In the age of infinite information available at the tip of the fingers, mothers still give out the best advice.

A new study has found that despite the plethora of crypto experts, advisors, and educators on social media offering investment tips based on their professional market analysis of overtly complex graphs and data, following Mom's classic advice to not "trust strangers online" is a much better investment strategy.

United States scholars Kenneth Merkley and Mark Piorkowski from Indiana University, Brian Williams from Texas A&M University, and Harvard Business School researcher Joseph Pacelli conducted a thorough analysis of the tweets of the 180 most prominent crypto influencers from January 2021 to June 2022 and found out that:

"Crypto-influencers' tweets are initially associated with positive returns. However, these tweets are followed by significant negative long-horizon returns, suggesting they generate minimal long-term investment value."

Just how damaging trusting these crypto experts' advice is depends on several factors, such as the size of the project and the influencer's number of followers, but overall, it follows the same trend.

The Smaller The Project, The Bigger The Fall

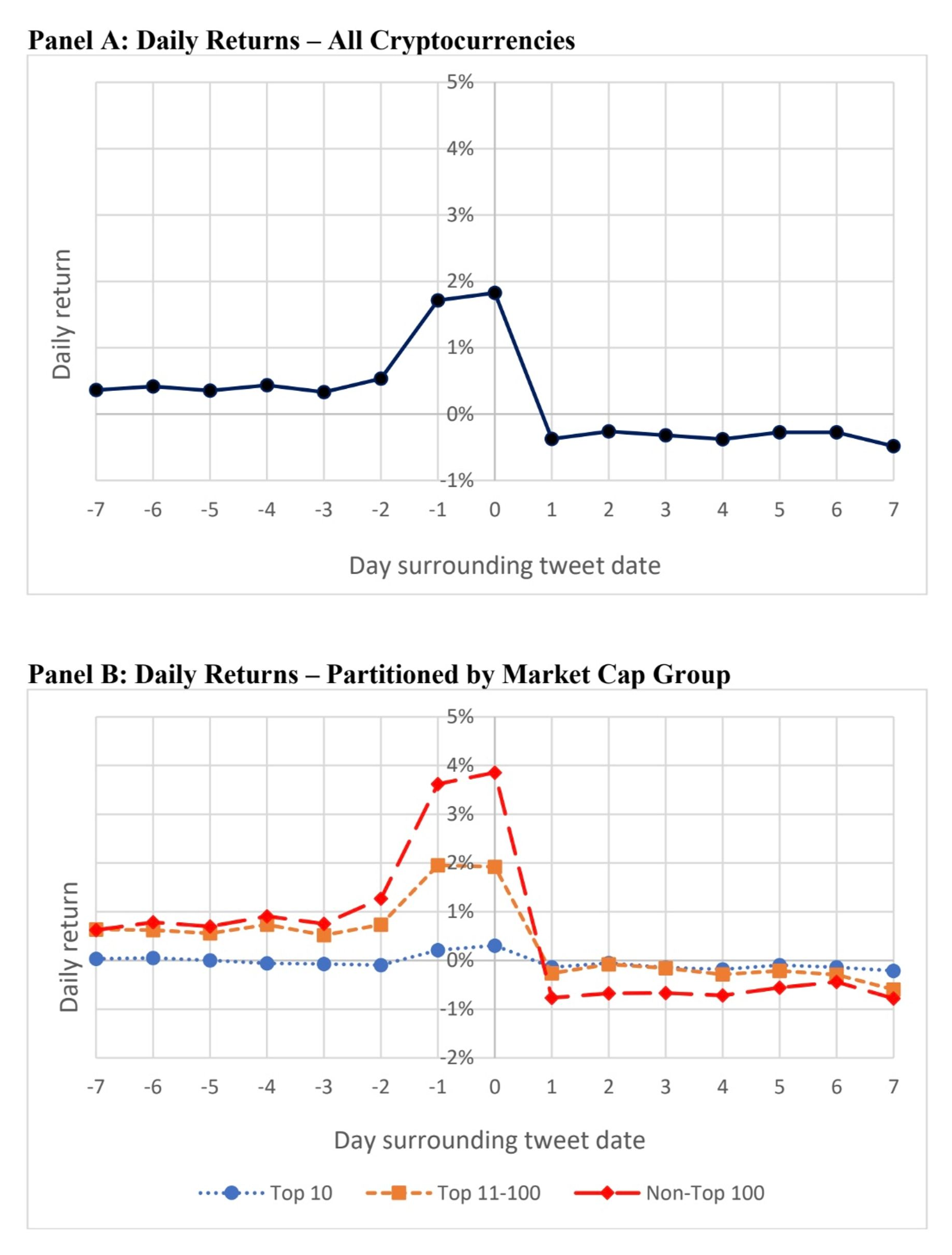

On the day a social media influencer publishes a tweet about a token, its price rises. The research points to a mean increase of 1.83% of the price of a token in the first 24 hours, a figure which is significantly lower for the top ten cryptos but much higher, 3.86%, for projects that fall outside the top 100 cryptos by market cap.

Yet, from day two to five, the mean return of an investment based on an expert-based tip is -1.02%, meaning that in less than a week, over half of the gains from the first day are lost. From then on, it is a downfall. On the tenth day, the average cumulative returns fall to -2.24% and decrease to -6.53% after one month has passed.

The losses are more pronounced for projects with smaller market caps. "An individual who invests $1,000 buying Non-Top 100 crypto tokens on the tweet date and holding the investment for thirty days would incur losses of $79 (7.9%), generating an annualized loss of 62.8%."

Bigger The Following, Bigger The Fall

Not all crypto influencers describe themselves as "experts" in the field, but the ones that do have more influence over token prices. The research points to their mentions of projects leading to returns 0.7% higher than the average.

In fact, the advertised professional experience often has little to no credibility, and advice from these "experts" leads to higher losses than average.

The trend is even more pronounced for influencers with a lot of followers. According to the study, these results "are particularly troubling from the perspective that so-called experts with large followings are potentially in the best place to help influence investors' views on crypto-assets, yet their advice appears to be the least profitable."

The Fool, the Street Smart, and the Evil Crypto Influencers

The study's findings are consistent with influencer pump-and-dump schemes, but researchers warn that this might not always be the case.

These self-entitled experts may subscribe to the "to the moon" mentality prevalent among crypto project communities. Their bullish behavior potentially leads them to ignore price signs that indicate it's time to sell. A conflict of interest can also arise in which influencers promote a trending project in the hope that it will attract more followers or encourage their followers to purchase a token they have already bought. The hope is that it will generate enough liquidity so that they can exit their positions.

The novelty of cryptocurrencies means that traditional gatekeepers who analyze and share information in conventional financial markets are mostly absent. To make matters worse, the space's permissionless nature leads to there being thousands of projects no one is talking about.

The lack of information on smaller and less-known projects means that influencers can indeed have an essential role in educating investors, informing them of new opportunities, and analyzing the market.

So far, however, this has not been the case. Either due to ignorance, cunning, or even malice, crypto influencers' expertise has more to do with defrauding their communities than helping them.