For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

CBDC Updates

We start this week in Brussels, where the European Central Bank is calling for Apple to open up the infrastructure that powers iPhone payments.

Piero Cipollone, who is spearheading efforts to roll out a digital euro, says the tech giant's promise to offer rival payment providers access to the device's near-field communication chip — which enables contactless payments — doesn't go far enough.

Cipollone claims the CBDC would suffer limitations when it came to transactions between friends, eCommerce, and payments made on Apple Watches. In a letter to European Commission Vice President Margrethe Vestager, Cipollone warned:

"This proposal is expected to result in a user experience that is not at par with the user experience offered by Apple Pay when it comes to authentication and transaction speed. This is why we believe that the current proposed commitments fall short of ensuring a truly equal level playing field."

Meanwhile, the Central Bank of Germany has launched its own research into the digital euro. Deutsche Bundesbank will partner with MIT to research the privacy and security requirements of CBDCs.

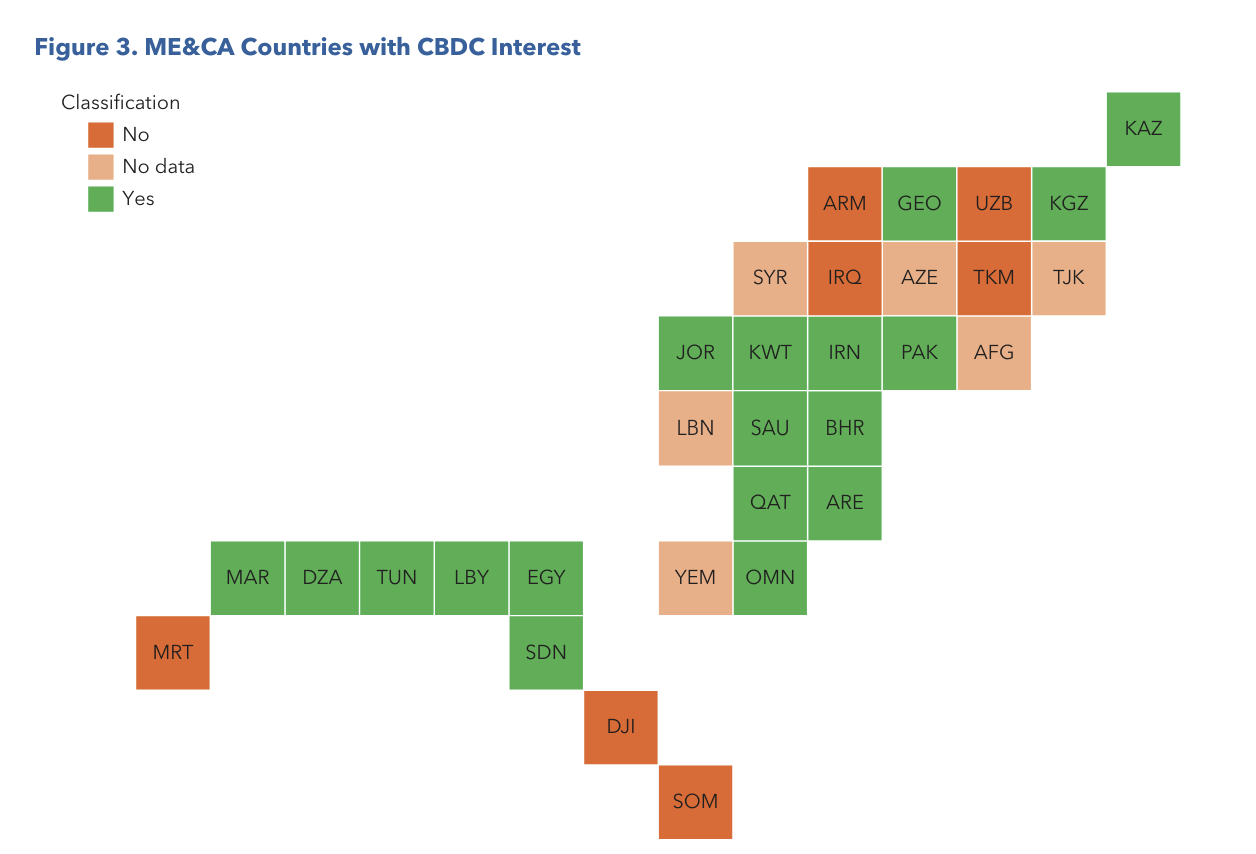

A completely different set of challenges is facing CBDC designers in the Middle East and Central Asia region countries, as evidenced by the recent IMF report. The survey explored the progress of CBDC projects in Saudi Arabia, the Republic of Georgia, Egypt, Iran, and others. We will be covering the findings in more detail in the coming week.

In China, local media reports suggest that the architect of the digital yuan — Yao Qian —is under investigation for "serious violations of discipline and law." No further details about the allegations against him have been released. Since leaving the People's Bank of China in 2018, he's been working at the China Securities Regulatory Commission.

Over in Brazil, there are fears that Drex — the country's central bank digital currency — may not launch on time. Bruno Salles, an executive at one company taking part in pilot projects for a digital real, told Época Negócios that progress is "volatile" as political support has dwindled. He said:

"It's about the government’s agenda and appetite to make investments. We went through strikes, some resources were diverted to other fronts... All of this slows down the process."

In other CBDC updates this week, the South African Central Bank published its Digital Payments Roadmap, and Giesecke+Devriant (G+D) won a bid for CBDC development in Mauritius.

Banking DLT and Tokenization Initiatives

After years of silence, payment services provider Stripe was highlighted in DLT news this week. Back in 2018, the FinTech company Stripe announced it was winding down its support for Bitcoin payments — concluding these transactions were too expensive and slow to achieve mass adoption. Six years later, the company has embarked on a partial U-turn. Now, merchants will be able to accept the USDC stablecoin across three major blockchains.

Interested businesses will be able to join a waiting list, with the functionality rolling out to some jurisdictions in the summer.

Crypto is back. @Stripe will start supporting global stablecoin payments this summer. Transactions instantly settle on-chain and automatically convert to fiat. Join the waitlist https://t.co/hws2OsU3Id and watch the demo (h/t @Solana) from Sessions. pic.twitter.com/zGKYW2FM6i

— John Collison (@collision) April 25, 2024

And in tokenization news, a big announcement from Franklin Templeton. The major investment manager launched the Franklin OnChain U.S. Government Money Fund back in 2021 — in what was the first American-registered fund to process transactions and record share ownership on a public blockchain.

Three years on, and it has more than $360 million in assets under management. Now, shares within this fund can be transferred between shareholders on a peer-to-peer basis without an intermediary. Franklin Templeton's head of digital assets, Roger Bayston, said:

"Eventually, we hope for assets built on blockchain rails, such as the Franklin OnChain U.S. Government Money Fund, to work seamlessly with the rest of the digital asset ecosystem."