For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

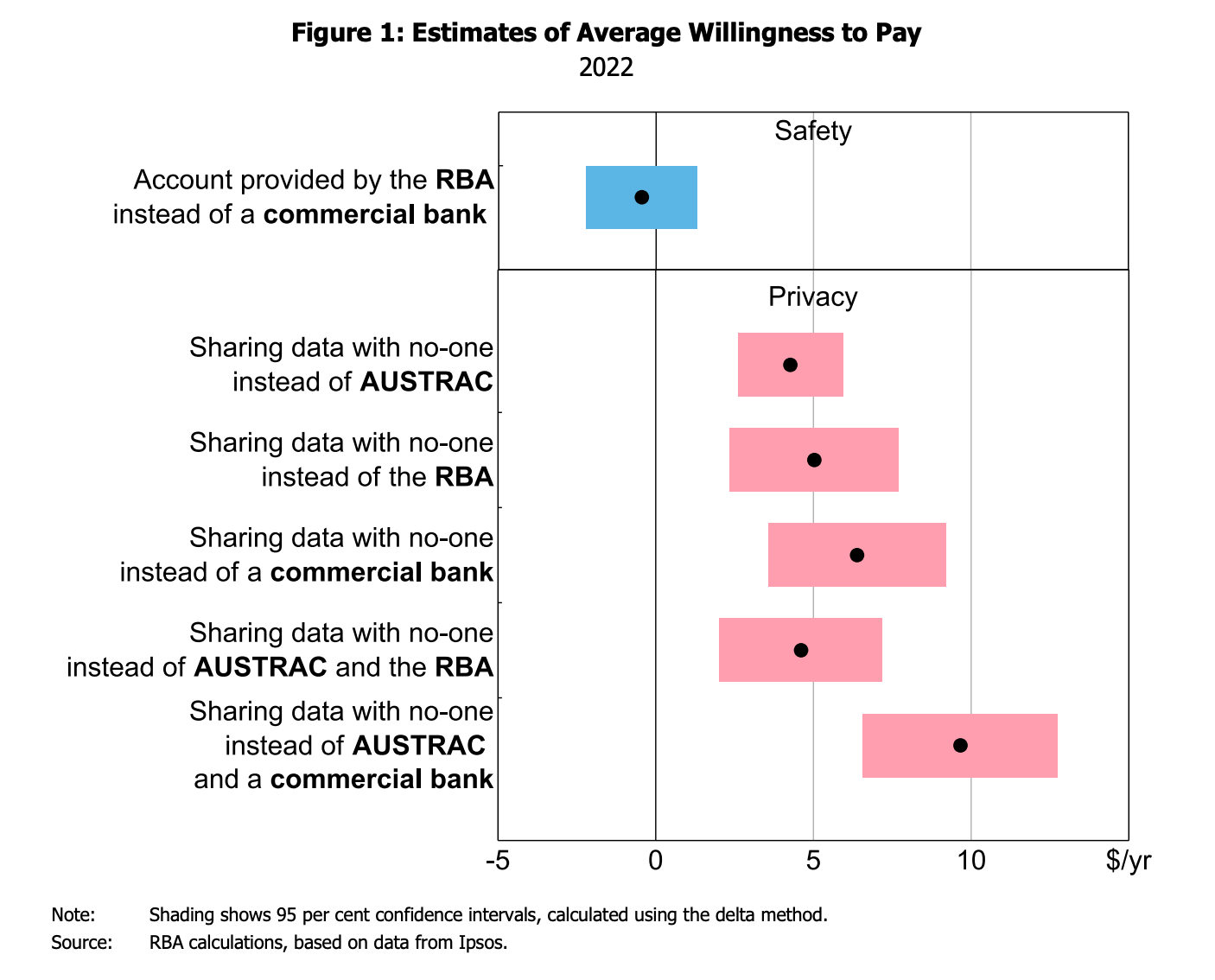

We're beginning Down Under this week, where eye-opening research from the Reserve Bank of Australia has revealed that consumers aren't all that interested in using a central bank digital currency. The study concluded that Australians are happy with the regulations already in force for financial institutions — and willing to pay a premium to ensure transactions are kept private.

In a case of "if it ain't broke, don't fix it," the RBA concluded that — in order to justify launching a CBDC — any digitized Aussie dollar would need to offer additional use cases and advantages that consumers can't receive at present.

There were similar sentiments from the Federal Reserve Bank of Kansas City, which has examined the rollout of three retail CBDCs in the Caribbean: the Bahamian Sand Dollar, DCash across eastern nations, and Jamaica's JAM-DEX. It concluded their adoption had been disappointingly low, and made three observations:

- The technology used to create a CBDC has little impact on adoption

- Consumers haven't been educated on why these digital assets are worth using (echoing a point made by the Reserve Bank of Australia)

- Retail CBDCs need to be integrated into the wider payments ecosystem, rather than running in isolation

The Kansas City Fed warned that embracing a "build it and they will come" mentality simply won't cut it, with circulation of these three CBDCs representing just 0.15% of currency used.

Over in Hong Kong, its monetary authority's chief executive Eddie Yue also struck a cautious tone during an international conference on CBDCs. Despite cash use declining, with insatiable demand for digital payments, he warned:

"While a retail CBDC may represent a more advanced version of cash, it remains to be seen whether the benefits of its issuance would outweigh the risks. More research would also be required on how the introduction of a retail CBDC would impact the broader financial system."

The European Central Bank (ECB) has no doubts about retail CBDC and shared planned activities for the second half of 2024.

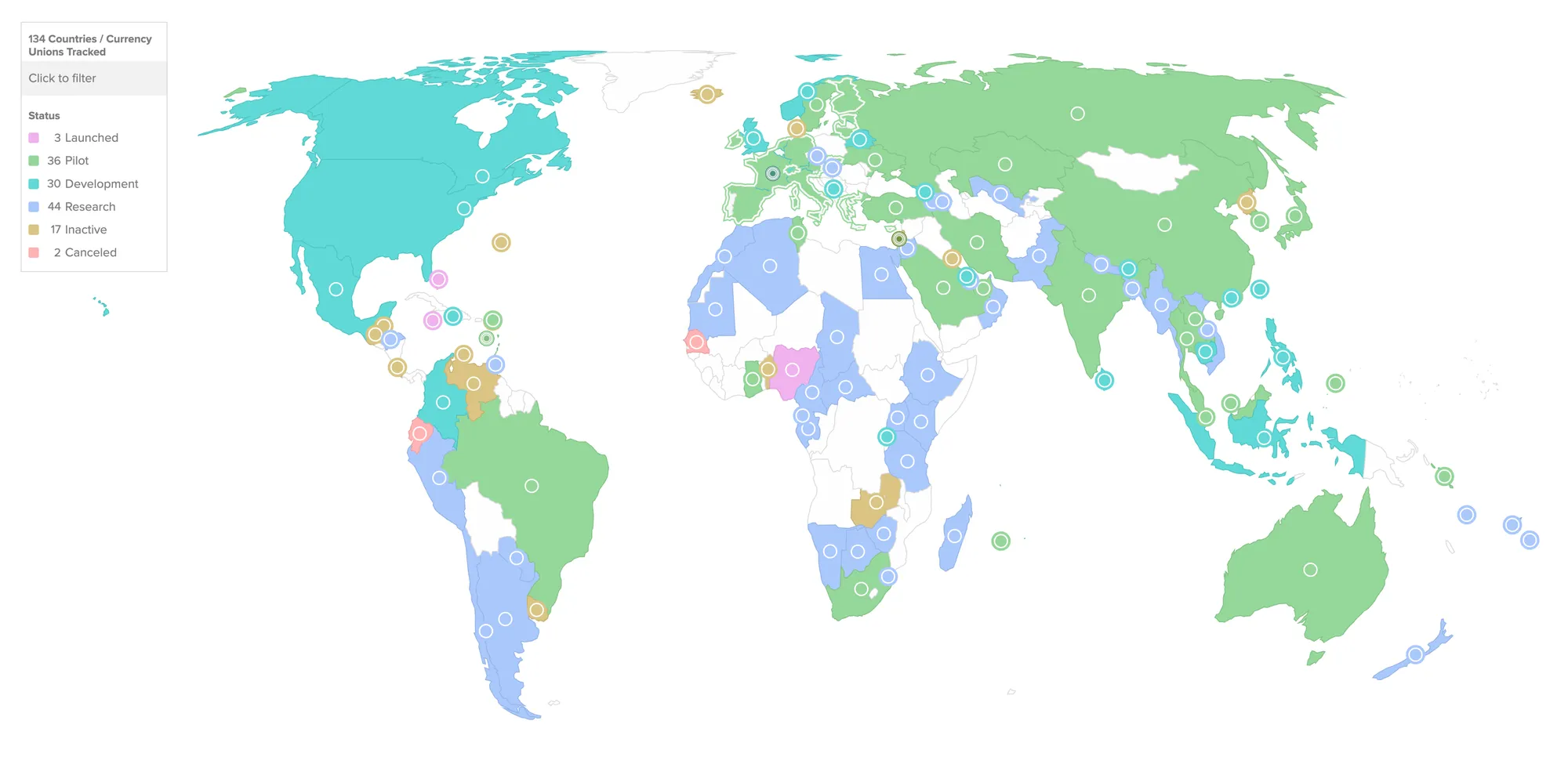

Regular readers will know that the Atlantic Council has long tracked who's working on a CBDC — with 134 countries and currency unions representing 98% of GDP now exploring one:

On Wednesday, the U.S. think tank issued a report warning that CBDCs risk turning into "walled gardens" unless economies work together to develop "a common framework of standards and collaboration." The Atlantic Council said interoperability was crucial — and described unification as a necessity "to foster harmony, quality and trustworthiness worldwide."

Finally, the International Organization of Securities Commissions has unveiled its priorities for the coming year — which include a sharper focus on the tokenization of financial assets. The objective is to gauge current levels of adoption and use cases, with a view to analyzing "whether further policy direction or guidance might be needed."