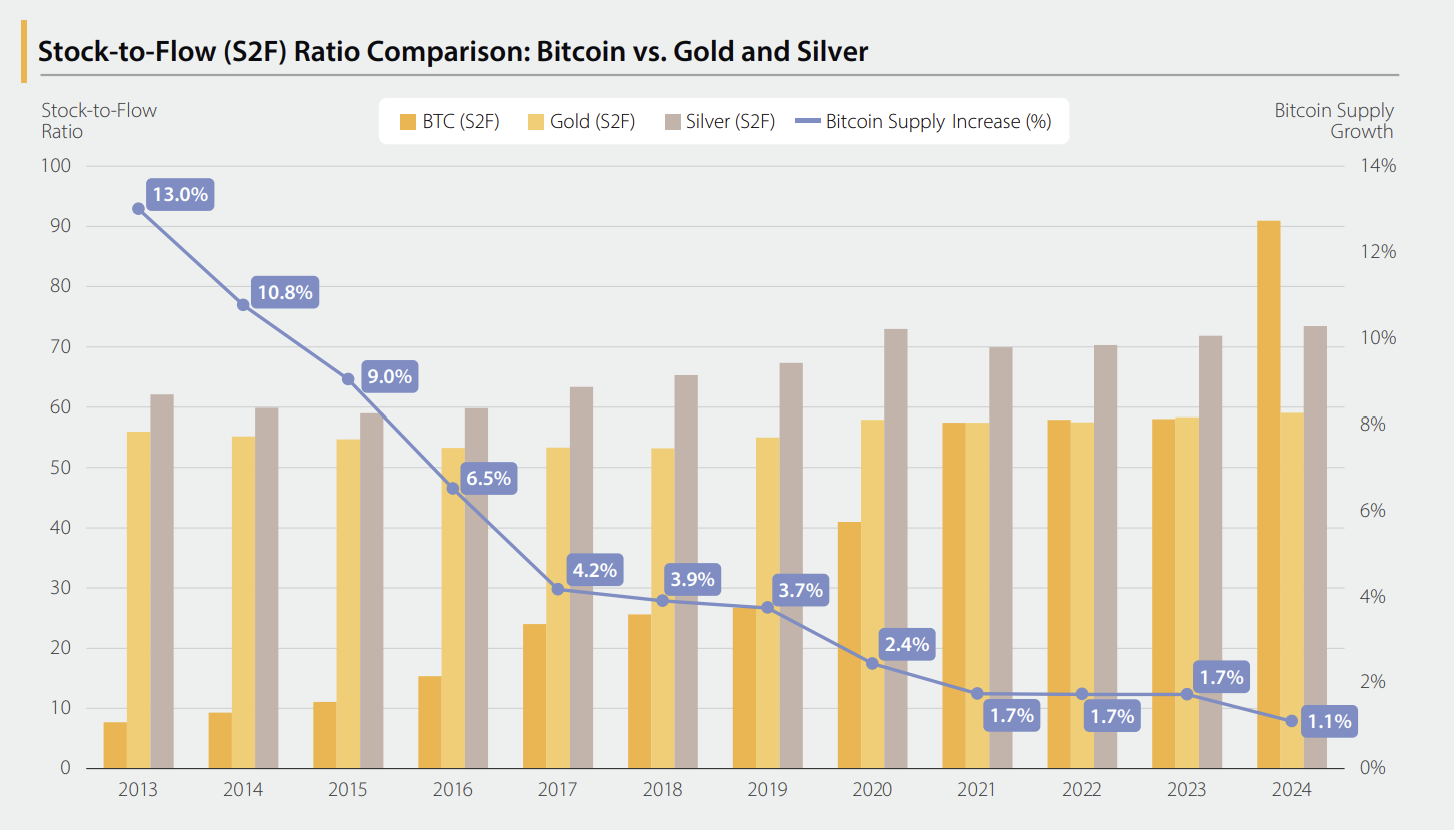

One section delves into Bitcoin’s programmatic scarcity—the fixed 21 million supply cap and halving events that reduce issuance every four years. The Bitcoin halving mechanism, which cuts mining rewards every four years, strengthens Bitcoin's scarcity but introduces a long-term security challenge. As block rewards shrink, miners may lose financial incentive to support the network—especially if transaction fees or Bitcoin’s price don't rise proportionally to compensate. This raises concerns about whether there will be enough miner engagement to keep the network secure.

Stock-to-Flow Ratio: Digital Gold?

The report examines Bitcoin’s stock-to-flow (S2F) ratio, a measure often used to compare it with precious metals like gold. Bitcoin’s current S2F is competitive with gold’s, reinforcing its narrative as "digital gold" and a potential store of value.

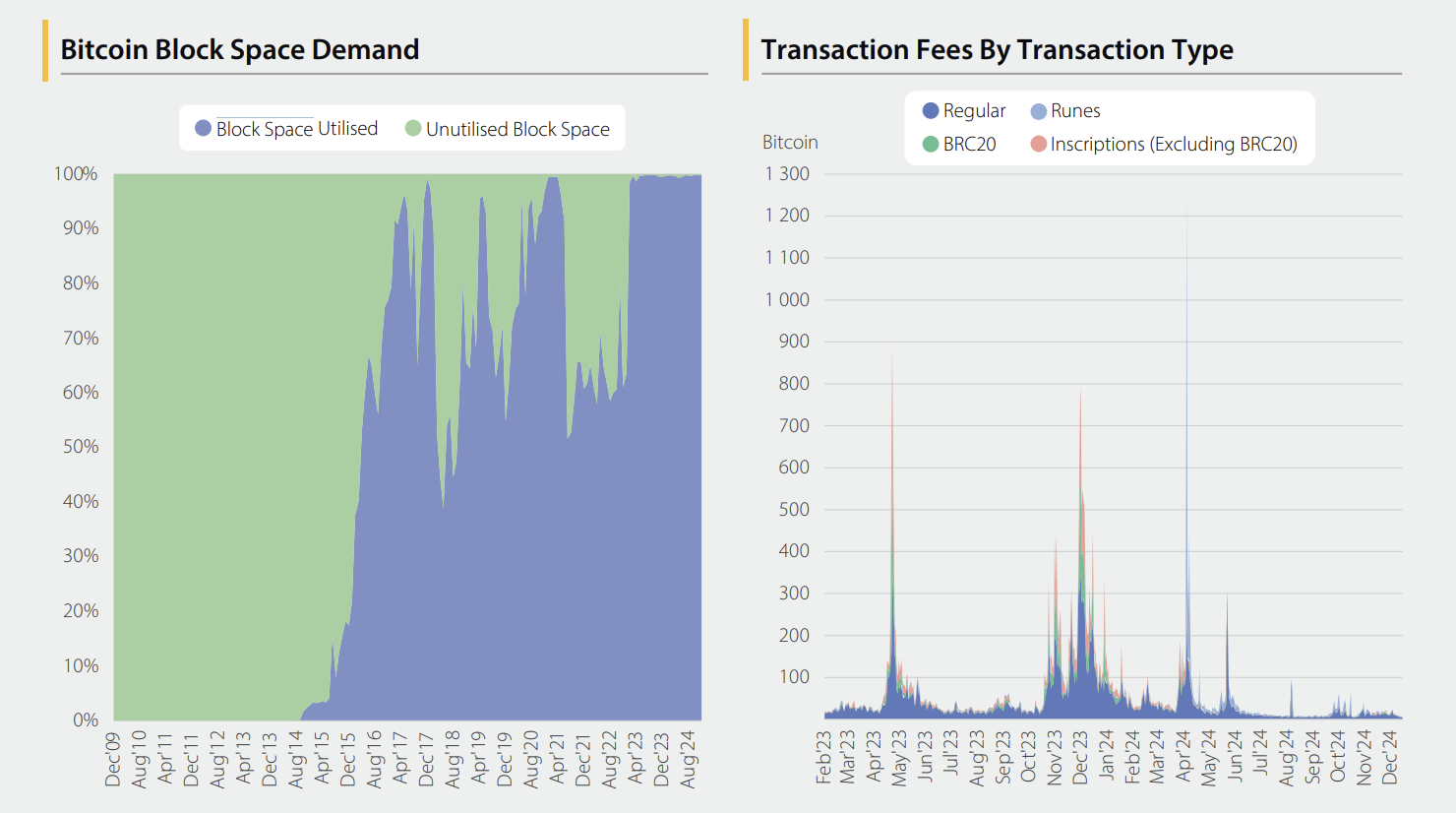

Block Space Demand: A Valuable Resource

Bitcoin block space is increasingly scarce, with demand rising as the network is used for new categories of Bitcoin messages, such as those relating to Ordinals, Runes, and BRC20.