The world of airdrops is buzzing with activity, as both Pixels and Starknet have recently rewarded their communities. However, the reception has been mixed. While the Pixels community celebrates, Starknet's followers are less than thrilled with their airdrop experience.

Pixels is the latest sensation in the blockchain gaming arena, capturing widespread attention and enthusiasm. Since its trading debut on Monday, it has quickly ascended to become one of the top 10 most actively traded tokens. Following the Monday morning airdrop, the PIXEL token has surged nearly 15% in just 24 hours, with a trading volume exceeding $1 billion and a market capitalization hovering around the $450 million mark.

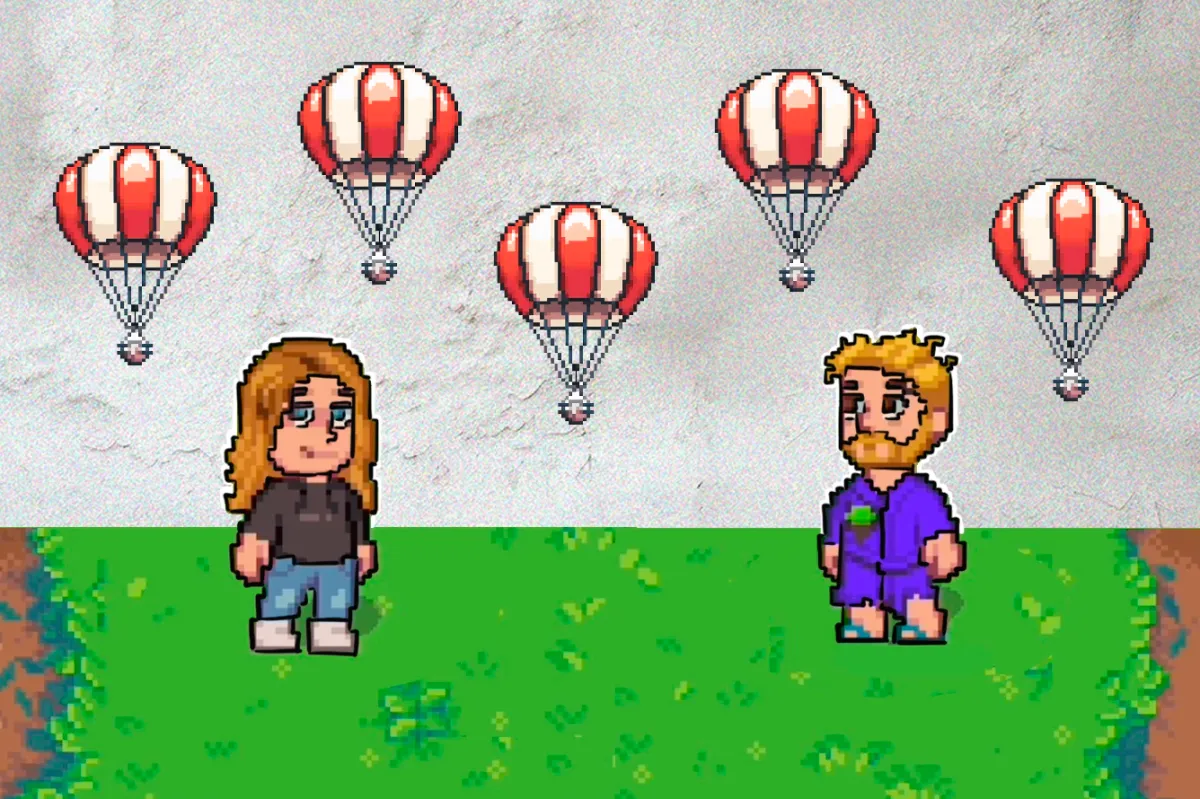

At its core, Pixels is an engaging online farming game accessible through a web browser, which made its debut in 2021. The game draws inspiration from the farm simulation genre, bearing similarities to the beloved Stardew Valley.

In the world of Pixels, players have the opportunity to own land plots, interact with NFT characters, and embark on a myriad of in-game quests. The game’s free access opens up a world of play-to-earn possibilities to a wide audience.

Incorporating Web3 mechanics, Pixels rewards players with a soft currency (coins) and a hard currency, the PIXEL token, for completing quests. Holding specific NFT assets enhances players’ earning potential, adding to the gameplay.

Source: pixels.xyz

Originally built on the Polygon network, Pixels transitioned to the Ronin network in late 2023. This strategic move was driven by the desire to align with a network that had already cultivated a substantial gaming community and had previously propelled a game, Axie Infinity, to remarkable success in 2021.

Pixels was previously featured on Binance Launchpool, with users given the opportunity to stake their BNB and FDUSD in separate pools to earn PIXEL tokens. To further encourage engagement, this week the project distributed a 20 million PIXEL airdrop, valued at $11 million, to users staking Ronin’s RON token. Despite an initial dip in RON price on Monday, it has witnessed a 17% increase over the past week, reaching a two-year peak of $3.49 earlier this month.

The token airdrop has also significantly bolstered the game’s popularity. Prior to the launch, the game had approximately 100,000 unique active wallets interacting with it. This figure has since doubled, with the game recording 224,000 unique active wallets in the last 24 hours.

Pixels game statistics. Source: dappradar.com

Contrastingly, the Starknet community is grappling with disappointment over its airdrop. Starknet’s active user base has plummeted by more than 50% in the last week, fueled by widespread discontent with the Starknet Provisions Program.

Source: starkscan.co

Many within the Starknet community have raised concerns about the airdrop's eligibility criteria, particularly the exclusion of users holding less than 0.005 ETH in their wallets. Numerous individuals have reported missing out on the airdrop despite conducting transactions worth thousands of dollars and contributing liquidity to the network, all because their wallet balances fell short of the minimum requirement.

Additionally, the token unlock schedule has become a point of contention. Starknet investors and early contributors are set to receive 1.3 billion STRK (13% of the total supply) on April 15, only two months after the launch. This is expected to increase the project’s circulating supply by over 100%, considering that, post-launch, only about 10% of the supply will be in circulation. The distribution of investor tokens could exert considerable downward pressure on the price.

Despite these issues, Starknet’s market capitalization remains robust at approximately $2 billion, with a fully diluted valuation of $29 billion, positioning it among the top 50 projects in the industry.