For all the key details of blockchain projects in the banking world, real-world asset (RWA) tokenization, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

Standard Chartered's Zodia Custody platform has joined forces with Ripple's Metaco to create a global sub-custody service. This will allow institutions offering custody solutions to sub-contract the storage of assets in order to take advantage of regulatory jurisdictions where they have no physical presence. Zodia also announced integrations with Fireblocks and Copper's ClearLoop.

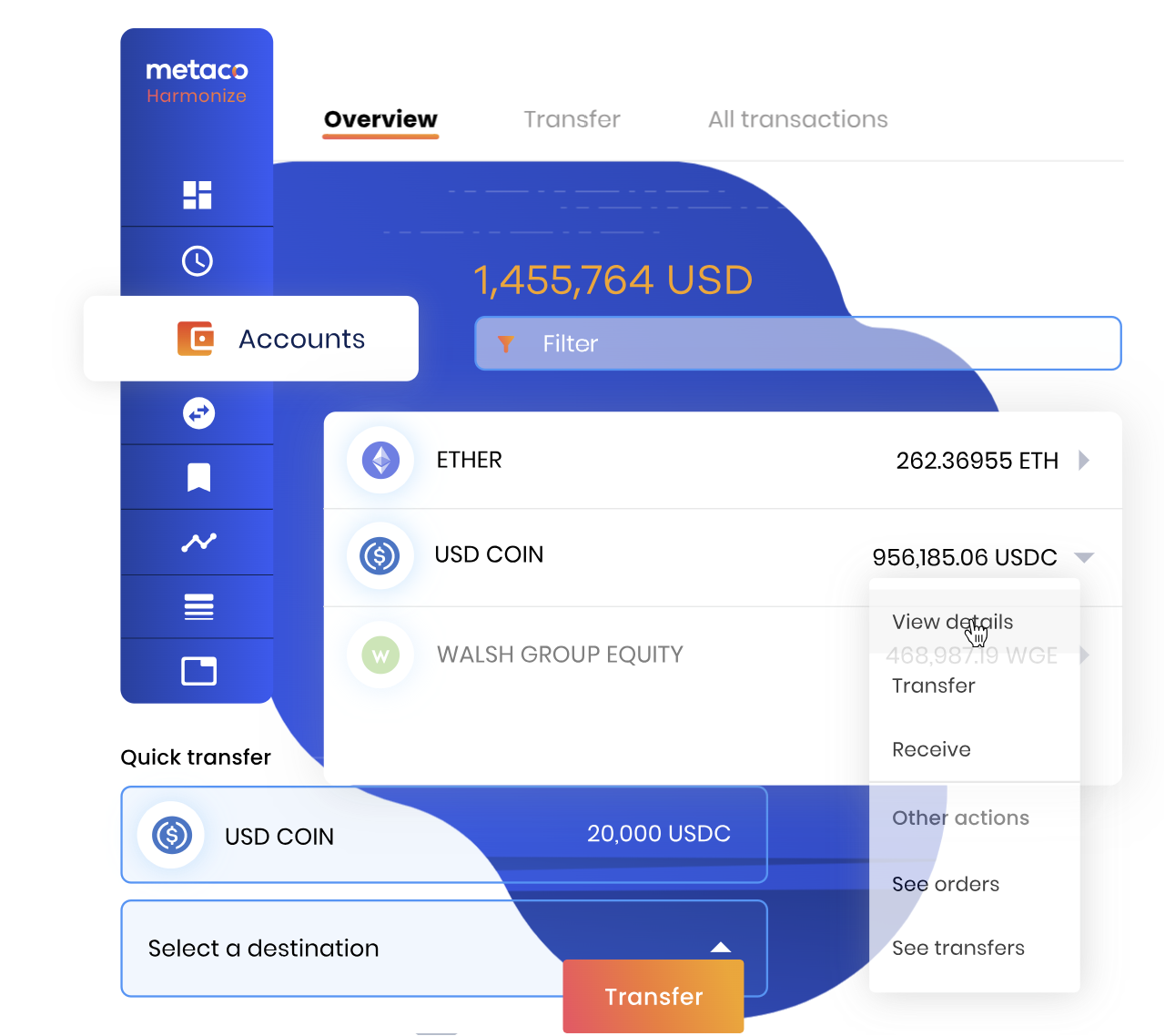

Meanwhile, the Swiss arm of Spanish bank BBVA has migrated its custody service to Metaco's Harmonize platform. This will facilitate connections to blockchains other than Bitcoin and Ethereum and will allow BBVA Switzerland to expand its crypto-asset offerings for institutional clients.

And Brazil's largest bank, Itaú Unibanco, has just launched a crypto trading service for its customers, with bitcoin and ether available initially and plans to add more tokens at a later date. The bank established its Digital Assets unit back in July 2022, and has been working on launching the custody and trading services since then.

The United Kingdom might be getting cold feet on crypto, at least where CBDCs and tokenization are concerned.

First, the parliament's Treasury Committee published a report urging further investigative work into the potential benefits of a digital pound, and suggesting that these might not outweigh the risks. While it again discusses common arguments such as improved efficiency vs. loss of privacy, a bigger concern is its effects on the role of private banks and, if not issued, the competition from privately and/or foreign-issued digital money. It is also interesting that the argument about financial inclusion is inverted in the U.K. - 7 per cent of UK adults (3.9 million) are digitally excluded, meaning that they will be financially excluded in the case that a CBDC replaces physical cash.

Overall, the report's title, 'The digital pound: still a solution in search of a problem?', gives a fair idea of the current level of negativity from parliament to a CBDC.

Then, the Bank of England's Financial Stability report warned that the growth of asset tokenization could increase the risk to the country's economy from unbacked crypto or stablecoins. You have to question whether the U.K. really wants to become a hub for crypto, or would rather just sit at home in front of a warm fireplace with a nice cup of tea.

Meanwhile, French banking giant Societe Generale had no qualms and issued a 10 million euro tokenized green bond on the Ethereum blockchain, which was snapped up by AXA and Generali Investments. Not content with that, SocGen also launched its EUR CoinVertible stablecoin on the Bitstamp exchange, the first stablecoin issued by a major bank. We first reported the announcement of EUR CoinVertible back in April, so it is nice to see it finally come to fruition.

The Deputy Governor of the Taiwanese central bank Chu Mei-lie shared her vision of the future at the Financial Information System Annual Conference in Taiwan this week.

Chu Mei-lie believes that CBDC will be the backbone of the future financial system serving not only new payment methods but also the tokenization of real-world assets (RWA). The Taiwanese central bank has completed its study into a potential wholesale CBDC and is contemplating its next steps. The bank first started looking into CBDCs in 2020 and has already carried out pilot projects for a retail version. Chu Mei-lie also mentioned the potential shift of the private banks' role in what she called the 'Banking 4.0' era.

Not quite a CBDC but very similar, Palau's U.S. dollar-pegged stablecoin project has successfully completed its first phase, according to a report. The project uses Ripple's CBDC platform and involved 168 government workers spending the stablecoin in local retailers over three months.

And finally, the central banks of Italy and South Korea have announced a memorandum of understanding regarding mutual knowledge sharing, with particular regard to real-time settlement systems and CBDCs.