Alex Harutunian

DeFi is moving from standalone apps into the backend of exchanges, with Coinbase and Crypto.com leading by embedding Morpho’s lending vaults. This “embedded DeFi” model raises a key question: are exchanges becoming banks, or just UIs? The answer will define DeFi’s role in future banking.

Alex Harutunian

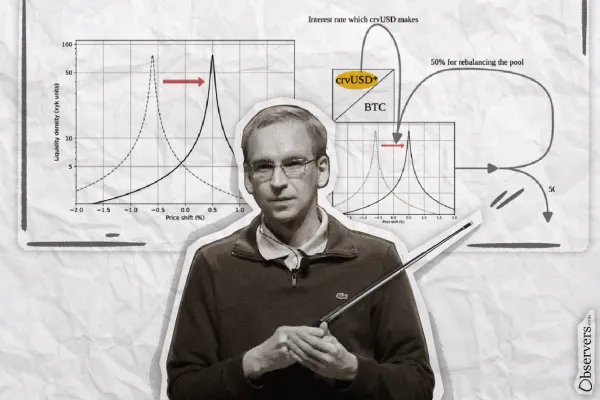

Curve Finance is launching Yield Basis with a $60M crvUSD credit line. The product aims to eliminate impermanent loss for liquidity providers, and at the same time transform CRV from a governance token into an income-generating asset with revenues shared back to holders

Alex Harutunian

Monero, the leading privacy coin, suffered an 18-block reorg after Qubic consolidated large mining power. Debate rages: Qubic claims 51% control; Monero devs deny widescale damage. Exchanges raised confirmations. The episode shows PoW chains can be threatened by economic incentives

Alex Harutunian

After years of development, blockchain games still capture only a sliver of the gaming industry. The promise of true asset ownership, stable economies, and transferability remains unmet. Recent trends suggest blockchain was more hype feature than genuine necessity

Alex Harutunian

Nasdaq has filed with the U.S. SEC to bring tokenized securities onto its main market, aiming to trade blockchain-based and traditional shares side by side. If approved, the move could make Nasdaq the first U.S. exchange to integrate tokenized equities under existing protections

Alex Harutunian

Hyperliquid is preparing to launch its own stablecoin, USDH, through a validator-led governance vote. With USDC currently dominating its ecosystem, USDH would reduce reliance on external issuers and capture reserve yield. Paxos, Frax, Ethena, and an Agora–MoonPay coalition are competing to deploy it

Alex Harutunian

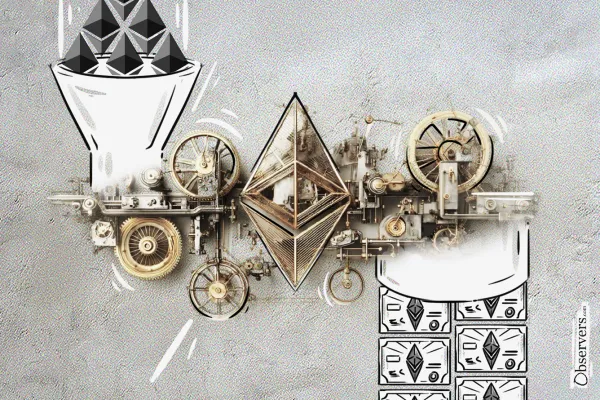

The Ether Machine is bringing Ethereum to Wall Street through a SPAC merger and $2.1B in committed assets. Backed by ConsenSys veterans, it mirrors MicroStrategy’s playbook with convertible financing and promotion, while adding staking and restaking strategies that ETFs and Bitcoin wrappers cannot

Alex HarutunianUniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.

Alex Harutunian