There are several stories every day about banks launching blockchain projects, tokenization of real-world assets, and live pilots for central bank digital currencies (CBDCs). But beyond a headline, basic functionality, some figures, and maybe a nod to the platform being used, most of these stories are full of context, which is often shared by multiple related stories.

So, Observers has decided to blur the content with the context, scrap the filler but keep the killer, by creating a regular roundup of all that is happening in banking and CBDCs. We will still be writing full articles on the really game-changing news in this sector, but will be covering as many other stories as possible through this newsletter.

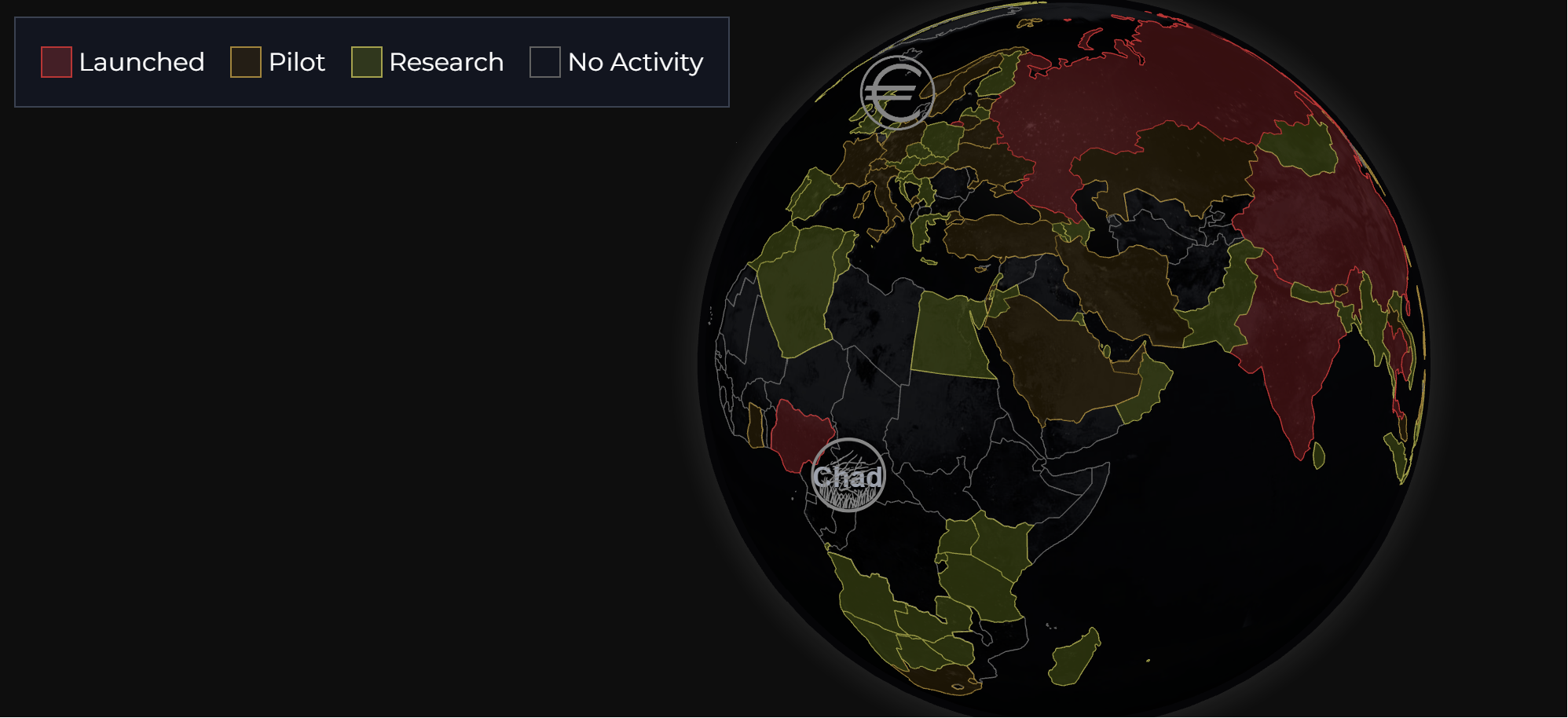

It’s been a week of talk and action (and inaction) in the world of CBDCs with some of the biggest players in finance having something to add to the ongoing debate.

The IMF says that CBDCs could eventually replace cash, especially in small and island economies where the deployment of notes and coins is costly. They can also benefit more advanced economies by providing greater resilience, according to a recent speech by managing director, Kristalina Georgieva, during Singapore FinTech Festival (SFF).

Meanwhile, also on SFF grounds, Mastercard has been telling anyone who will listen that customers are so comfortable with current payment methods that they don’t need a CBDC coming along and confusing matters. Not that Mastercard has anything to gain from maintaining the status quo, of course.

The BIS seems to have accepted the general idea that CBDCs are on their way, and are trying to make them better, according to a recent study. Apparently, greater privacy encourages CBDC user uptake by up to 60%. Well who’d have thought.

While all of this discussion was going on, Singapore and Kazakhstan were putting plans into action and launching pilot projects for their prospective CBDCs.

Kazakhstan set its digital tenge pilot scheme in motion, with an official making the first retail payment with the new CBDC. The country plans for a full implementation by 2025. Further East in Singapore, the central bank announced a ‘live’ trial of its CBDC for use in wholesale settlements. MAS plans to start the development of the platform next year.

Meanwhile, the U.S. Federal Reserve is continuing with its CBDC pilots but said that a digital dollar is unlikely to become a reality in the near future.

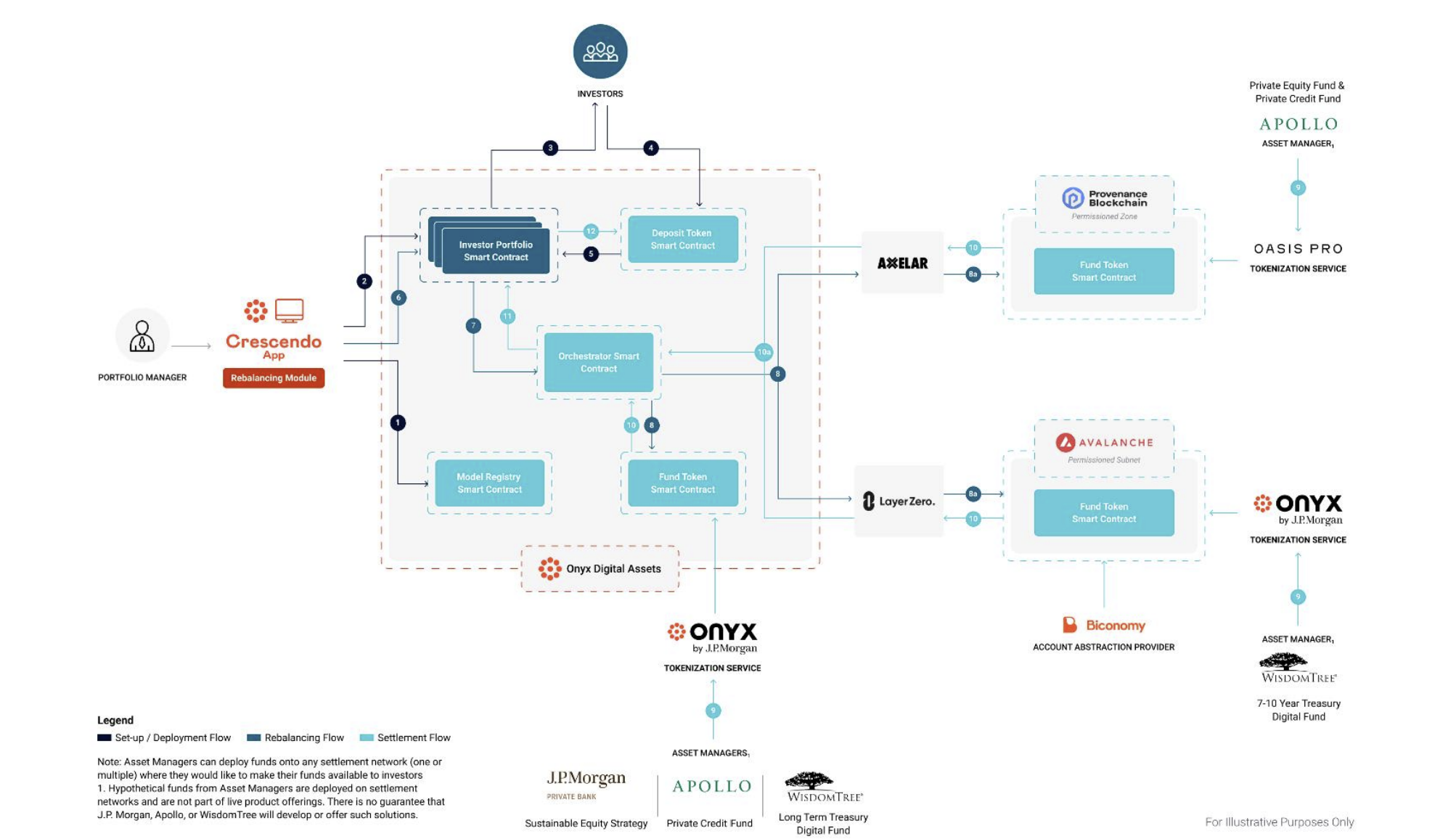

Onto banking… JPMorgan has joined forces with Apollo and blockchain firms including Ava Labs and LayerZero, to create a ‘proof of concept’ for a tokenization platform with a twist. The novel system allows fund managers to purchase and rebalance positions on tokens across multiple blockchains. It formed part of a lineup of pilot projects announced by the Monetary Authority of Singapore (MAS).

Standard Chartered also announced a new tokenization platform, called Libeara, although don’t ask us how to pronounce it. The platform has been designed to create a tokenized Singaporean dollar government bond fund.

Also tokenizing its treasury bonds is the Philippines, which will reportedly be selling $179 million dollars worth of its, er… tokenized treasury bonds. The move is an attempt to further develop the country’s domestic debt market.

Finally, Commerzbank has been granted a crypto custody license in its native Germany. Commerzbank claimed to be the first full-service bank to receive such a license from regulators.