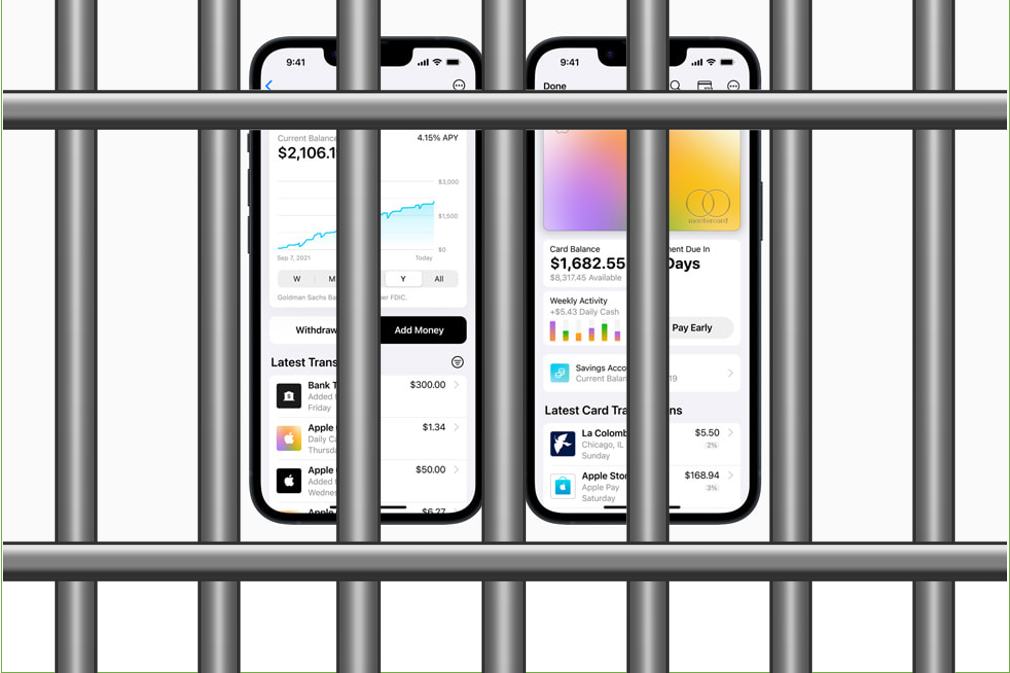

Back in April, Apple launched a high-yield savings account with investment banking giant, Goldman Sachs. Offering an annual percentage yield (APY) of 4.15% (over ten times the U.S. national average), the account was an immediate success and attracted over $1 billion in deposits in the first four days after its launch.

Unfortunately, while Apple and Goldman Sachs were more than happy to take their customers’ money, it seems that they are somewhat less keen to give it back. Just three days after the official launch, a thread titled “Apple Savings won’t allow me to withdraw?” was created on Apple’s community support forums.

Apple’s forums have a ‘Me too’ button for those who are experiencing similar problems, which has been clicked by 258 other people as of June 4. Some users have reportedly waited several weeks for withdrawn funds to reach the receiving account, according to a report from the Wall Street Journal.

Customers are allegedly given inconsistent advice by Goldman Sachs customer services operatives, with one being told to “wait a few days,” each time they called up. Some have reported more success when withdrawing money to the same account that the funds were originally transferred from, but many have complained that funds simply disappeared without turning up in the expected destination account.

A statement from Goldman Sachs claimed that the issues may be down to “a delayed transfer due to processes in place designed to help protect [customer] accounts,” adding that it “takes our obligation to protect our customers’ deposits very seriously.”

Anti-money laundering (AML) experts suggested that new accounts such as Apple’s savings account can set off alarm bells, and security concerns can be raised when customers try to transfer large sums of money from newly opened accounts.

This is no consolation to the customers who have fallen victim to these issues, such as Grammy-winning musician, Antonio Sanchez. Sanchez allegedly spent weeks navigating an opaque customer service system, trying to track down $100,000 of funds intended for a real-estate purchase, before eventually having to borrow the money from his mother-in-law.

Which begs the question, why would anyone trust their money with a conventional bank, when funds are apparently at the whim of AML legislation which can see them seized and withheld until further notice?

Affected customers are calling the whole affair “Very un-Appley,” and the tech giant will undoubtedly want to distance itself from the problems.