Aave is a decentralised non-custodial liquidity market protocol. Users can use this protocol to lend or to borrow a loan. Those who give a loan receive passive income, and those who borrow a loan are able to borrow in an overcollateralized (perpetually) or undercollateralized (one-block liquidity) fashion.

We wrote about Aave not so long ago. In August, a vote was held among the company's community, during which it was decided to launch a GHO stablecoin pegged to the dollar. Today we will tell you about another proposal that froze more than ten credit markets.

On November 27, voting amongst the governance members was executed. The issue of freezing several markets for precautionary reasons was raised at the proposal, because these markets had become unstable.

The proposal was intended to resolve the issue of freezing the following markets:

- YFI

- CRV

- ZRX

- MANA

- 1INCH

- BAT

- sUSD

- ENJ

- GUSD

- AMPL

- RAI

- USDP

- LUSD

- xSUSHI

- DPI

- renFIL

- MKR

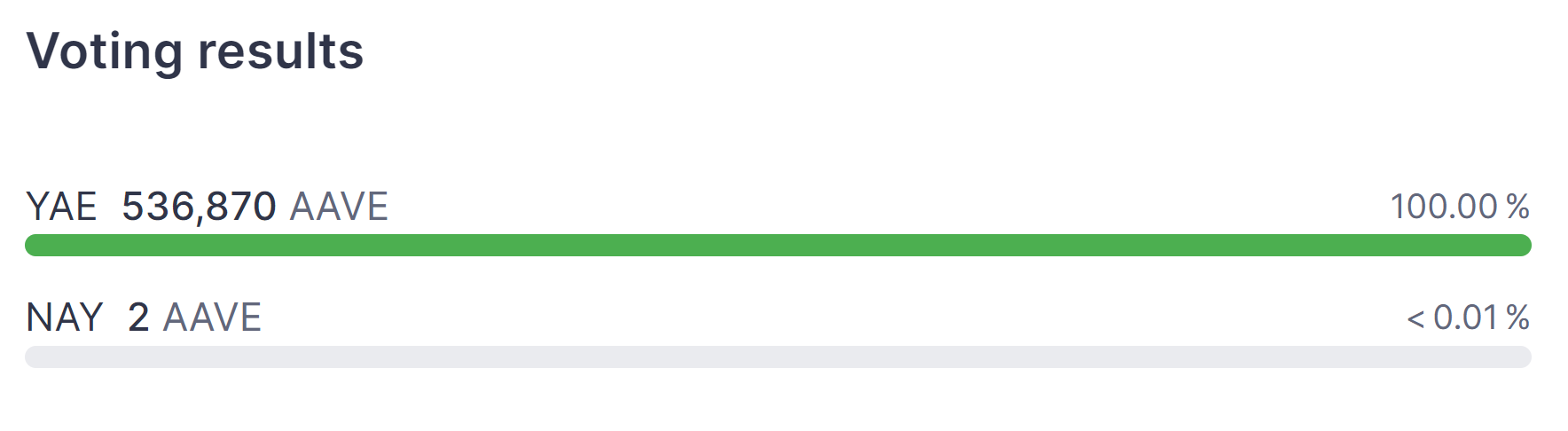

Almost all governance members decided to temporarily freeze the above-mentioned markets. Only less than 0.01% of those who voted voted against the proposal. There was no “abstain" option.

Using the freezeReserve method in LendingPoolConfigurator, volatile markets were temporarily frozen. The proposal does not specify for how long these markets will be frozen. It is worth mentioning that the markets were frozen in the Aave V2 protocol. But, there is also Aave V3.

“V3 Market offers greater capital efficiencies, increased security, and cross-chain functionality, while facilitating increased decentralization across the protocol. Aave V3 brings new features as well.”

The freezing of credit markets in the Aave V2 protocol was motivated not only by the fact that these markets were unstable. In the discussion of the proposal, it was also reported that the freezing of markets could contribute to the transition to Aave V3 protocol.

“Aave V2 lacks many of the risk controls that Aave V3 solves for (supply caps, borrow caps, isolation mode, e-mode, etc). Out of an abundance of caution and given the community’s current lower risk tolerance, we recommend temporarily freezing the assets outlined above in an effort to derisk Aave V2 and promote eventual migration to V3.”

Marc Zeller, an employee of Aave, spoke about the proposal in his Twitter. He spoke positively about the results of the vote, and also explained to Aave users what the freezing of markets would mean for them.

What does frozen means?

— Marc Zeller 👻 💜 🦇🔊 (@lemiscate) November 27, 2022

a frozen asset reserve allows users to pay back and withdraw their assets, but new deposits and increased positions are not allowed anymore.

That means that 0$ of users' positions are stuck, just no new position on specific assets can be open pic.twitter.com/DSNvEQ0EbC

Also, Marc Zeller talked about the next step of Aave in its growth.

before year-end and if audits allow, V3 with an architecture that makes this week events nearly impossible by design will be deployed.

— Marc Zeller 👻 💜 🦇🔊 (@lemiscate) November 27, 2022

V3 is the future of Aave and IMHO this week makes this new version, safer and more efficient by design even more attractive.

Aave has demonstrated one good tactic to deal with potential problems. Sometimes, you can just suspend work with something risky. This way out of a situation is no worse than trying to change something. We wish Aave trouble free operation and continue to observe.