For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, stablecoins and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

An overall green week for cryptocurrency was tainted by a red from the European Central Bank (ECB), which published a blog post calling Bitcoin a "bouncing dead cat" with "zero fair value". But how do the experts of the European monetary authority justify such an aggressive stance?

The authors first debase three common explanations given for the current Bitcoin run: 1) the expectation of lower interest rates, 2) Bitcoin's halving event in April and 3) the release of spot bitcoin ETFs. Instead, they suggest their own drivers for Bitcoin's success: 1) price manipulation, 2) criminal transactions, and 3) misjudgment by authorities. The third explanation criticizes the soft stance of regulators and governments on Bitcoin.

Authored by two ECB staff from the 'market infrastructure and payments' department, the article does contain a disclaimer that the views are those of the authors and "do not necessarily represent the views of the European Central Bank".

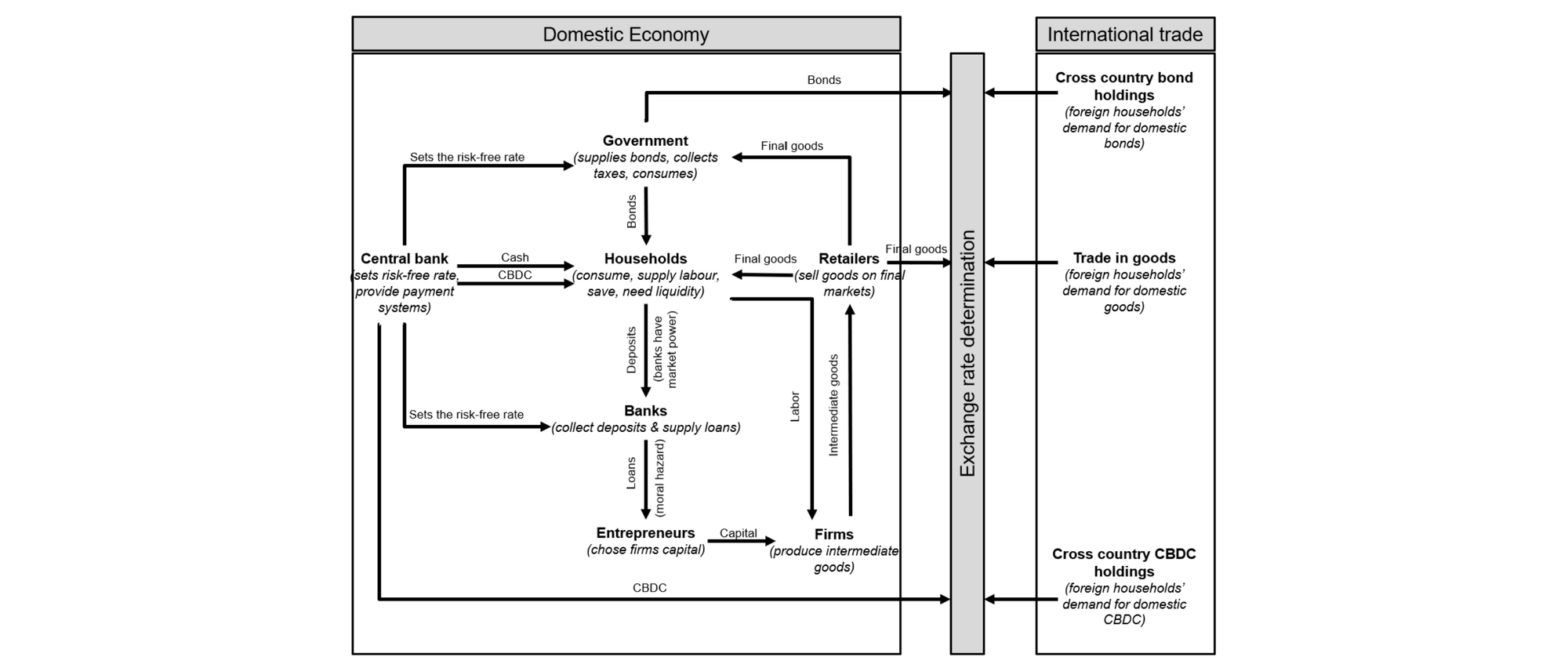

Meanwhile, the Central Bank of the Netherlands (DNB) completed its research on disintermediation risks arising from a CBDC. Most papers on CBDC talk about the potential effect of CBDC on commercial bank deposits – it is believed that the alternative saving method would result in a weaker market for the banks. Surprisingly, the simulation model in the DNB's research showed that the volume of deposits would likely increase, because banks, having lost their monopolistic position, would increase deposit interest rates. The research paper further investigates and concludes that strict limits and penalizing of CBDC holdings will keep banks safe from such risk.

Possibly inspired by the results of the DNB's study, the ECB recently published encouraging material for the banks explaining that the planned EUR 3,000 CBDC holding limit per person “would be effective in containing the impact on banks’ liquidity risks and funding structures.” The material comes from the same authors as the Bitcoin article, yet without the disclaimer, so probably safe to assume that this one is the ECB's true view.

The Turkish Central Bank (TCMB) is currently in Phase Two of its digital lira development. The findings of Phase One, completed in December last year, contain similar suggestions to many CBDC papers published by other countries, except for the use of a special "Digitalized Identifier" (DID). The DID will be a prerequisite for any physical or legal entity to use the digital lira, and is envisioned as a universal identifier not just limited to the financial systems.

Switzerland's fifth-largest bank, PostFinance has launched crypto trading services for its 2.5 million clients. They will be able to buy and store 11 cryptocurrencies (list undisclosed at time of writing) through an API with the digital asset services provider Sygnum. PostFinance is a subsidiary of SwissPost which is fully owned by the Swiss government.

In the U.S., the acting Comptroller of the Currency (OCC) Michael J Hsu compared crypto entities to the Bank of Credit and Commerce International (BCCI), an international bank that closed in 1991 after a seven-country investigation into money laundering and other financial crimes. Before its closure, the BCCI had offices in over 72 countries. Calling for uniform regulation, Hsu made parallels between the BCCI and FTX: both had no single supervisor, and their parent holding companies were not subject to regulation in the jurisdiction where they were chartered.

Hsu also pushes for the separation of the concepts of tokenization and distributed ledger technology (blockchain). On several occasions, he has mentioned that tokenization benefits the financial industry, but the blockchain is not required for it.