Verb Technology Company (Nasdaq: VERB) announced on August 21, 2025, that its treasury now exceeds $780 million, including $713 million in Toncoin (TON) and $67 million in cash. At the same time, the company confirmed a rebrand to TON Strategy Company, marking a decisive pivot from its roots in social commerce software to becoming a publicly traded Toncoin treasury.

The announcement follows an August 8 private placement of $558 million, joined by more than 110 institutional and crypto-native investors. Most of the proceeds were used to acquire Toncoin, with the company targeting control of more than 5% of TON’s circulating supply. Executive Chairman Manuel Stotz described the move as “more than building a balance sheet; it’s about contributing to the security of the TON blockchain – where participants can build, transact, and benefit directly from the underlying financial protocols.”

From Operating Business to Digital Asset Treasury Reserve

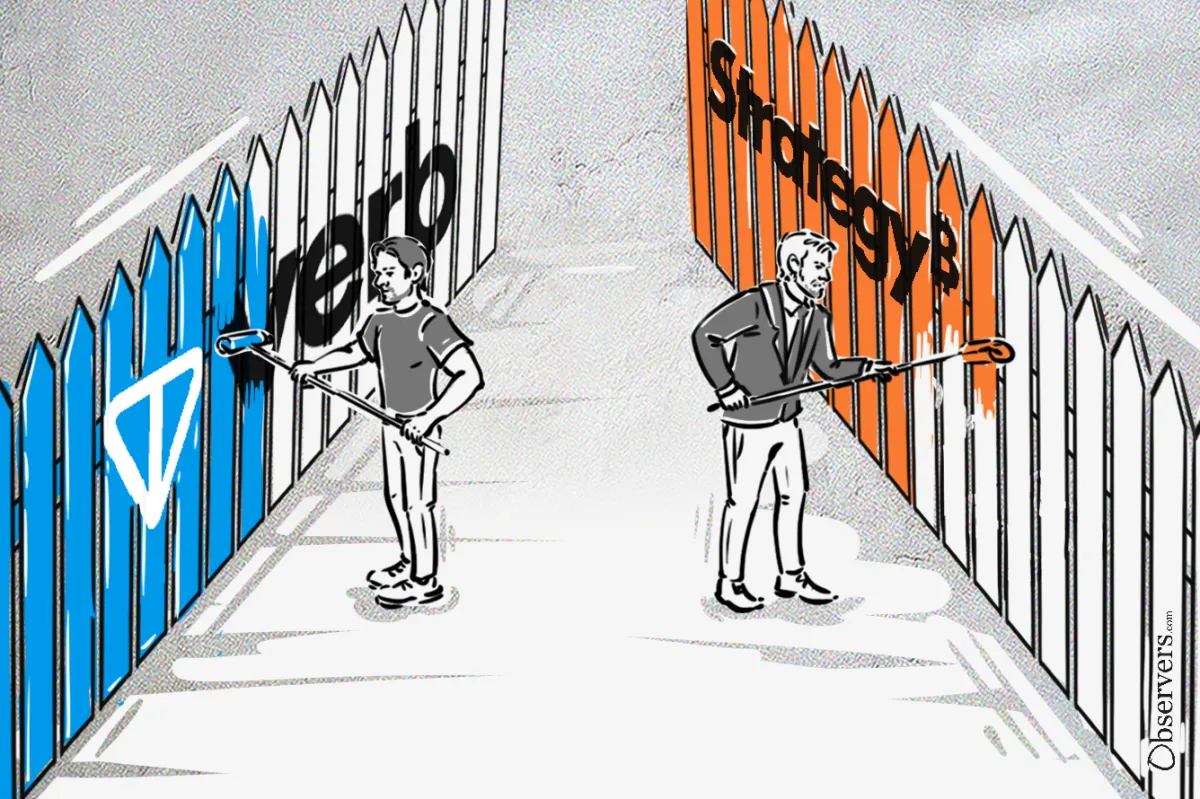

This transformation follows the model set by Strategy (formerly MicroStrategy), which turned its balance sheet into a single-asset crypto treasury. TON Strategy is applying the same approach to Toncoin: not just allocating part of its reserves, but redefining its entire corporate identity around the asset — becoming a publicly traded vehicle for investors seeking direct exposure to the TON ecosystem.

Toncoin is directly integrated with Telegram, the world’s second-largest messenger with over one billion monthly active users. Earlier this year, Telegram designated TON as its exclusive blockchain, making it the backbone of Telegram’s Mini App ecosystem. Wallets, payments, and applications now run natively inside Telegram.

By accumulating TON at scale, TON Strategy is betting on the same kind of network effect that Strategy leveraged with Bitcoin.

Financial Engineering On Digital Asset Trading - A New Business Niche

While the company has not disclosed details of its financial engineering, it is reasonable to assume it may adopt a convertible note strategy similar to Strategy’s. In that model, the company issues low-yield convertible bonds to institutional investors, raising cash at favorable terms. The proceeds are then deployed into additional crypto purchases. Investors gain the option to convert into equity if the stock appreciates or collect the coupon if it does not, while the issuer accumulates a larger crypto position without immediate equity dilution.

Unlike Strategy, TON Strategy plans to stake its TON holdings, generating recurring staking rewards on top of its treasury position. This introduces an income component absent from pure Bitcoin treasury strategies, creating a pool of distributable profits that could eventually flow to shareholders.

What began as isolated treasury allocations is now evolving into a broader corporate model: companies structuring their entire identity around a single crypto asset.

This approach — raising equity in public markets and deploying it into digital assets — is emerging as a new template for corporate finance. For investors, it offers a regulated stock wrapper for crypto exposure. For blockchains, it creates aligned corporate participants who contribute directly to network security.

With its bold bet on Toncoin, TON Strategy positions itself at the forefront of this shift, signaling that corporate treasuries dedicated to single blockchain ecosystems are no longer an outlier but the beginning of a mainstream model.