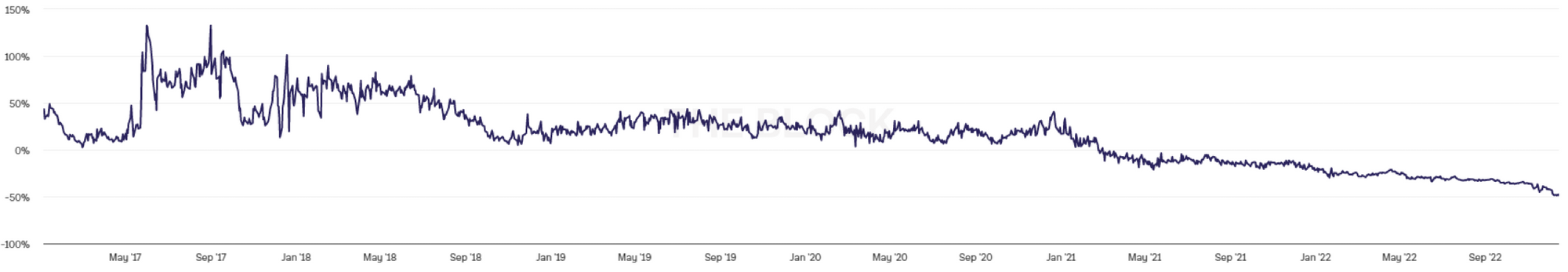

Grayscale Investments is a fund that allows investing in cryptocurrencies not directly, but through its investment instruments. For example, the only asset of Grayscale Bitcoin Trust is Bitcoin, so its share price follows the BTC price. However, the price charts do not correlate 100%. The fund has traded with a premium to net asset value (NAV) until February 2021, when the trend changed. GBTC is now trading at a record discount approaching 50%.

Simply put, it is now possible to buy shares in a trust whose assets are Bitcoin, cheaper than Bitcoin itself. Sounds like a great deal, but you should not expect a guaranteed profit. Such a large discount has its reasons.

Bitcoin fall.

The only asset on which the price of the trust shares depends is getting cheaper. Pessimistic sentiments in the cryptocurrency market do not encourage investors to choose Bitcoin-related instruments. Since February 2021, GBTC has fallen by 76%, while Bitcoin has only fallen by 50%.

The problems of the Digital Currency Group.

In the article Who Is Next? Genesis and DCG FUD we wrote about the possibility of the forthcoming bankruptcy of the crypto broker Genesis. The company is a subsidiary of DCG, as well as Grayscale Investments. The management of Grayscale stated that Genesis Global Capital is not a counterpart or service provider for their products, but the negative news still affected the confidence of investors.

SEC Denial.

Grayscale applied to The United States Securities and Exchange Commission in October 2021 to convert the GBTC trust into an exchange-traded fund (ETF), which would have made it available to a wider range of investors. The request was rejected. The decision was motivated by the fact that the underlying base asset is not subject to supervision, because the crypto spot market is not regulated. Grayscale disagreed and sued the SEC in June 2022. It should be noted that the SEC registers ETF, the base asset of which are cryptocurrency futures, but not cryptocurrencies themselves. So far GBTC is traded on the OTC market.

The lawsuit against Fir Tree.

The hedge fund Fir Tree Capital Management sued Grayscale for disclosing information to investigate possible mismanagement of the fund. They want to force the company to reduce management fees (which is 2% - higher than many competitors) and to start a buyback of shares.

The pressure of all these circumstances has led Greyscale’s main product to new low records. The discount of almost 50% may seem like a good entry point, but it must be understood that buying GBTC now is not quite the same as buying Bitcoin for half the price. There is no guarantee that the company’s problems will not deteriorate further. Trying to buy at the bottom can lead you to another bottom, a deeper one.

At the same time, if the main problems of the parent company and the fund itself are solved and the SEC allows the conversion of the GBTC trust to the ETF, Greyscale will get a new inflow of investors. In any case, the future of GBTC strongly depends on how soon the crypto winter turns to spring.