For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

"Blockchain built for the real world," Celo, announced that real-world assets platform Centrifuge would be joining the platform, noting tokenized T-bills and carbon credit pools as two of the new assets that the collaboration will bring to the ecosystem. Celo is currently in the process of migrating from a standalone blockchain to an Ethereum Layer 2 and is evaluating stacks from Optimism, Polygon, zkSync and Arbitrum.

Deutsche Bank-backed crypto custody specialist Taurus has been given approval for its TDX marketplace by the Swiss financial regulator FINMA. The new marketplace will bring tokenized security trading to retail investors, in the form of blockchain-based shares in some well-known Swiss companies.

SORA is accepting applications for its SORA Card which provides an easy connection between the cryptocurrency self-custodial wallet and European IBAN member financial institutions. On the crypto side, SORA extended its connectivity by securing one of the 100 Polkadot parachain slots.

The Bank of International Settlements announced six new projects for 2024, which cover topics such as tokenized RWAs and CBDC privacy. Project Promissa promises (sorry) to test the feasibility of tokenized promissory notes, which are used to fund development banks and, in many cases, are still currently paper-based. Meanwhile Project Aurum, in collaboration with the Hong Kong Monetary Authority (HKMA), is entering the next phase of its study into CBDC privacy.

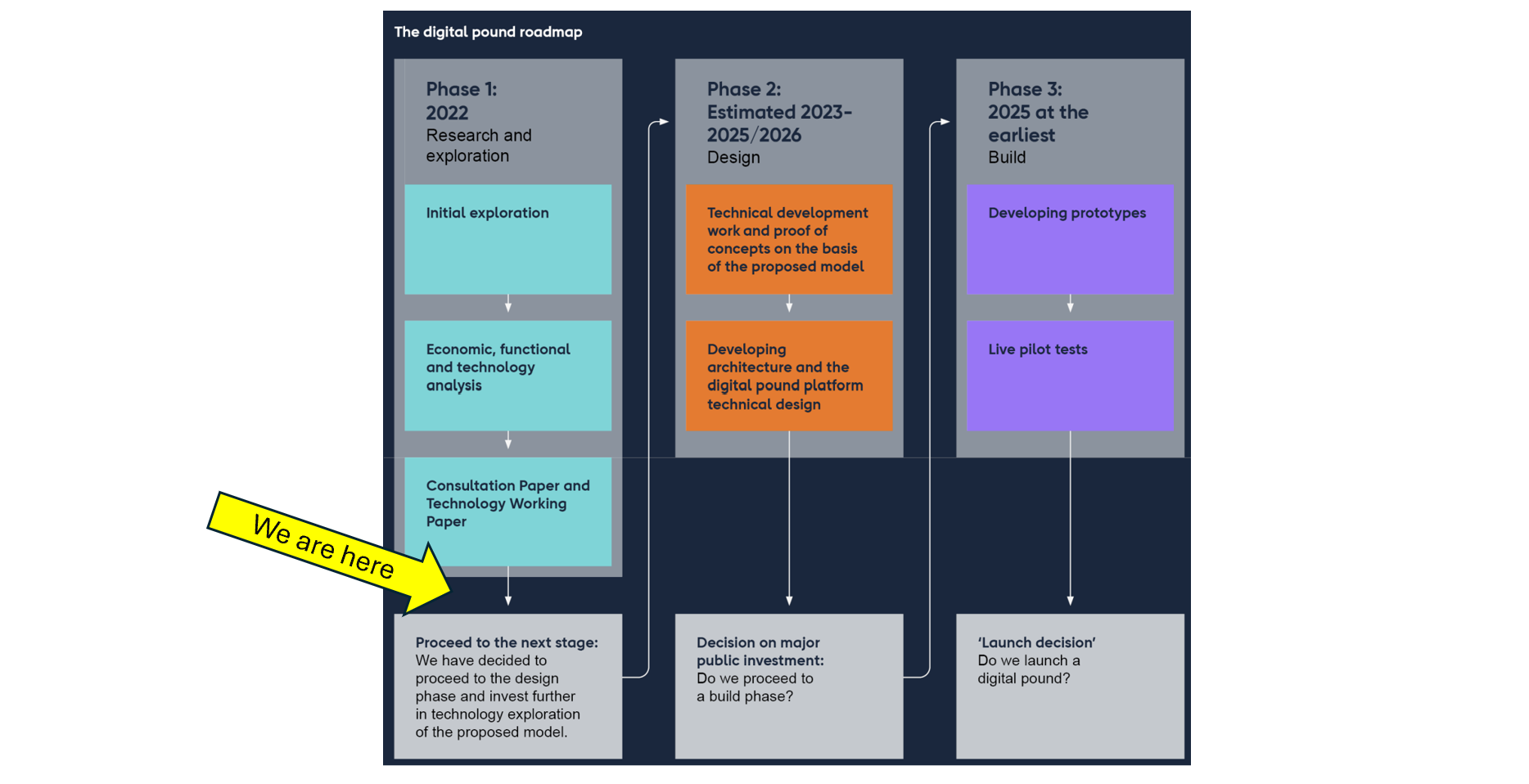

The Bank of England published the results of its almost year-long consultation on a potential digital pound, promising "primary legislation to guarantee users’ privacy and control", based on the feedback it had received. However, the bank was at pains to point out that, as yet, "no decision has been made" on the eventual issuance of a 'Britcoin' CBDC.

And finally, China has revealed big plans for the Pudong New Area of Shanghai. The area will be developed into an international hub with facilities to attract talent from partner countries in China's Belt and Road Initiative. This will include several pilot projects involving the digital renminbi CBDC.