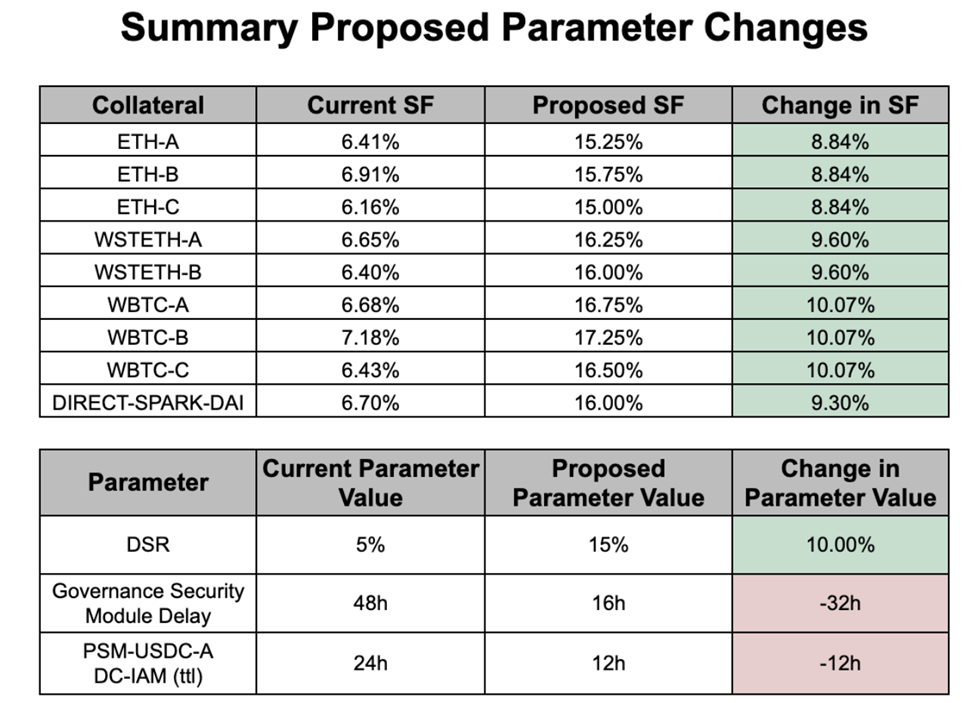

On Friday, 8 March, Block Analitica Labs, the group hired by MakerDAO to oversee the protocol’s metrics and maintain stability, posted an “Accelerated Proposal” that included a set of emergency parameter changes to the Maker’s lending protocol. In short, it introduced prohibitively high rates for borrowing the Maker’s DAI stablecoin.

The proposal was passed by executive vote the same day and put in action on March 10.

So what caused such an abrupt intervention to the protocol’s economics? The rationale laid out in the proposal is rather contradictory: DAI supply dropped from 5 billion to 4.4 billion. Why would Maker propose to limit further minting of DAI if its volume goes down?

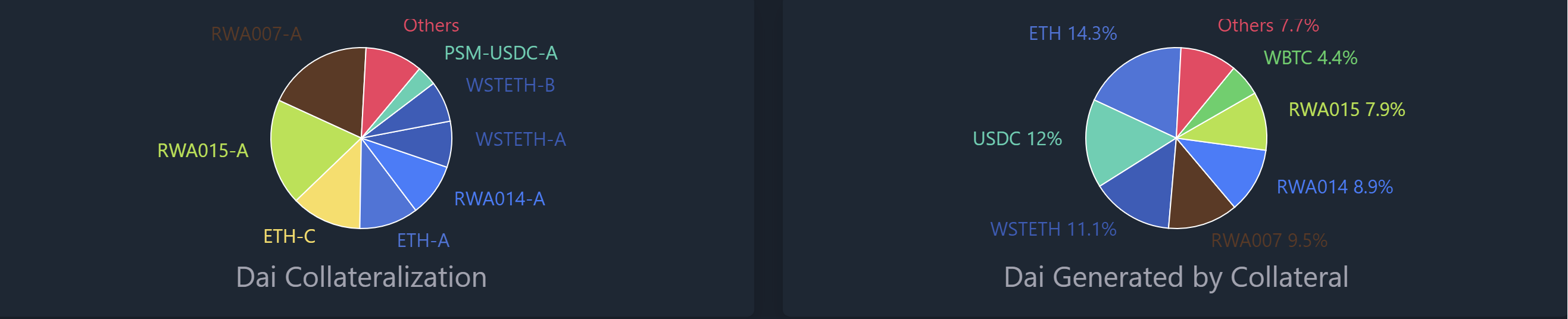

The reason behind the current problems of the decentralized stablecoin is in the composition of its reserves.

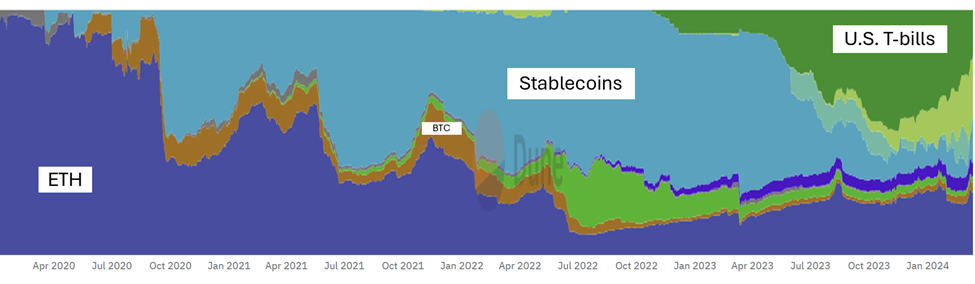

Maker’s DAI stablecoin is backed by three major types of assets:

- Cryptocurrency (mostly ETH and some BTC)

- Real World Assets (mostly U.S. T-bills), and

- Other stablecoins (mostly USDC).

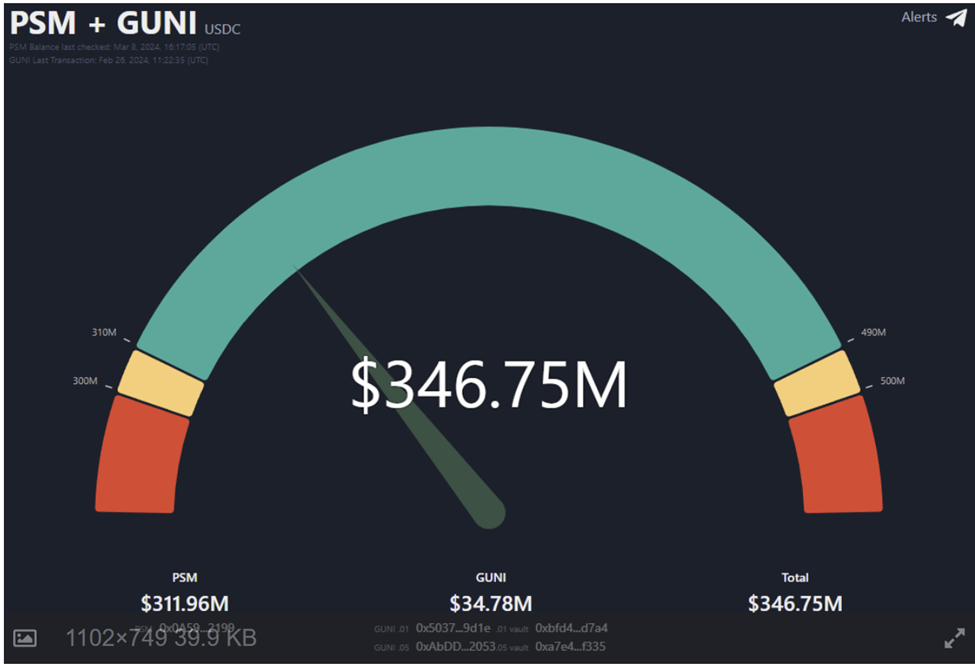

The last category has the smallest share and is designed to absorb sudden selling pressure on DAI stablecoins. Dubbed “Peg Stability Module” (PSM), it also operates differently from other reserve vaults – instead of borrowing against the collateral, DAI in PSM is directly swapped with USDC.

The recent bullish sentiments on crypto markets have fueled DAI borrowing activity on the Maker platform. Traders wishing to leverage their positions were borrowing DAI against their cryptocurrency, buying more crypto, and using it as collateral to borrow more DAI. But stablecoin markets are very competitive and DAI is not the first player there. So excess DAI was then funneled back to Maker for redemption. While redemption to Real Word Assets (mainly T-bills) is inherently slower, the hardest hit went to the USDC in PSM. In a few days, the reserves have depleted to less than half of their maximum $800 million level.

Maker acted very much like a central bank in this situation by hiking the base borrowing rate. The difference is that central banks prioritize maintaining inflation targets, while the ultimate goal for Maker DAO is maintaining DAI’s peg to USD.

Maintaining a peg to a stable fiat currency while keeping extremely volatile assets in reserves, all this governed using “decentralized” methods is a tricky venture. MakerDAO has already significantly drifted from its original crypto-only backing concept. The share of volatile crypto reserves in Maker’s vaults is down from 95% to less than 40%.

Yet, as we can see, even this fraction of reserves in volatile crypto assets can cause damage to the Maker’s operations. And ironically, it does when crypto is up too.

The current emergency state is declared as temporary. Yet, the implications of this move to the Maker DAO’s business prospects are not favorable. DAI stablecoin has not caught DeFi traders’ interest. This was a strong hit to Maker’s reputation as a lender. The regular holders of DAI are now paying multiple times the interest they signed for. What’s more, this manual intervention in the governance process erodes trust.

The only parties that benefited from this proposal were the Maker governance token holders. MKR token jumped almost 50% on the news, triggered by expectations of stronger protocol profits from the high fees. Having the governance token traded on the volatile crypto markets is another brilliant idea of the Maker’s designers.

Shortly after the events, the Maker’s co-founder and the current lead, Rune Christensen, reassured the public by reiterating its Endgame transition plan and announcing the first phase launch in the summer of this year. Besides mainly cosmetical upgrades such as rebranding and renaming the protocol and the stablecoin, the first phase will include mostly upgrades to the Maker’s lending subprotocol Spark. The founders are also planning the redenomination of the MKR token by a factor of 24000. Probably, the reasoning is that the current $3,000 price does not attract Degens.

In his post, Christensen set a target for the Maker’s Endgame to take DAI market cap to “100 billion and beyond” among many other ambitious statements. Yet, per our observation, nothing was mentioned about the path of compliance and the path of decentralization.