Cryptocurrencies were supposed to be an alternative to the global economic system, but they are increasingly merging with it.

In its early years, Bitcoin was considered a complex toy for techies and an exotic investment tool. Later when the market capitalization of the industry began to count in hundreds of billions it became a great speculative asset that moved independently of traditional assets. Now, when cryptocurrencies are increasingly being used as a means of payment by various services, institutional players and governments are working with the technology, we more and more see crypto and general economic news in the same articles.

Bitcoin is still a speculative asset, but for the last few years, its price has displayed some behavior patterns typical for that of commodities and reserve assets. We have looked deeper into the interrelationships of S&P 500 index and the Bitcoin price.

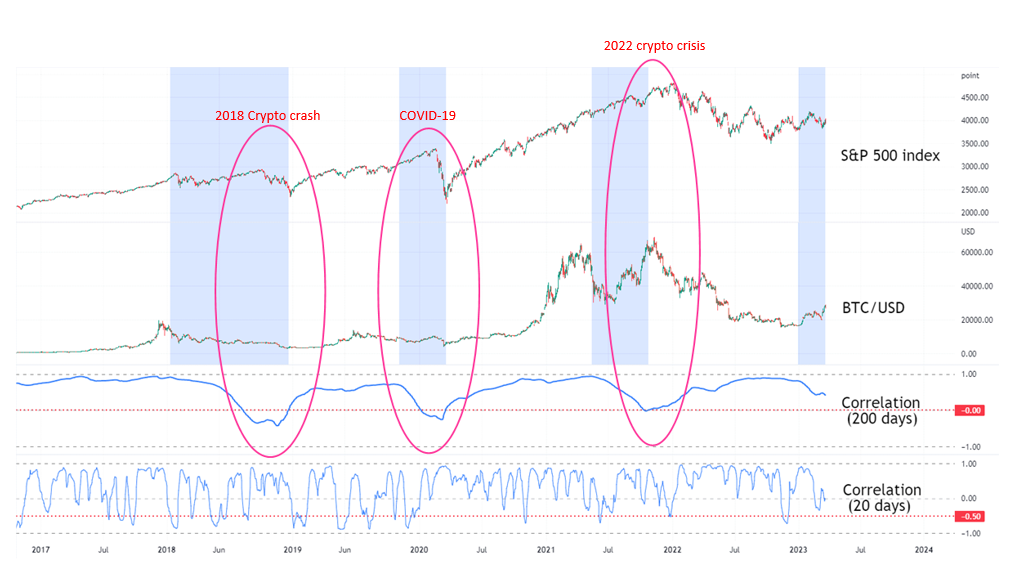

The chart below shows the index, Bitcoin price, and two correlation indicators depicted with blue curves. The indicators show how similar or different the price movements of two assets are. Values above zero mean the movement of asset prices in one direction, below zero - in opposite directions, fluctuations near zero - the absence of obvious relationships. The upper indicator shows the trend for 200 days, which allows you to see the big picture, the lower indicator shows the correlation measured for 20 days.

It is noticeable for the last five years the upper indicator has stayed above zero most of the time, often approaching the maximum value.

The long-term positive correlation has been violated several times: during the collapse of crypto in 2018, which for a long time was accompanied by the continued growth of the S&P 500, then the second violation occurred with the beginning of the COVID-19 pandemic, when Bitcoin reacted to the news earlier than the stock market, and finally, during the catastrophic events of the crypto industry last year.

Overall, the correlation is visible, and it is strengthening. This trend is even more obvious if we look at the lower indicator, which measures correlation in 20 days and responds to changes faster. The indicator leaves the area of positive values less and less often. A significant negative correlation, less than -0.50, occured 15 times from 2017 to 2020, and only 4 times after 2020.

While the correlation is visible, it is difficult to judge on the causation of Bitcoin S&P 500 price relationship. The crypto's downward trend of 2022 was explained by LUNA/Terra collapse and coincided with S&P 500's dive. However, the collapse of the FTX crypto exchange in early November did not have such an effect - the US stock market was quietly increasing while the crypto market was drowning in chaos.

An interesting situation has been unfolding since the beginning of 2023. The correlation is violated since equity is down while Bitcoin grows. The markets react to certain news similarly. On March 22, the FOMC announced an interest rate increase of 0.25%. The S&P 500 reacted typically with an increase in volatility. The price chart for the day shows how the volatility of bitcoin is growing at the same time, which largely repeats the movements of the index.

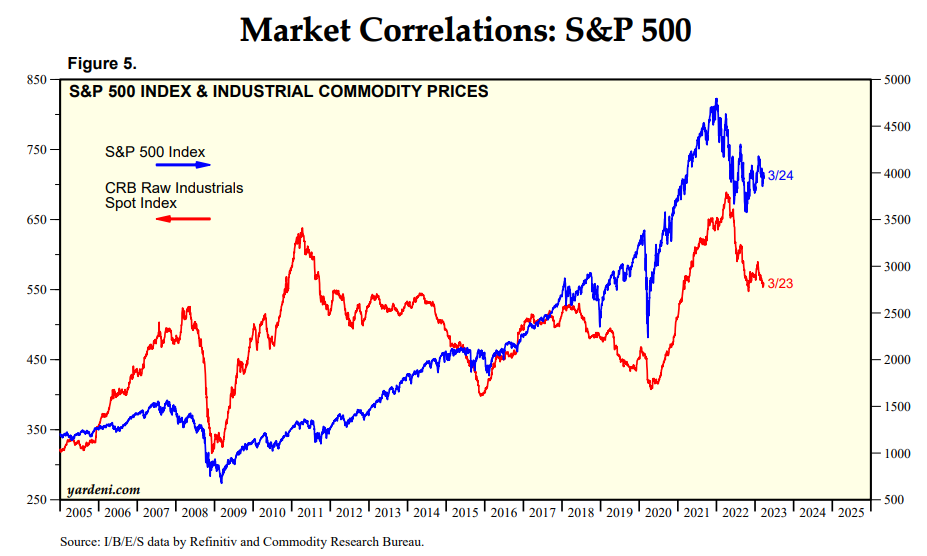

A close correlation with S&P 500 is typical for the prices of commodities. CRB RAW Industrials that consists of 19 commodities: aluminum, cocoa, coffee, copper, corn, cotton, crude oil, gold, heating oil, lean hogs, live cattle, natural gas, nickel, orange juice, gasoline, silver, soybeans, sugar and wheat has been moving in parallel with the equity index since 2000.

The situation with gold is more complicated. The standard view is that these two markets are negatively linked: when the stocks go up, gold dives, and vice versa. This agrees with the theory that gold is a safe haven and when investors go into bearish mode the prefer it to relatively risky stock market. As the chart below shows there were periods of co-movement, which means that the gold to stock market relationship is complex and dependent on external macroeconomic factors.

All the above suggests that Bitcoin is still a largely speculative trading asset but with some dynamics toward the reserve asset league. It could be a matter of size: the total market capitalization of U.S. stock market is more than $40 trillion, and the capitalization of all cryptocurrencies barely exceeds $1 trillion at the time of writing. Or, it could be a matter of social and regulatory adoption. We will observe how this progress and report.