The virtual land rush for the ape-centred metaverse project has already cost traders more than $176 million in fees alone.

On April 30th Yuga Labs, the creators of the Bored Ape Yacht Club, launched the sale of NFTs for its Otherside metaverse game called “Otherdeeds”. They are believed to serve as a deed to some type of virtual land in the game, similar to such NFTs for The Sandbox and Decentraland.

They cost about $7,000 each, and were only available for purchase in ApeCoin (APE), Yuga Labs’ official cryptocurrency. On secondary marketplaces like OpenSea, the cheapest listed price for an Otherdeed was around 4 WETH (roughly $11,000), as this article was being written.

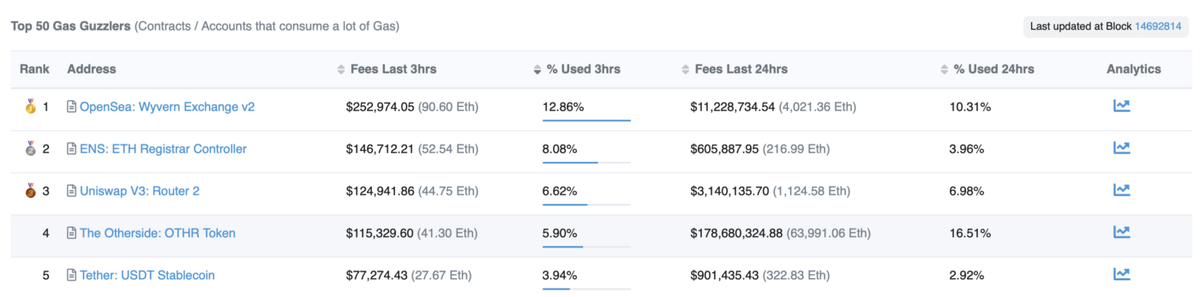

On the night of the sale, the resulting land rush generated approximately $285 million for the company, but it also created some of the highest gas fees in the history of the Ethereum network: investors have spent over $176 million on fees alone over the first 24 hours.

The night was a win for the company, which previously raised $450 million from venture capital giant Andreessen Horowitz, and a disaster for everyone else. (The Otherside raise was worth even more the next night — around $320 million — but the value of APE has since fallen.)

The company publicly apologised amidst the fee-related chaos:

“This has been the largest NFT mint in history by several multiples, and yet the gas used during the mint shows that demand far exceeded anyone’s wildest expectations,” they posted to Twitter. “We’re sorry for turning off the lights on Ethereum for a while.”

Source: Etherscan

The statement also implies the idea of refunding traders’ gas fees, though it’s entirely clear what that process would look like. The average fee for an Ethereum transaction grows with the congestion of the network. It’s a phenomenon known as a “gas war” — users compete to have their transactions processed at the top of the queue.

According to the calculator on the blockchain data site Dune Analytics, the average gas price was around 800 Gwei on May 1st, with spikes from 6,000 to 7,000. During these waves, a simple transaction could cost up to $3,000.

The expensive night questioned Ethereum’s long-term viability as a host for large-scale NFT projects. Yuga Labs even mentioned the idea of building its own dedicated blockchain at the end of its apology thread:

“It seems abundantly clear that ApeCoin will need to migrate to its own chain in order to properly scale. We’d like to encourage the DAO to start thinking in this direction.”

Sources:

https://decrypt.co/95398/apecoin-what-is-bored-ape-ethereum-token-who-gets-it

https://etherscan.io/address/0x34d85c9cdeb23fa97cb08333b511ac86e1c4e258#analytics-txfees

https://www.coindesk.com/business/2022/03/22/bored-apes-owner-yuga-labs-raises-450m-led-by-a16z/#:~:text=Eli is a news reporter,%2C SOL%2C AVAX and LUNA.&text=Yuga Labs%2C the company behind,by Andreessen Horowitz (a16z).

https://twitter.com/realDannyNelson/status/1520650234153611267?s=20&t=VTCerF4egtQgmswnWMWLrw